A 50 Year Pattern is about to Break Out

"The appeal of the wild for me is its unpredictability. You have to develop an awareness, react fast, be resourceful and come up with a plan and act on it." Bear Grylls

Silver looks like it's gearing up for a big move—one that's been decades in the making. Meanwhile, the bond market isn't exactly playing along with the Fed's plans, and there's even a hint that we could see a year-end rally. Plus, with the dollar making the cover of The Economist, we have to ask: is this the dollar’s peak?

I've rounded up some of the most critical charts to watch this week, and there are setups everywhere you look.

Also, I’ve had a few requests to go over these charts once in awhile with an audio note—something old-school for Fridays. Let me know if that format would be helpful!

Silver

Silver/Gold Ratio

Fed Rate/Two Year Yield

Nasdaq/Small Caps

Coffee

Copper

Breadth data

Measuring the volatility of volatility

Economist cover

This is a real trading channel. Not speculation about the future. I share what I am doing. Returns, wins and most importantly my losses.

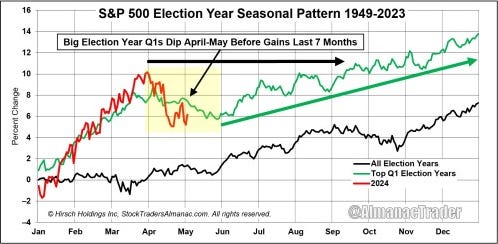

Seasonality

Inflation is everywhere, except if you wander in to a 1992 style bathroom at a gas station.

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees: Help save the native bees! Learn more and get involved here.

“Rugged ‘n Ready” LOL

That VVIX:VIX chart looks scary. Getting tight...