A Brave New World: A Fully Present Future

"I think the leading cause of financial disablement is the belief that you can rely on the experts to help you. Investing requires an intense personal involvement." Michael Marcus

As I stand here in my backyard, surrounded by the vibrant colors of fall—purple, yellow, and orange flowers—I’m fully present.

While markets may be choppy, there’s a calm in stepping back, focusing on the bigger picture, and sticking to your plan and strategy.

Only when we detach from the noise of the day-to-day can we truly see where we’re headed.

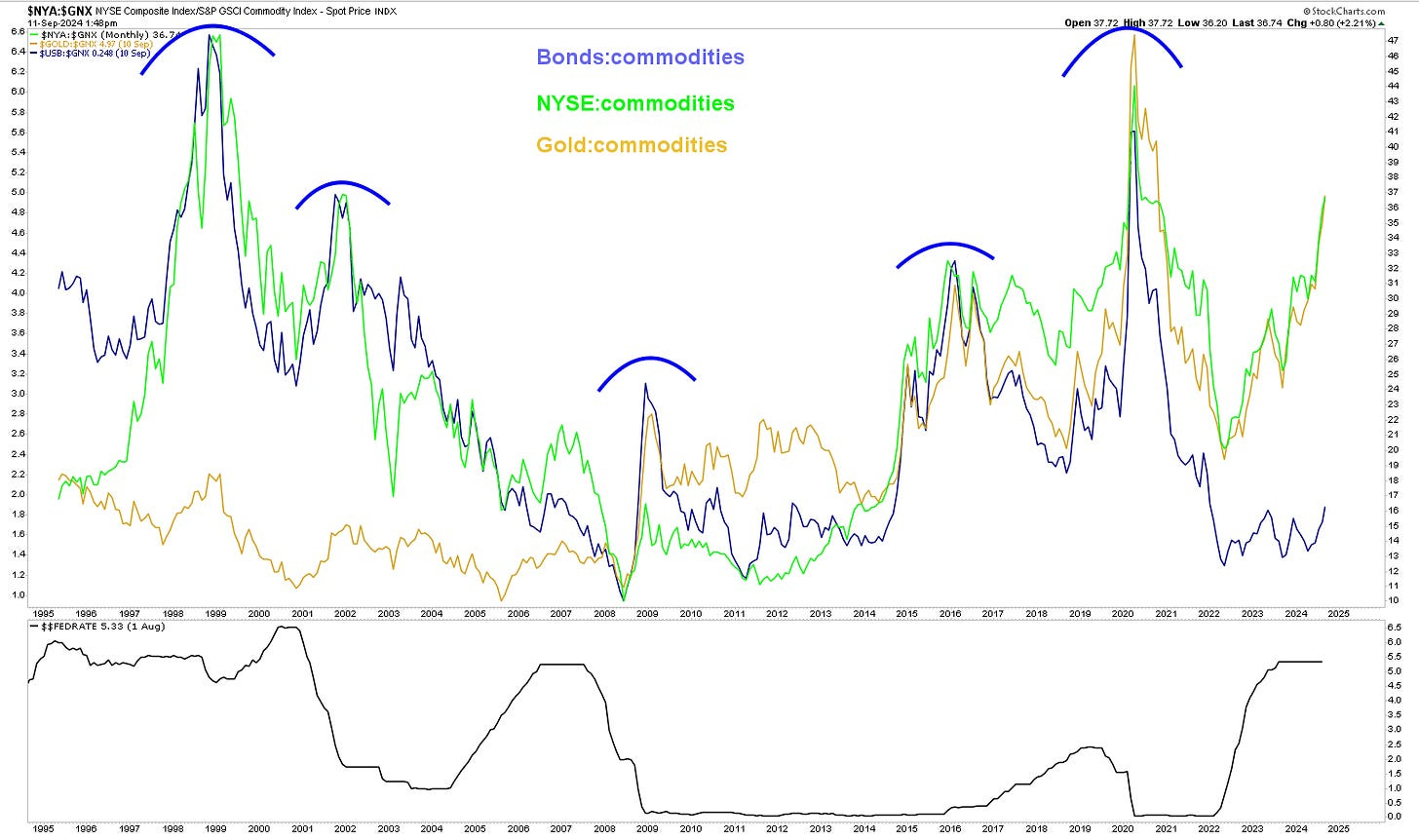

As we look ahead, it’s clear we’re entering a market with shifting dynamics—lower rates, an unwinding yield curve, and the potential for big moves ahead.

Stop thinking about where you are at and think about where you are going.

So, things are changing. (No shit Jason)

This isn’t bearish for stocks, at least not yet. However, we need to stay vigilant as we could see a quick shift between market regimes.

From a bond heavy regime and back to commodities later in the year…

We see that these shifts can be violent but what are the ingredients for a rally in commodities?

Have you ever cooked a meal that you’re truly proud of? You follow the recipe just as you’ve done countless times before, and everything comes together—the smell, the taste, and for a moment, the world makes sense. You feel in control of your life, even for a second, knowing exactly what you can and can’t manage.

Let’s focus on what we can control.

Inflation over the years…

1999: OPEC Cuts Spark Oil Rally

OPEC’s production cuts helped oil prices recover from historic lows, marking the beginning of a multi-year commodity bull run driven by rising demand from emerging markets like China.

2009: Post-Financial Crisis Stimulus Boosts Commodities

Massive global stimulus efforts and China’s infrastructure spending spurred a recovery in demand for commodities, while gold surged as a safe haven during economic uncertainty.

2016: Oil Price Crash and OPEC’s Comeback

After a sharp collapse in oil prices due to oversupply, OPEC’s agreement on production cuts in 2016 stabilized the market, while a strong dollar kept pressure on broader commodity prices