A few charts on why I think this might be a bottom but I would be very cautious here. I would not buy anything until we see confirmation on everything that I am looking at here.

Just to add on to yesterdays post… Also see more from Kevin and I on the podcast.

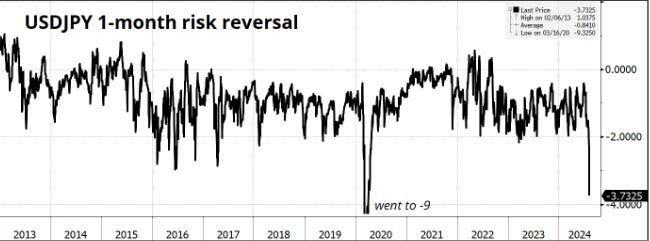

The Rate of Change (ROC) turned negative last week, and between Friday and yesterday, it seems the trade has possibly bottomed out for now. It will take some time before we know who took the hit.

Positioning was incredibly lopsided.

Based on the latest positioning report, which examines the tactical flow of funds in the FX market, investors are net long as of this week. While this doesn't rule out the possibility of a more structural unwind of carry flows, it helps contextualize the current stage of the movement.

Source: MacroCharts

As long as the SPX and QQQ stay here, it is sitting within it’s normal range. If we make a new low, I would not stay long… anything.

These types of moves align with historical trends. I always want to pay attention when it gets outside of average moves.

Source: AM/FX thanks Ian Culley

Buybacks are coming in to the market.

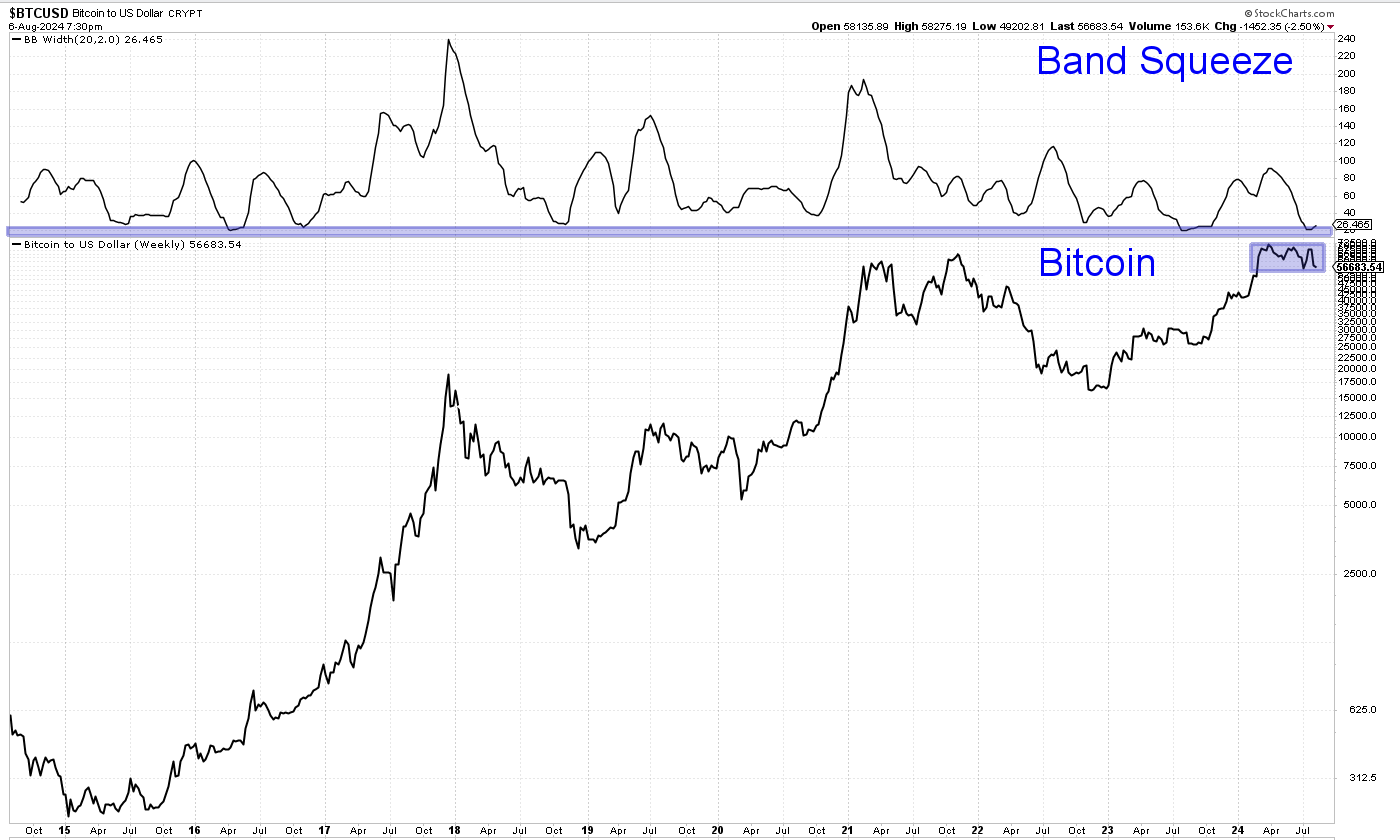

Bitcoin breaking it’s range and then moving back in to it.

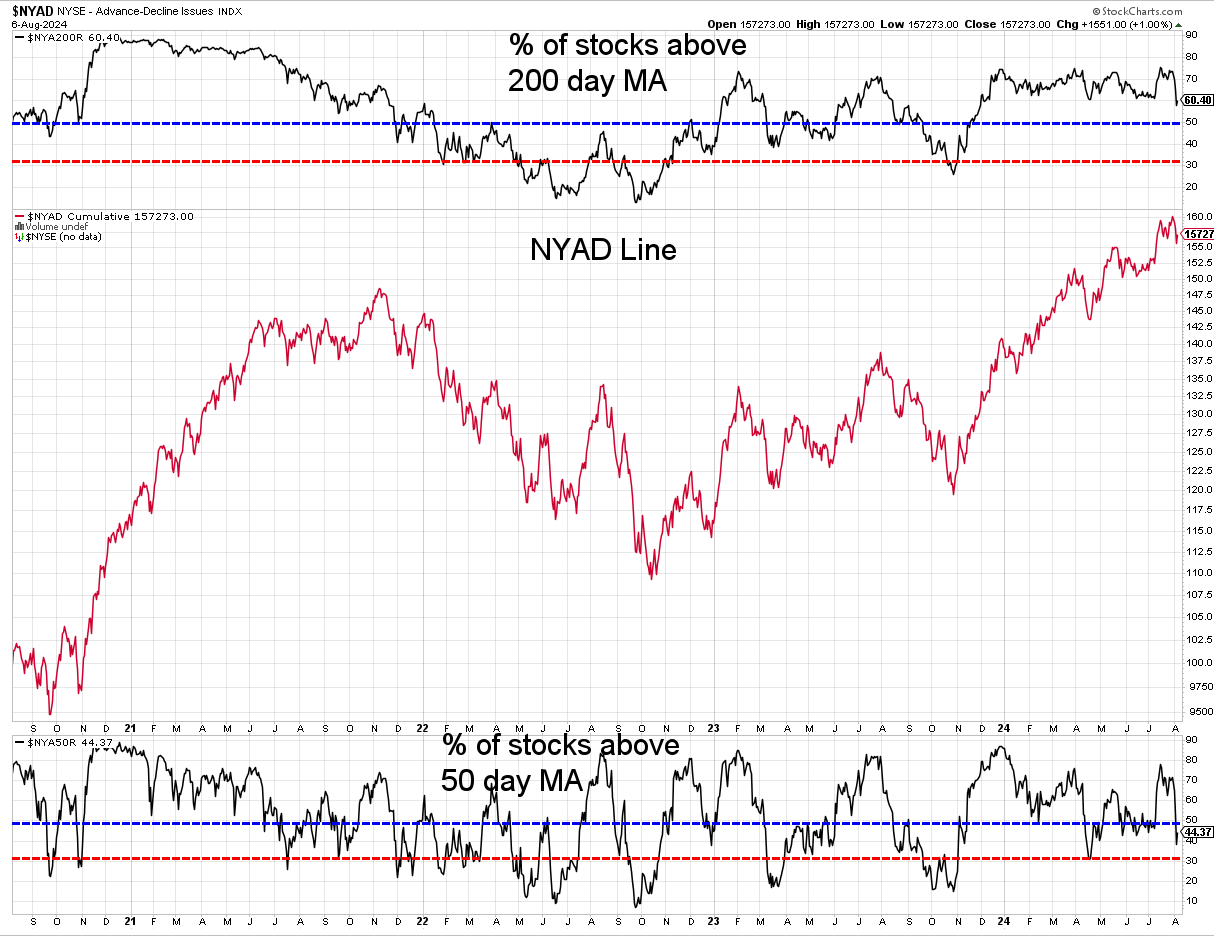

Breadth

Look: we are not in the danger zone yet but we are getting closer. I will say more than anything else the thing that I keep saying. It is summer, summer is full of pain. Be patient here. Don’t buy, don’t sell and more will be revealed.

Much love, if any of you want to reach out please do. Making this free so everyone can see this. Adding on to…

Follow the plan. Trust the plan.

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees:

Help save the native bees! Learn more and get involved here.

Share this post