A Tipping Point-System Addict

"To create one contagious movement, you often have to create many small movements first." Malcolm Gladwell

Emerging trends are surfacing across the board, driving up stock and commodity prices. Inflation can creep into any asset, and in a reflationary market, I’m seeing exactly that. I’ve been talking about this coming reflationary wave for months—and today, it’s here.

Our trend models (which you'll find at the bottom of this post) are showing green across nearly every asset, sector, and commodity—across all three major timeframes. This is where things get exciting.

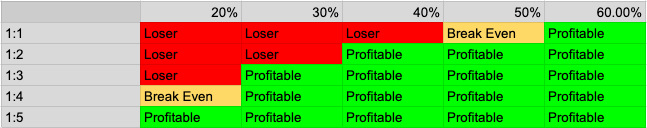

With our risk management system in place, I can confidently take concentrated bets on multiple trends and models. In backtests, our systems average a 45-55% win rate, but when combined with my regime and cycle model, those numbers rise. And most importantly, we always set up our risk-to-reward skew in our favor—aiming to risk $1 to make $5.

As I have mentioned before, this is a recipe for good trading. It is not because we are hoping for a 20% win rate.

It is because during your worst times, you still will not blow up. I have seen a few comments from people saying how ridiculous this idea sounds because they don’t understand what I just said. Just like compounding your returns by limiting drawdowns will help you make money. So will this idea of 1:5 risk to reward.

It all starts with Risk management. This is how we can have confident in the next trade and hold on to the next major trend.

Let’s Model It!

This is what a typical reflation trade looks like: energy, financials, growth-driven commodities, industrials, and sectors related to them tend to outperform the broader market. However, the surge in gold shouldn't be ignored—it’s a clear signal of stagflation. In a stagflationary environment, only a few sectors move higher, with energy leading the way, much like we saw in early 2022.

To get a sense of what’s ahead for the market, let's dive into a few key charts, starting with Bitcoin.

(Your subscriptions helps with videos, interviews, groups and gets you access to all of our trades, portfolios and more. Most importantly, liking, sharing and subscribing helps to get this information out to those who need it the most. Let’s change the fear mongering media together.)

Bitcoin, in particular, reveals a lot about market dynamics. From liquidity flows to risk appetite, it’s all reflected here. The current long-term band squeeze is indicating that the market's appetite for risk has been somewhat indecisive.

I dislike trades that are obvious to everyone but everyone should pay attention to this break out.

Bitcoin remains the most volatile asset in the market. When people believe it's heading higher, they’re willing to exchange safety, security, and sometimes even their homes for cryptocurrency. It’s a powerful indicator of the market’s appetite for risk.

Right now, Bitcoin is stuck in a range. This isn’t a clear signal yet, but trust me—you’ll want to be ready for the breakout. If you’re not already in a position, I recommend setting a buy stop on BTCUSD once it closes above 72k.

Another key element of the reflation/stagflation trade is energy. In last Friday's report, I covered how to take advantage of this. Since going long on Natural Gas, I haven’t discussed it much because there hasn’t been much to say—stay long until you get a sell signal.

I’m not here to sell you false promises; I’m here to help you make money. I don’t invent buy and sell signals every week. I stay long, neutral, or short based on real trends, not noise and NOT trying to get more followers.