Agricultural Commodities Fall/Soft Commodities Rise

Corn, Cattle, Hogs, Cotton, Oil, Copper, ISM and more...

I have had a very wide focus for everyone because of how many products I trade. I have a large portfolio these days. I have built that up over the years and it has taken a lot of time, dedication and pain to get to where I am today. I DO NOT expect everyone to be able to trade all of the products I trade. I am in the LTR rule category, if you know what that means then you know… Now that I am creating a retail product I have to try to narrow my focus a bit on here.

Understand the size of your portfolio and understand that above all else risk management is everything.

There are tons of products to trade in the futures space that are minis and micros. You might not be able to trade things like cattle, hogs, palladium, orange juice and so on… I am going to try to stay focused on the broadest and most common commodity markets going forward. Gold, silver, copper, oil, gasoline, natural gas, corn, soybeans, wheat, oats (small contracts), cattle, hogs, sugar, cotton, cocoa and coffee.

We will still talk about others when they come up but I will try to regularly talk about most of these so we can keep our focus on the majors.

Will commodities take off again? Let’s look under the hood.

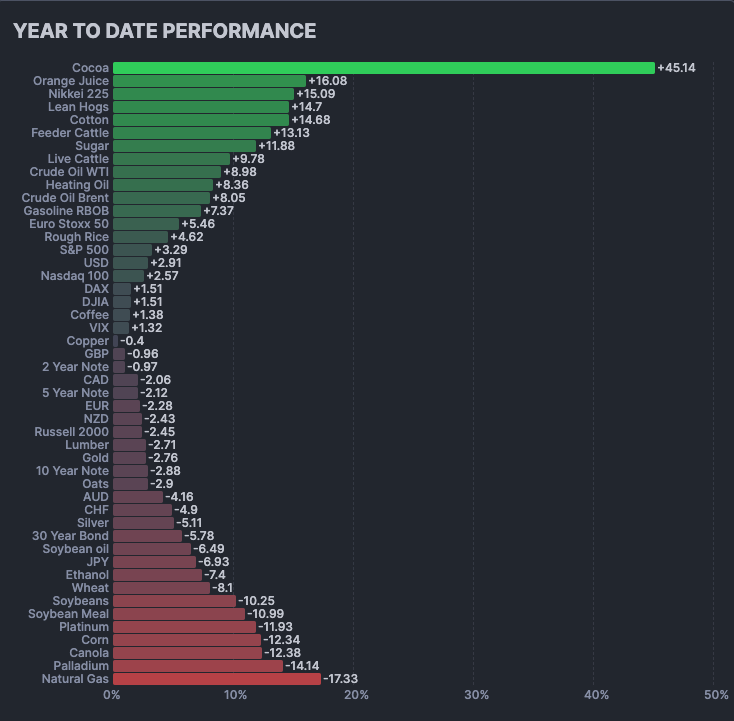

Ags have taken a hit. Corn🌽 , soybeans and wheat🌾 are all negative YTD. However can we take a look at what is positive YTD. Cocoa, Orange Juice, Japan, Lean Hogs, Cotton, Feeder Cattle, Sugar… These sound familiar because we are long all of these.

Not every position will be a winner of course and to make money we do not have to be right on every trade.

Understand this cheat sheet and you will understand trading.

We can understand a lot about the market by paying attention to what is moving. Energy (we are long) is up 8-9% YTD across the board.

What is this market trying to tell us?

United States ISM Purchasing Managers Index (PMI)

That Manufacturing has bottomed?

Things like copper and oil would love this type of environment. At the moment we have not seen copper follow oils lead this year yet but we need to keep watching and listening to what the market is telling us. My goal as a trader is to take the right trades and be positioned well for the next market move. Patience is needed here.

Why do I keep saying that and what does that mean?

It means that we are between two regimes.

So my model is right between Goldilocks and Reflation. A few points down and we will hit Stagflation. This is incredibly rare but it does happen. What this means is that we could switch regimes quickly.

The regime where growth and inflation are moving up together is called Reflation. This is when we see growth based commodities like oil and copper moving up together.

Oats are a buy here if we can close over 385. Oats has lower volatility than other commodities. We use a 15% trailing stop.

Corn will not catch a bid until cattle starts moving lower. Stop trying to buy corn until we get signals for it.

Conab, Brazil's equivalent of the USDA, has reduced its estimates for soybean and corn crops for the second consecutive month, bringing them down to approximately 149 million metric tons (mmt) for soybeans and 113 mmt for corn. These adjustments align with our own analysis. In contrast, the USDA has been slower to revise its estimates, and while it has also reduced its forecasts for both crops, it has done so at a more gradual pace, resulting in higher projected levels.

As the planting season progresses, the impact of the smaller crop sizes on prices is likely to become more pronounced, particularly as the critical second crop corn pollination phase approaches from mid-March onward. This effect could be exacerbated if dry weather persists, as our forecasts anticipate.

A significant risk factor for US spring planting is the possibility of a cold and wet May, potentially leading to hard freezes in the first half of the month. Stay patient here… No position.

Similar to the situation with corn, Conab has significantly reduced its soybean crop estimate for the second consecutive month, which initially seemed bullish. However, the USDA's subsequent announcement of a smaller reduction in production tempered this optimism. We anticipate that the USDA will likely follow Conab's lead in the coming months.

The Brazilian crop harvest has already reached 25% and is expected to hit the critical 50% mark in two weeks. Once this milestone is reached, the pressure on the harvest is expected to ease, and the wide cash basis in Brazil may begin to tighten once more.

As with corn, the month of May is crucial for monitoring the potential impact of cold, wet weather and hard freezes on the market. This could challenge the widespread belief that 2024 will see record grain yields, especially given the current level of weather volatility. No position.

Wheat prices have been consolidating since October, aiming to complete a double bottom pattern.

The demand for wheat is increasing, driven by its attractive pricing compared to rice, which remains historically high. Although not all wheat and rice demand is interchangeable, a significant portion is, and when the wheat-to-rice price ratio is heavily skewed in favor of wheat, we can anticipate a demand-driven price increase until this gap is normalized.

Winter kill risks must be closely monitored in the latter half of February, as both US winter wheat and Russia/Ukraine winter wheat have emerged from dormancy without snowfall coverage. With speculators already starting to reinvest in wheat, any weather anomalies could accelerate this new trend in capital flows.

No position.