All Miners Are Equal, But Some Are More Equal Than Others

Animal Farm and the Leadership of Metals & Mining

George Orwell’s Animal Farm was never really about animals. It was about power, illusions, and how narratives can blind people to what’s happening right in front of them.

Markets are no different. Every sector, every asset class, every commodity gets its turn in the rotation. But let’s be honest: not all sectors are created equal. Some quietly take leadership while others lag, no matter how loudly the crowd insists otherwise.

Right now, the leaders are clear. Metals and mining are stepping up. And just like the pigs on the farm, they’re proving themselves more equal than others.

The Fire at the Core: Metals and Mining

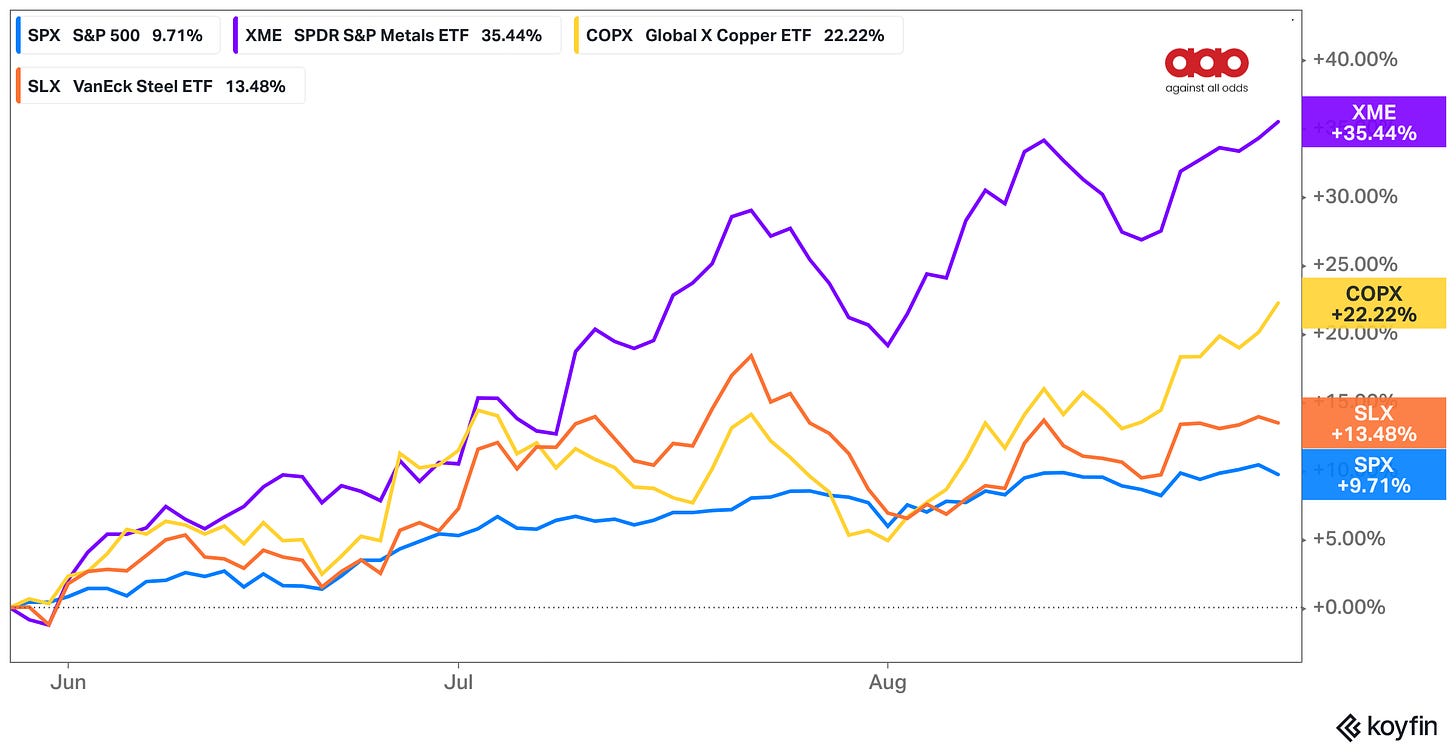

Look at the Metals & Mining ETF ($XME). Relative to the S&P 500, it’s not just holding — it’s running laps. Up more than +35% over the last 3 months compared to +9% for the index. That’s leadership.

When metals and miners lead, it’s rarely about one-off stories. It’s a macro message: global growth trades are alive, demand for hard assets is firming, and reflation is real.

“All animals are equal, but some animals are more equal than others.” — George Orwell

This is the market’s version of Orwell’s line. Every sector gets priced on supply and demand, but some sectors — right now, metals — are commanding disproportionate flows. They are “more equal” in their ability to drive portfolios.

Steel and Copper: Breaking the Chains

The story isn’t just broad ETFs. The Steel ETF ($SLX) is pressing against multi-year resistance. This is the moment when years of frustration could flip into acceleration.

The Copper Miners ETF ($COPX) is even clearer — breaking out into fresh 52 week highs. Copper is often called “Dr. Copper” because it diagnoses the health of the economy. When copper miners rip, it’s not just about mining stocks — it’s about infrastructure, global demand, and risk appetite across the board.

“The creatures outside looked from pig to man, and from man to pig, and from pig to man again; but already it was impossible to say which was which.” — George Orwell

Markets do this too. They blur the lines. Investors who once insisted commodities were “dead money” now chase copper miners at new highs. Yesterday’s laggard suddenly becomes today’s darling.

Relative Strength: The Real Signal

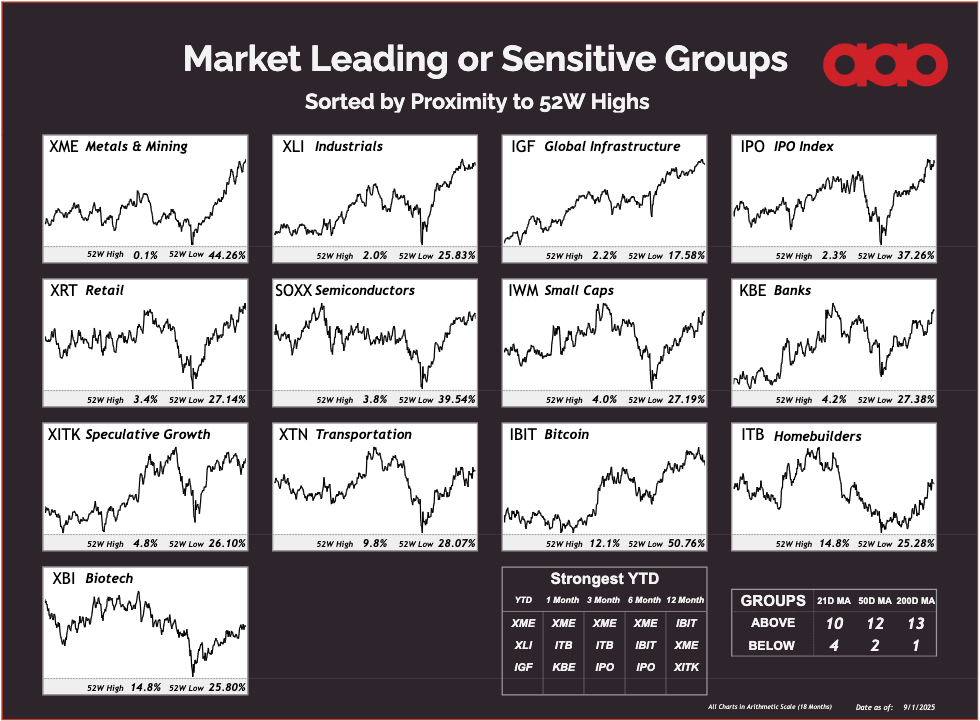

At AAO Research, we always come back to relative strength. This isn’t about stories or forecasts; it’s about evidence. Our proprietary TrendFinder scans are lighting up across metals and miners:

$XME leading all major sectors.

$COPX outperforming.

$SLX pressing resistance.

Taseko Mines ($TGB) flagged in the scan — coiled at resistance, ready to break.

The scans don’t lie. They’re showing us where capital is flowing before the narratives catch up.