Being a contrarian wont help you make Friends: It will make you a lot of Money 💰 💴 💷

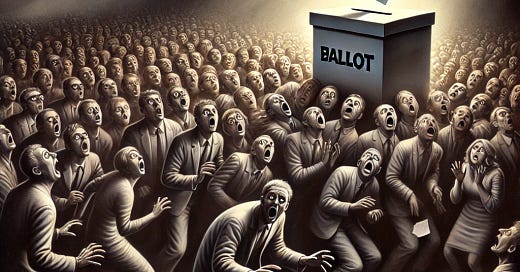

A wild story from the 2020 election and how to profit from the 2024 election...

I am seeing so many interesting setups that are worth paying attention to, especially with the election around the corner.

A lot of people are still focused on the big scary headlines about the election and the usual suspects like the Magnificent Seven, but there’s so much more going on beneath the surface. Bitcoin, small caps, regional banks and breadt…