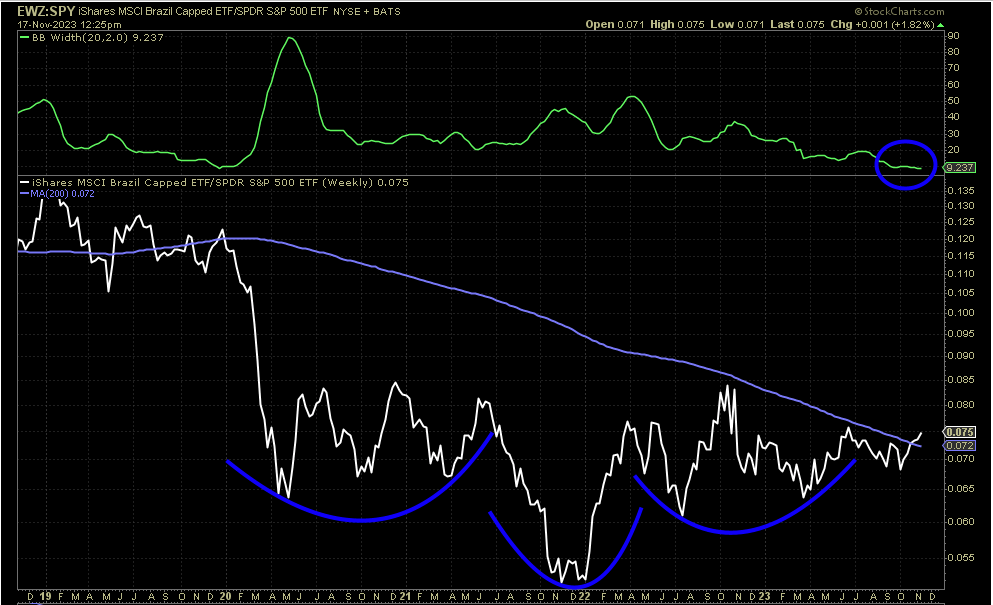

This morning, we incorporated Brazil into our long-term portfolio. I've been patiently awaiting a clear break in volume resistance for this opportunity, and today it finally provided a buy signal.

Relative strength has entered a positive zone, marking a notable shift. Additionally, a significant volatility contraction is currently underway. Typically, low volatility precedes high volatility.

Investing in commodity-rich countries can offer a range of advantages for investors seeking diversification and potential long-term returns. These nations, often endowed with abundant natural resources such as minerals, energy, and agricultural products, tend to be significant players in global commodity markets. Investing in such countries provides exposure to the inherent value of tangible assets, serving as a hedge against inflation. When we observe an influx of relative strength into a commodity-rich country precisely at a juncture when the consensus signals victory in the battle against inflation, particularly amid rate reductions. Concurrently, when the local currency exhibits resilience in the face of a strengthening dollar. At this juncture, I believe it's time

to consider taking a strategic swing at this opportunity.

Brazil is a major player in global trade, and its economy is characterized by diverse exports and imports.

Major Exports from Brazil:

Soybeans and Soy Products:

Brazil is a leading global exporter of soybeans and related products, including soybean oil and soybean meal.

Iron Ore:

Brazil is a significant exporter of iron ore, a crucial raw material for the production of steel.

Crude Petroleum:

The country exports crude petroleum and petroleum products, contributing to its position in the global energy market.

Raw Sugar:

Brazil is a major exporter of raw sugar, reflecting its prominence in the global sugar industry.

Poultry and Beef:

The agricultural sector in Brazil plays a key role in exports, with significant quantities of poultry and beef being shipped globally.

Aircraft and Aircraft Parts:

Brazil has a strong presence in the aviation industry, exporting aircraft and related components.

Corn:

Corn is another important agricultural export, with Brazil being a major supplier to global markets.

Coffee:

Brazil is renowned for its coffee production and is one of the largest coffee exporters in the world.

Major Imports to Brazil:

Refined Petroleum:

Brazil imports refined petroleum products to meet domestic energy needs.

Vehicle Parts and Cars:

The automotive industry in Brazil drives imports of vehicle parts and finished cars.

Electrical Machinery and Equipment:

Brazil imports a significant amount of electrical machinery and equipment for various industries.

Medicaments:

Pharmaceutical products, including medicaments, are among the major imports to Brazil.

Telecommunications Equipment:

With the growth of the telecommunications sector, Brazil imports equipment to support its infrastructure.

Plastic and Plastic Products:

Plastics and plastic products are imported for use in various industries, including manufacturing and packaging.

Iron and Steel Products:

Despite being a major exporter of iron ore, Brazil also imports iron and steel products.

Electronics and Computers:

The demand for electronics and computer-related products contributes to Brazil's imports.

Speaking of aircraft and parts, this piece of news came out…

On Friday, Brazil officially became a member of the World Trade Organization's agreement on trade in civil aircraft, marking a significant step welcomed by planemaker Embraer. The entry into this pact ensures that member states can import components without facing tariffs. Embraer, headquartered in Brazil, specializes in segments such as regional and executive aviation, standing alongside major players like Boeing and Airbus.

Up until this point, Brazil stood as the sole relevant aircraft producer and original WTO member that had not participated in this agreement, while its competitors were actively engaged. The signatories of this deal, in force since 1980, encompass major global players like the European Union, China, Canada, Japan, Switzerland, Norway, the United Kingdom, and the United States. The Brazilian government highlighted the positive impacts of joining, emphasizing enhanced predictability in input prices and a favorable signal for attracting investments. Embraer's CEO, Francisco Gomes Neto, expressed optimism, considering Brazil's accession a significant milestone for international trade, with the move consolidating import taxes on aircraft and parts at zero, effectively averting potential tariff barriers between member countries.

So… it’s on the dart board!