Beyond the Ups and Downs: Navigating Volatility with Reliable Portfolio Allocations

Building a Steady Investment Foundation Amid Market Fluctuations

This is a study (go to the voiceover to know my actual opinions on how terrible the 60/40 portfolio is) and not my opinion.

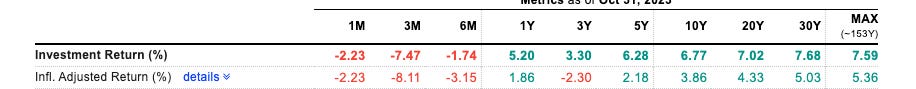

The time-honored asset allocation model, known as the 60/40 portfolio, represents a fundamental strategy in investing. This traditional portfolio structure allocates 60% of the investment to stocks (S&P 500) and the remaining 40% to 10-year U.S. government bonds.

The rationale behind the inclusion of both stocks and bonds in many investment strategies is their tendency to exhibit non-correlated behavior. This means that while stocks may experience fluctuations, bonds often move in an opposite direction. Although this relationship is not consistently steadfast, the amalgamation of two or more non-correlated assets in a portfolio typically yields a more robust investment approach compared to individual assets alone.

How has the performance of this portfolio been over time?

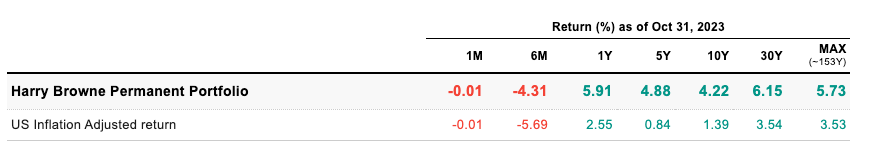

In the 1980s, a brilliant mind designed a simple and diversified investment approach. This approach, known as the "Permanent Portfolio," aimed to ensure financial stability without the need for frequent adjustments, even in the face of shifting future expectations. The strategy focused on maintaining a balanced mix of assets that would safeguard wealth against any unforeseen catastrophe or market turmoil. It emphasized the significance of achieving diversification without complicating the investment process.

This portfolio strategy offers consistent performance with lower volatility and drawdowns across various market conditions. However, it might not always outperform more traditional investment options such as solely investing in stocks or adopting the 60/40 asset allocation approach. This poses a question for all investors: How much are they willing to deviate from the standard approach in pursuit of stability, considering the potential for occasional underperformance in specific market environments?

Mebane T. Faber and Eric W. Richardson, the minds behind Cambria Investment Management, introduced the Meb Faber Ivy Portfolio. Their investment strategy, as outlined in the 2009 book "Ivy Portfolio," mirrors the approach of prestigious endowments, like those associated with Ivy League universities.

The Ivy Portfolio, designed to achieve global diversification, combines various asset classes, including stocks, bonds, and other investments. With a strong emphasis on cost-efficiency, the strategy leans towards passive management through the utilization of low-cost index funds.

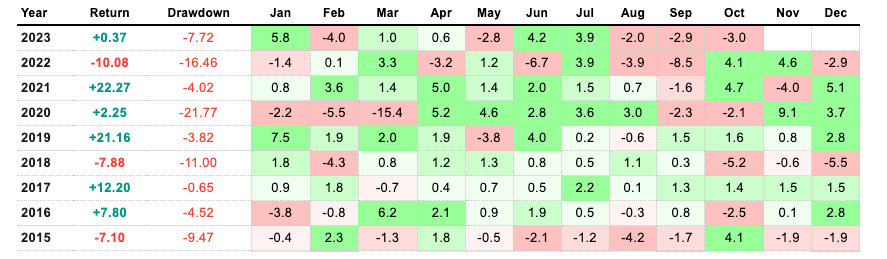

Meet Marc Faber, the Swiss economist and fund manager currently residing in Asia, known for his contributions to the Gloom, Boom, and Doom market newsletter.

Faber has outlined a rough asset allocation strategy of 25% in gold, stocks, bonds, cash, and real estate. While he might hold some bonds and real estate assets in foreign markets, his basic portfolio structure serves as a solid foundation for general discussions. Although he hasn't explicitly mentioned splitting his stocks into U.S. and foreign equities, it's a reasonable assumption in this context.

Surprisingly, Marc's straightforward allocation strategy has proven to be one of the most consistently performing portfolios I have seen. Across different decades, this portfolio stands out for delivering positive real returns.

How are we positioned in futures and our long term portfolio?