Bitcoin the Next Leg Higher: The Week Ahead

“A candle loses nothing of its light by lighting another candle.”

Ready to buy the breakout?

(Side note: Thanks for dealing with my schedule over the last week. I am working on some big things for all of us and our community. Seeing what this can be is exciting. I can’t wait to show everyone what we have going on. We should have some solid answers soon. Also our schedule is back to normal now. I will post a zoom link about our live group tomorrow. Open to all subscribers. The most likely time is 2pm Thursday.)

CME BTC Futures-CME is still leading the way for futures open interest for Bitcoin.

Total Bitcoin spot ETF inflows.

Marathon Digital Holdings has partnered with the Kenyan government to utilize Kenya's geothermal energy for bitcoin mining, aiming to harness surplus energy, generate revenue, and enhance infrastructure. Meanwhile, criticisms of bitcoin have shifted from environmental concerns to issues of money laundering and national security.

Semler Scientific, Inc. has adopted bitcoin as its primary treasury reserve asset, purchasing 581 bitcoins for $40 million while maintaining its focus on healthcare innovation. The federal government is appealing a court ruling that deemed the Corporate Transparency Act unconstitutional, which required entities to report beneficial ownership information.

In global bitcoin adoption, Argentina is exploring collaboration with El Salvador, signaling growing international recognition of bitcoin. Additionally, significant developments include the NYSE launching bitcoin financial products, BlackRock investing in bitcoin ETFs, and projections of substantial GDP growth for El Salvador due to bitcoin and AI initiatives.

Bitcoin is in a volatility squeeze.

Bitcoin is showing relative strength.

Bitcoin volume has been stagnant, which is what we like to see when we are in a consolidation pattern.

A weekly close above 72k would say that we are in a new bull move for Bitcoin.

We are still long.Global Yields

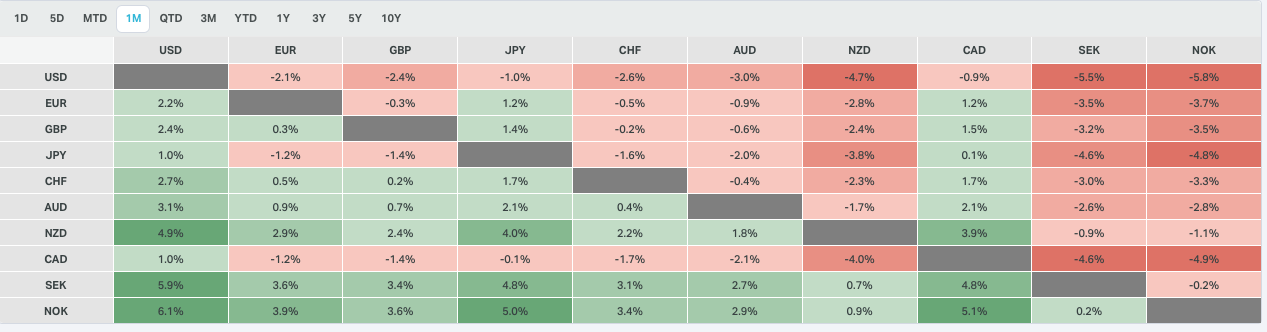

Currencies YTD

Currencies over the last 3 months.

Currencies over the last month, are we starting to see a trend emerging.USD-Long USD positioning has started to unwind. While Chinese reserve holdings are rotating OUT of the dollar.

We have an interesting dynamic building here. We are between regimes but the dollar is starting to breakdown. Is it just the expectation of rate cuts or is it a rush out of dollars and in to things that have real value?

Keep watching.

Copper to Gold ratio is giving a blow off top signal. That is a huge reversal candle. We are not selling copper yet, but we need to pay attention to this. We need to be open to a retracement rally in bonds.

Nasdaq/Small cap ratio. If small caps are going to make a run. It is right here right now. If not, I would be open to the Nasdaq having more upside ahead. For now, we don’t see a decisive move one way or the other.Here is a hard one to understand. We are between regimes and this ratio keeps pointing to higher level of inflation. This is my go to for inter market analysis. However we need to see more information in the charts pointing to it as well. Oil is very weak here. If it continues to look weak, I am afraid we are heading in to a very rough risk off environment.

Even in this environment we have to continue to hold precious metals.