Bonds and Market Cycles: Timing Your Investments for Maximum Returns

Bonds, my cycle models, rotations, junk bonds, gold, commodities and more...

The three stages of a bull market: “the first stage, when only a few unusually perceptive people believe things will get better, the second stage, when most investors realize that improvement is actually taking place, and the third stage, when everyone concludes things will get better forever.”

― Howard Marks, Mastering The Market Cycle: Getting the odds on your side

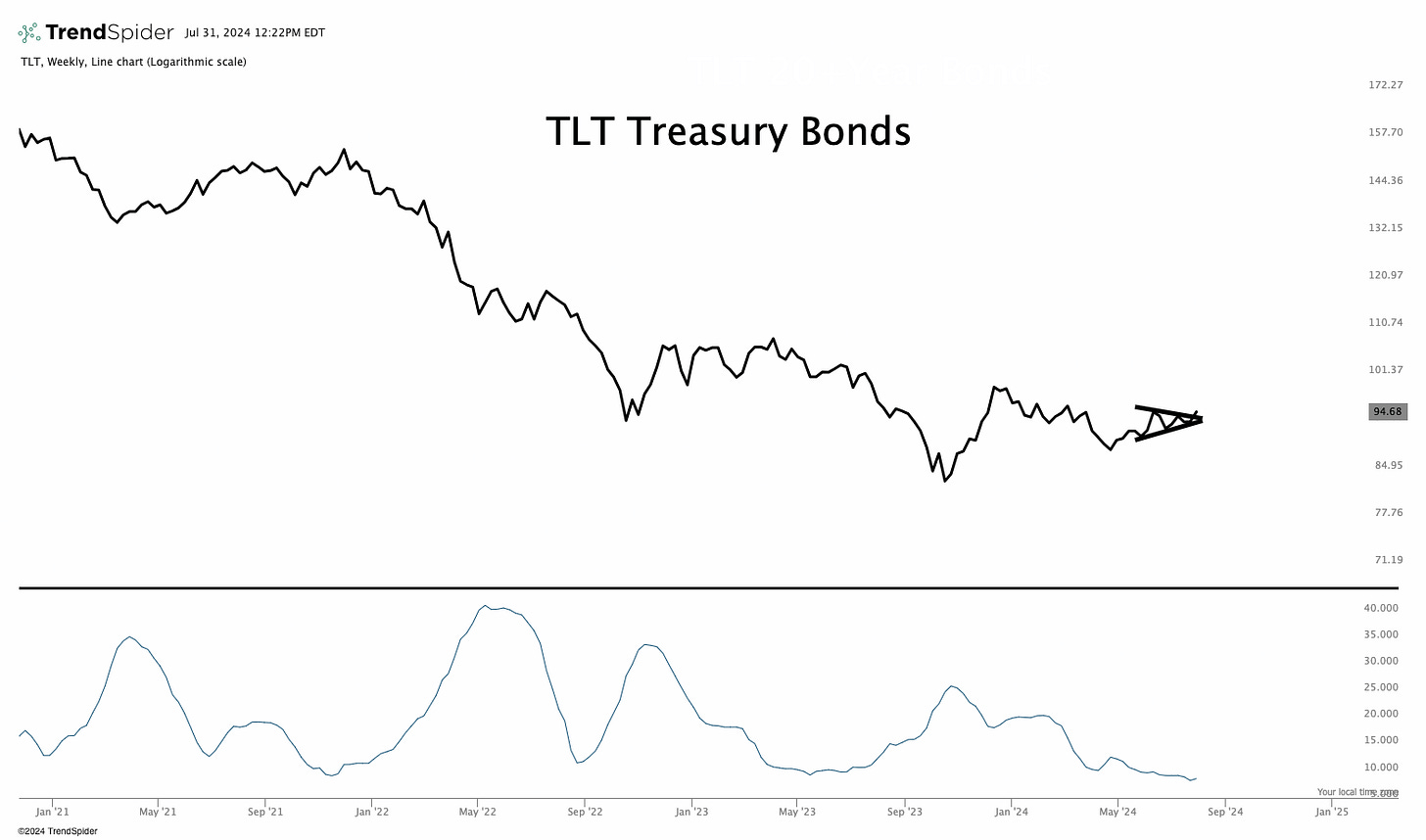

I know I usually talk about commodities today and we will get to that, but we also NEED to talk about bonds.

(The TIPS ETF tracks the performance of Treasury Inflation-Protected Securities (TIPS), which are designed to protect investors from inflation. This ETF invests in a portfolio of TIPS, providing exposure to U.S. government bonds that adjust their principal value with changes in the Consumer Price Index (CPI).)

It’s making a new 52 week high.

Yields and the yield curve

If you are not in our chat-our buy stop was hit today. Before the Fed meeting. Ugh.

Good or bad, I have learned to follow the system.

Trailing stop-9.5%

I think we all need to stay aggressive this year when it comes to gold and silver. It won’t be easy and we will see a ton of volatility but trade it systematically and stay bullish until the trend breaks.

So let’s think about what environment assets like.

Source: Merril Lynch