Breaking it Down: Backtesting

'Breaking It Down,' where we embark on a journey into the world of futures, commodities, bonds, equities and more! In this edition, we shift our spotlight to the intricacies of backtesting.

In the world of financial trading, understanding backtesting and optimizing a strategy is crucial. Examining charts, signals, and returns are key. Success lies in grasping the edge source—small consistent wins or infrequent significant gains. Quantify adjustments, mind sample size, avoid overfitting. The aim? A sustainable, stress-free strategy akin to a successful business.

Components of a basic backtest typically include the following:

Selection of the chart for the backtest.

Determining the entry and exit signals.

Analyzing the win rate.

Calculating the average win and average loss size.

Evaluating the maximum drawdown on capital.

Assessing returns.

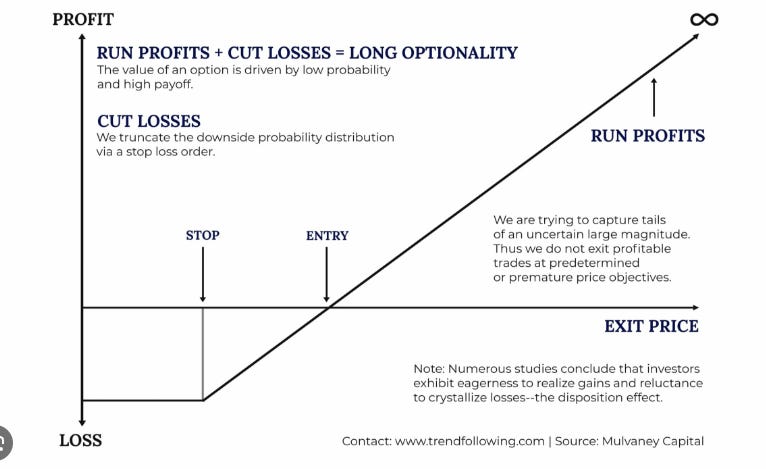

Understanding the source of an edge in a strategy is crucial. It may arise from maintaining a high win rate and minimizing losses or from a smaller number of significant, major wins combined with effectively managing numerous small losses.

Key considerations

when optimizing a trading strategy:

Quantify all adjustments made to the strategy with new parameters and conduct backtests accordingly.

Backtest the newly optimized adjustments on a sufficient amount of historical data that encompasses various market environments.

Ensure the sample size for the second backtest on new optimized parameters is significant enough to yield statistically meaningful results, rather than being based on selective market environments to enhance past performance.

Simplicity in adjusting fewer strategy parameters and variables can help prevent overfitting. Employing two sets of data for backtesting can guard against the pitfalls of randomness. Testing the strategy on in-sample data, optimizing it, and then testing it on out-of-sample data can reveal what truly enhances performance.

Live trading of a backtested system aids in comprehending the commitment, discipline, frustration, stress, and screen time required to execute it in real-time with capital at risk. An ideal trading strategy enables a trader to feel at ease during both wins and losses, with a clear understanding of the expected win/loss ratio and drawdowns. Confidence in the strategy and self-assurance in consistent execution over time are vital for a trader.

Traders often adjust position sizing and risk exposure of a trading strategy in real-time as they gain insights into its performance across different market environments.

Successful trading involves the continual evolution of both the trader and the strategy to identify what works best for them in the long run. The most effective trading strategy is one that can be consistently followed with minimal stress and maximum gains, simulating the operations of a business rather than engaging in high-stakes gambling at a casino.

In the dynamic realm of financial trading, a comprehensive grasp of backtesting intricacies is imperative for any successful trader. The multi-faceted components of a backtest, from chart selection to win rate analysis, pave the way for a strategic understanding of a trading system's competitive edge. Navigating the complexities of strategy optimization necessitates a mindful approach, encompassing quantification of adjustments, careful consideration of sample size, and avoidance of overfitting. As traders delve into live trading, understanding the commitment and discipline required reinforces the significance of confidence in a trading strategy and self-assurance in consistent execution. With the recognition that successful trading is a continual journey of evolution, the ultimate goal remains crafting a sustainable, stress-minimizing approach that mimics the stability of a successful business, not the unpredictable nature of high-stakes gambling.