Breaking it Down: On the Hunt

“No one who can rise before dawn three hundred sixty days a year fails to make his family rich.” From: Malcolm Gladwell-Outliers

Whether you're a novice looking to make your first trade or a seasoned trader aiming to refine your approach, here's how you can build a robust trading system that works for you.

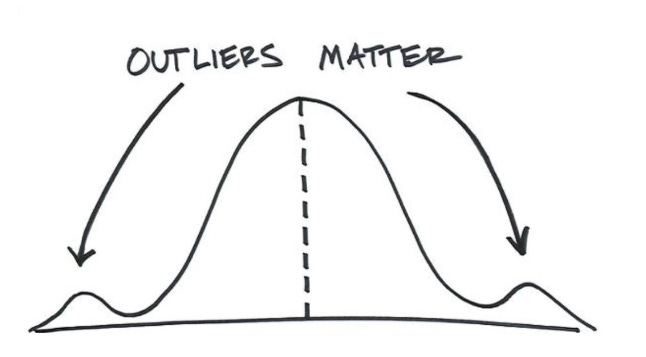

Let’s discuss the pivotal market phenomena known as outliers, guiding you through a strategic approach to capturing these rare but transformative opportunities.

This is pivotal for understanding our strategies, from trend following, relative value, our call and put options tail risk strategies and more…

System Addict: A Web of Macro Trades

Every week, we peel back the layers of the market to reveal hidden opportunities and navigate the complex currents of the economy with precision. 🔪

At AAO, we focus on finding unusual patterns in the market because we've learned that big swings in prices often come from factors within the market itself, not just from big news events. These internal factors make us question if markets always reflect their true value.

Our studies show that big changes in prices can't always be explained just by basic market drivers. The market is complicated, made up of many different players whose actions can affect each other in unexpected ways. Sometimes, even a small change can cause a big ripple effect.

These ripples are different from the sudden jumps caused by news like a pandemic or an oil crisis. They build up slowly and create a lot of uncertainty because it's hard to see where they started. This means the market isn't always quick to show the true value of things, especially during these big shifts.

Since markets aren't always predictable, we focus on protecting ourselves from these unexpected shifts rather than trying to guess when they'll happen. Our strategies help us take advantage of these unique situations by understanding the deeper patterns that aren't obvious at first glance.

Simply put, at AAO, we pay attention to these unusual patterns because they teach us more about the market and offer opportunities that regular strategies might miss. We're always ready, whether we're dealing with expected or surprising market changes.

Photo: Beyond the Chart

Now, let’s teach you how to hunt!

Diversify Across Markets

The first step in hunting for outliers is to cast a wide net. Since outliers are rare and significant events in market data, increasing the number of markets you trade in can improve your chances of encountering them. For example, if a single market might present only a few outlier events over a 30-year period, trading across 150 different markets can multiply your chances of capturing these events. This approach also helps normalize the data for each market, ensuring consistency in how you manage trades across different environments.

Use Long Lookbacks

The second step is to use long lookback periods in your trading strategy. This means analyzing a longer history of market data to identify potential outliers. By doing so, you can minimize the noise and more common patterns of wins and losses that occur due to short-term fluctuations. Long lookbacks help focus on more significant, impactful market movements that characterize outliers.

Incorporating Volatility as a Signal

To confirm potential outlier events, you can use measures like volatility expansion. This involves observing whether there's a sudden increase in market volatility, which can indicate the start of an outlier event. Both sudden news-driven shocks (exogenous events) and more gradual build-ups of market tension (endogenous events) can cause these spikes in volatility.

Systematic Exclusion of Unwanted Trades

To refine your focus on outliers, systematically exclude less promising trade signals that do not meet your criteria for potential outliers. This selective approach helps maintain a clean and focused trading strategy that prioritizes high-impact opportunities over routine market noise.

Understanding the Nature of Outliers

Outliers in the market aren't just random anomalies; they often have a serial correlation, meaning they can influence subsequent events in the market. They aren't repetitive patterns but rather significant shifts that can be thought of as 'rogue waves' in the market—large, unexpected, and potentially transformative.

Long-Term Perspective

Finally, consider the impact of trading horizon on your ability to capture and benefit from outliers. Short-term traders may find that the 'noise' of regular trading obscures the gains from outliers, resulting in a mix of many small wins and losses punctuated by rare significant gains. In contrast, long-term traders, with their broader view and longer lookbacks, can better isolate and retain these outliers in their trading results, leading to a clearer pattern of fewer but more significant wins.

By diversifying your approach, using long lookbacks, focusing on volatility signals, and systematically filtering out the noise, you can effectively hunt for outliers

Against All Odds Research Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)