Buy International Stocks-The Weekly Scope: Snipers Only!

Sectors, Relative Strength, Growth, Value, International Stocks... Our free weekly report

📈 Jump into the world of market analysis with me. In this episode, we're gearing up for an intense exploration of market dynamics, trends, and the strategies that matter most. Get ready for a laser-focused perspective on the ever-evolving financial landscape. Let's navigate the chaos and find clarity together. Welcome to The Weekly Scope!

For our subs. You already saw it in our paid post yesterday. You know what to do. VNM 0.00%↑ . Your buy stop should have been hit.

VNM

Hey there! We're on a mission to share valuable content, and we could really use your support. If you find our content helpful or entertaining, consider giving it a thumbs up, sharing it with your friends, and hitting that subscribe button. Your support means the world to us, and it helps us reach even more people. Thanks a bunch!2. RS is flowing in to Real Estate, Financials and Industrials.

3. XLRE 0.00%↑ is finally coming out of a base as well.

4. XLF 0.00%↑ has been in our portfolio for awhile but now we are starting to see it run away from the broad market.

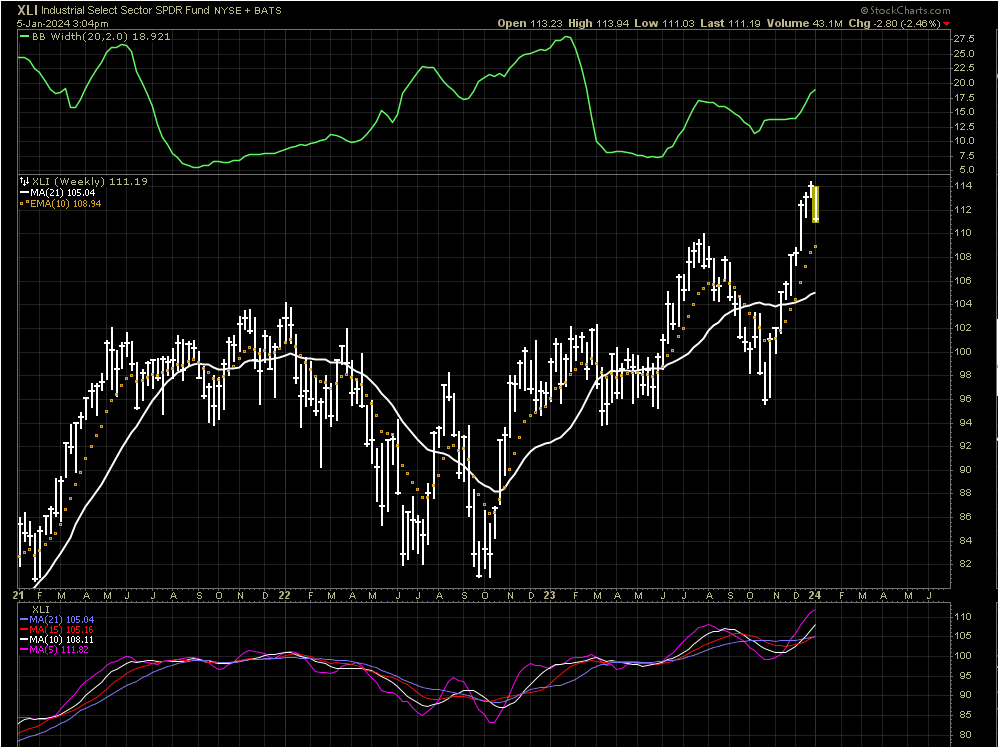

5. XLI 0.00%↑ has been running higher for awhile as well. It has been in our portfolio for a year now. What we are seeing here is the beginnings of reflation trade.

6. In the last 5 weeks value has started to outperform growth.

What Value/Growth means to normal people… The choice between value and growth stocks is a fundamental decision for investors that significantly influences their overall investment strategy. Value stocks, often characterized by stable companies with lower stock prices relative to their intrinsic value, offer the allure of potential undervaluation and steady dividends. On the other hand, growth stocks represent companies with high potential for earnings growth, often reinvesting profits for expansion rather than paying dividends. The decision to favor one over the other depends on an investor's financial goals, risk tolerance, and market outlook.

To me it is tech or… banks, financials and energy stocks. Always look inside the indexes.

7. Value index holdings

8. The Magnificent 7… I mean the Growth index holdings.Stop trying to buy China

9. Look outside of the US for real value.

10. Commodity producing countries are leading the way.Bonus: Crypto-I still want to own Bitcoin over alts. I still think its going to be a smoother trade. Yes you can pick some but when you have leverage. Why? Hold the trend that we have held all year until the end when it bends!

Stay informed. Stay resilient. Against all odds.Warm regards, Jason Perz

If you find this content valuable, please consider liking, sharing, and subscribing. Feel free to pass it along if you think it can benefit others.

YouTube: @againstalloddsresearch https://www.youtube.com/channel/UCLvDNCnhNQbQnABUSFbwaggTwitter: @jasonp138

Substack: aaoresearch.substack.com

Against All Odds Research

jperz1985@icloud.com