Markets move in cycles. Always have, always will.

And if you’re in the business of catching outliers, you need to be paying attention to commodity supercycles—because that’s where the biggest trends of all time happen.

Most of the big moves happen quickly.

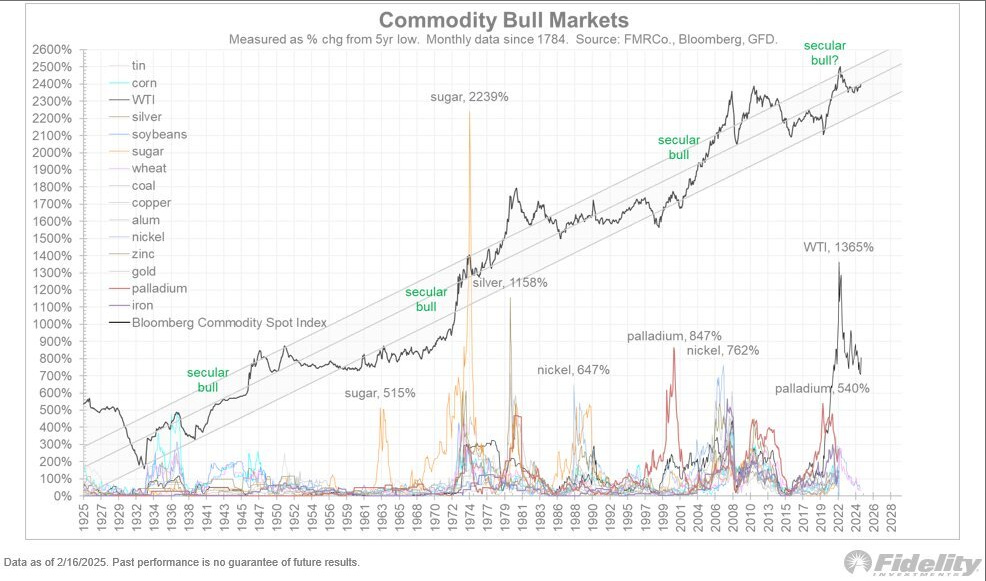

Just look at this chart from Jurrien Timmer

📈 Sugar +2,239%

📈 Silver +1,158%

📈 WTI C…