Commodities are Set Up to Explode! Free Weekly Report-The Seven Day Scope: Snipers Only

Commodities, Gold, Currencies and more. Welcome to our free weekly report available every Friday.

📈 Jump into the world of market analysis with me. In this episode, we're gearing up for an intense exploration of market dynamics, trends, and the strategies that matter most. Get ready for a laser-focused perspective on the ever-evolving financial landscape. Let's navigate the chaos and find clarity together. Welcome to The Weekly Scope!

Let’s see what we can see in our scope this week!

A quick update on upcoming content! We have two exciting video interviews lined up on our YouTube channel featuring the insightful perspectives of Andrew Thrasher and Mish Schneider. You can find the link at the bottom of this page. Your support means a lot, so please take a moment to like, share, and subscribe. I invest considerable effort into delivering valuable free content, and your assistance in reaching the right audience is crucial to fulfilling my mission. Thank you for being a part of our community!

Macro Markets

1. Futures-Performance MTD

“You need to know very well when to move away, or give up the loss, and not allow the anxiety to trick you into trying again.” – Warren Buffett

2. Crypto majors MTD performance

3. 1 month ETF performance

SPX SPDR sectors YTD

5. Currencies

“5/1 risk/reward ratio allows you to have a hit rate of 20%. I can actually be a complete imbecile. I can be wrong 80% of the time and still not lose.” – Paul Tudor Jones

Commodities

Oil-Revisit that report.

The next day. Once again. I am not saying it is the 2000s all over again. I am just saying that…

“History Doesn't Repeat Itself, but It Often Rhymes” – Mark Twain

8. Gold Breakout-Be patient here…9. Gold Seasonality

10. Silver-Not the prettiest cup and handle pattern. However it is a massive and I mean MASSIVE cup and handle pattern.

11. Lumber-This is a perfect set up.

12. Oats

13. Natural Gas-This is a theme in the commodities complex.

14. Heating Oil-This could be next.Equities

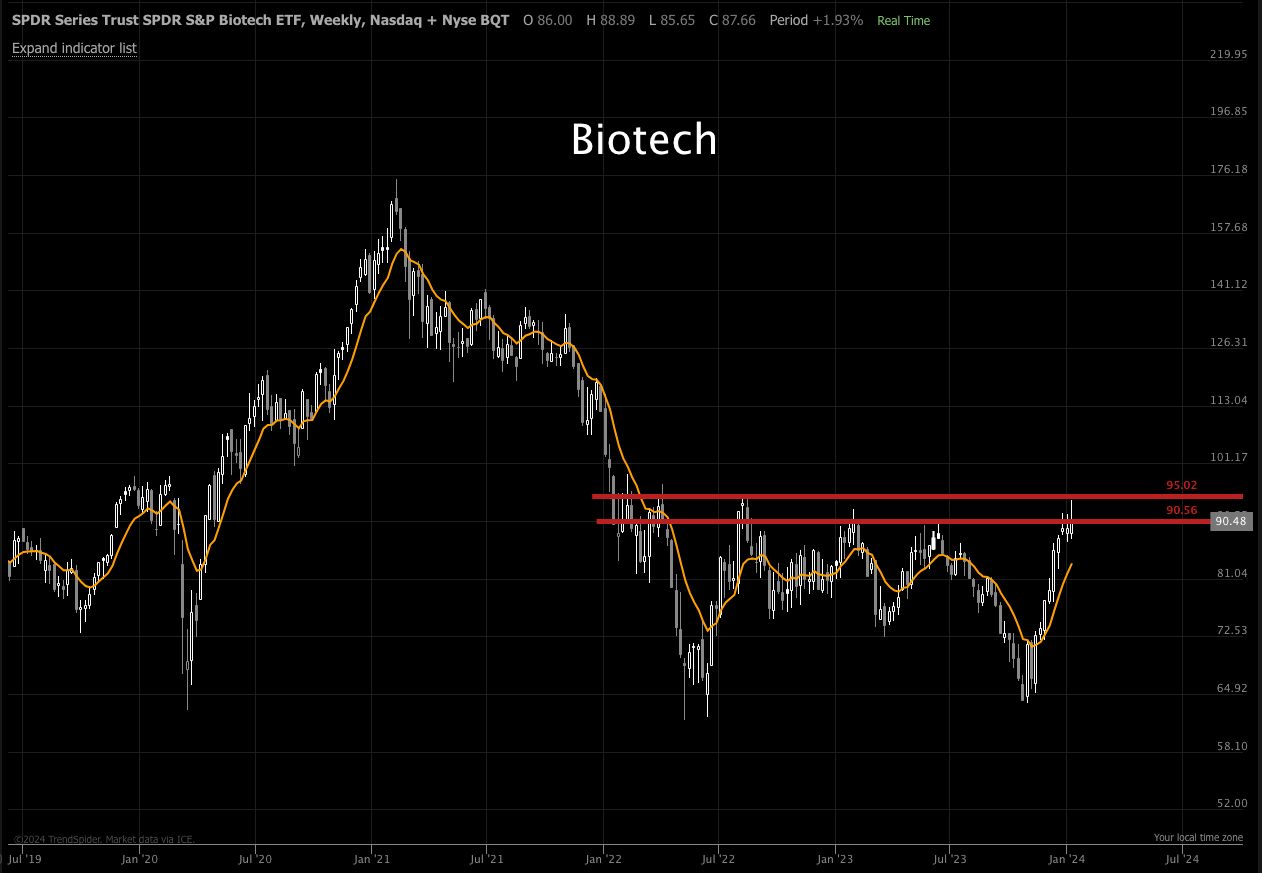

15. Biotech-The most risk on sectors are strong!

16. Semiconductors-New highs17.

18. New Highs/New Lows-This usually means more upside incoming.

19. Warning signs…

20. My short term swing model is still in a sell. I am still long. This does not effect my time frame but in the short term, I still think caution is advised.

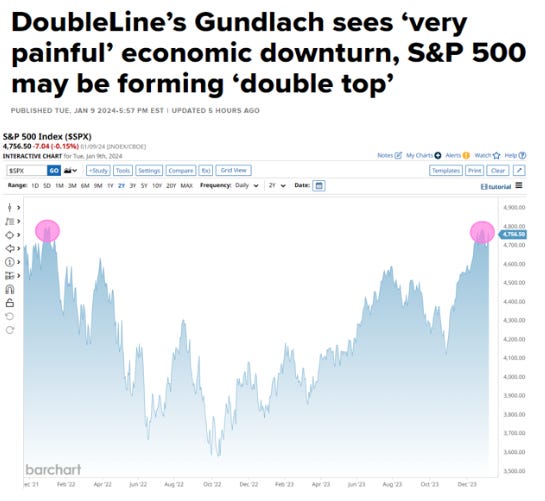

21. However back to my double top theme. People get way too bearish at double tops. Even guys who make fun of technical traders like Gundlach. So now we will see an abundance of double top charts and how the market is done here. Consolidation is what I am seeing as a possibility for now. A crash? No.

22. Monthly options expiration next Friday. Next week could be very choppy.

23. URNM weekly-Stay long Uranium. The structure of this market is very bullish. https://x.com/AAOResearch/status/1745841979747909719?s=20

24. URNJ Junior Uranium Miners Daily- Holy Breakaway gap.

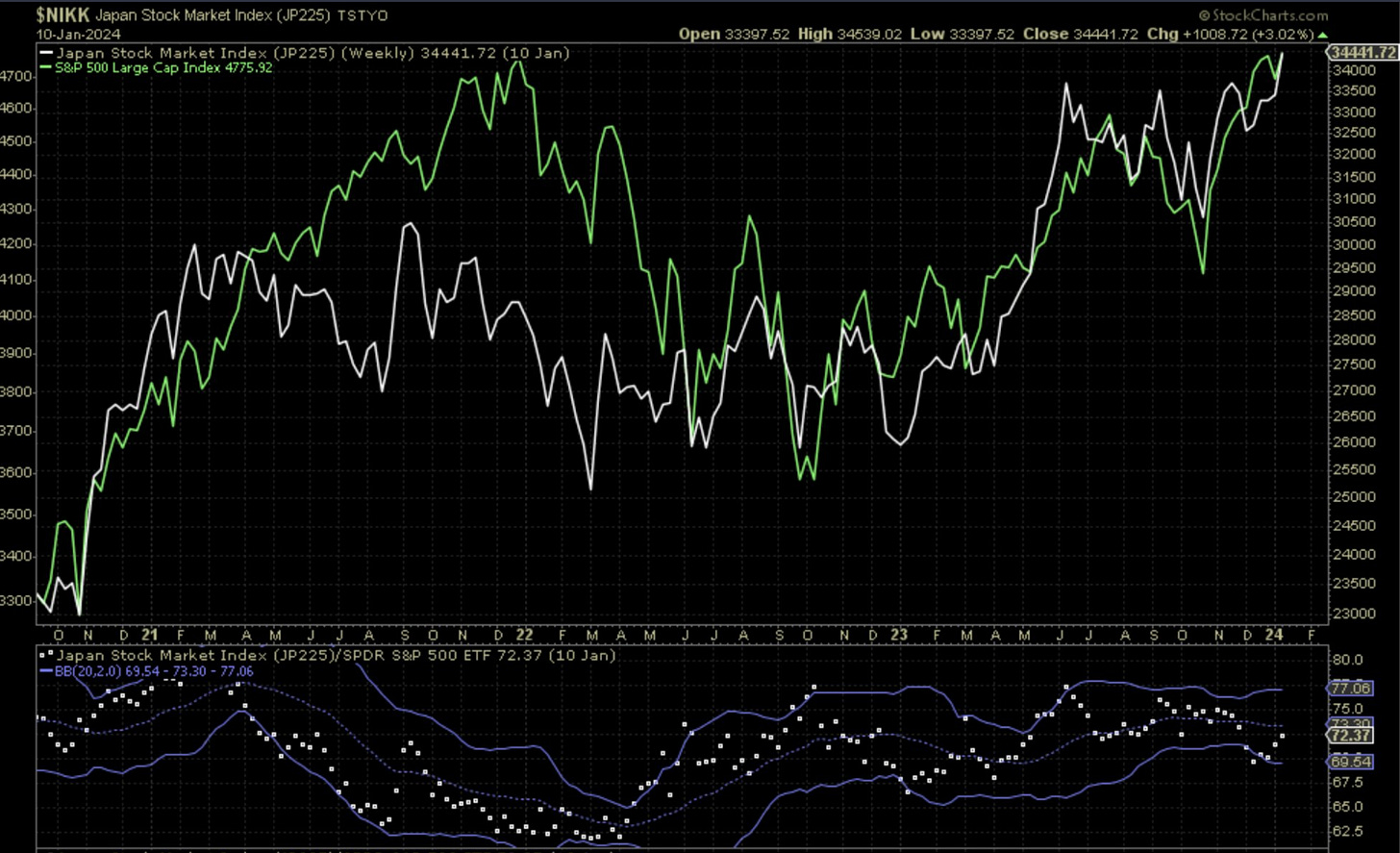

25. Japan usually peaks and bottoms before the $SPX. Right now it is breaking out to new highs. What does that mean?

26. Relative Strength is still in tech but take a look at REITs and Financials.

27. Now that we have the Magnificent Seven starting to slow down. Who will be the next hero?We need a hero!

Till then, keep it simple.Stay informed. Stay resilient. Against all odds.

Warm regards, Jason Perz

If you find this content valuable, please consider liking, sharing, and subscribing. Feel free to pass it along if you think it can benefit others.

YouTube: @againstalloddsresearch https://www.youtube.com/channel/UCLvDNCnhNQbQnABUSFbwagg

Twitter: @jasonp138

Substack: aaoresearch.substack.com

Against All Odds Researchjperz1985@icloud.com