Commodity Report/Navigating Inflation: A Portfolio Update

Fight Club, The Trading Panel, Weather Cycles, Copper, Oil, Lumber...

“It's only after we've lost everything that we're free to do anything.” Chuck Palahniuck

I looked for a quote to start this one off with today, for 2 hours. This is not an efficient use of my time and this is a very dark quote. However, I can’t change the core parts of my personality. If you have ever seen the show West World. You will see that the robots have these horrible things that happen to them to make them more human. To make them conscious. A dead child. A sense of longing that they can’t explain. A murdered wife or husband. A dead parent…

These things stick with us. They drive us to destroy ourselves or to be the best versions of ourselves.

Today, I look at the things that have hurt me like they are the things that protect me. Because of the events that have happened in my life I feel like I can get through anything. You need that mental toughness as a trader. You also need to understand that losing everything is a gift if you understand that the only thing you can change is your perspective.

Kevin Green and I did a video together on commodities. This really covers everything. Cocoa, natural gas, oil, seasonality, hogs, cattle and systematic trading. I do lives multiple times a week. A couple that are scheduled are Wednesdays at 2pm EST which is called the Trading Panel.

Fridays we have a show that starts between 10:30-11 on Fridays. Feel free to ask questions and participate. We will answer any questions that you have.

Here is the pop up live that Kevin and I did yesterday. A great commodity update.

https://youtube.com/live/wsk77bowkHc?feature=share

I am watching so many things right now in the global commodity market. Major headwinds are coming in to play as most of the commodities are starting to move higher and half of them have already made a move.

In terms of weather conditions across the United States, moisture-related issues typically don't arise until late June. Until then, the moisture levels are expected to remain favorable.

One significant concern for the US planting season is the possibility of a cold and wet May. Such conditions pose a heightened risk of a hard freeze, which could disrupt early-planted corn and soybeans, potentially leading to significant winter wheat damage.

Looking ahead, July this year might bring exceptionally hot and dry conditions, a phenomenon not experienced in over a decade. This could be a crucial test for crop genetics' ability to withstand such stressors.

Our analysis delves into past droughts like those of 2012, 1988, 1936, and 1934, examining the impact of specific sea surface temperature patterns. We also explore potential variations that could still pose significant crop challenges.

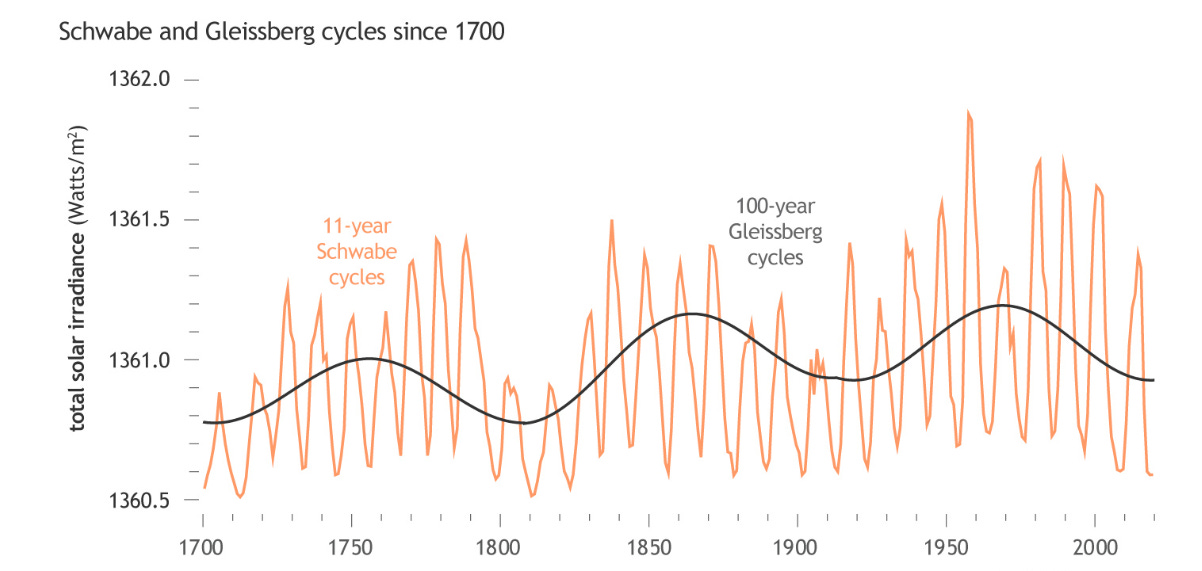

Let’s look into the Gleissberg cycle, the 11-year solar cycle, and the 18.6-year Earth nutation cycles, illustrating their relevance to major crop issues. Currently, a Neutral La Niña is expected by mid-July, and the Gulf of Alaska's colder-than-normal sea surface temperatures remain a key factor in hot and dry weather patterns.

Let’s look at the weather outlook for Central West Brazil in April, considering factors like the El Niño Modoki, Antarctic oscillation, and Madden Julian Oscillation trends. Despite a brief increase in rainfall expected by early April, the region's historic drought is likely to persist.

Cycles are incredibly important. Not because it completely guides my trading decisions. It is because it helps me to figure out how I would like to be positioned in these markets. What to buy and more importantly what I should not buy.