Copper's Surge: Navigating China's Demand Dominance and Our Strategic Buy Signal

The Story Behind Our Timely Investment and China's Growing Influence

In this issue you will learn when and how we are buying copper.

In the world of copper demand, China stands tall as the undisputed leader. Surging to nearly 11.3 million metric tons in 2020, China solidifies its position as the globe's largest consumer of copper. Impressively, this demand has seen a staggering increase of approximately 3.5 million metric tons since 2012, underscoring the nation's pivotal role in shaping the copper market.

A recent move by Chinese-backed miner MMG has made waves in the industry. MMG successfully secured the high-grade Khoemacau mine in Botswana through its acquisition of Canada-based Cuprous Capital. Holding one of Africa's largest copper deposits, Khoemacau's flagship project aims to contribute 60,000 tons of copper annually. This strategic move by MMG, valued at an enterprise value of $1.9 billion, emphasizes China's unwavering commitment to ensuring long-term copper supplies crucial for the ongoing global transition to green energy.

As global copper producers eye Khoemacau for its significant potential, it's noteworthy that MMG, headquartered in Australia but listed in Hong Kong, is backed by China Minmetals, a state-owned entity. China's urgency for securing more mines is evident, with its copper smelting capacity projected to grow by 45% by 2027.

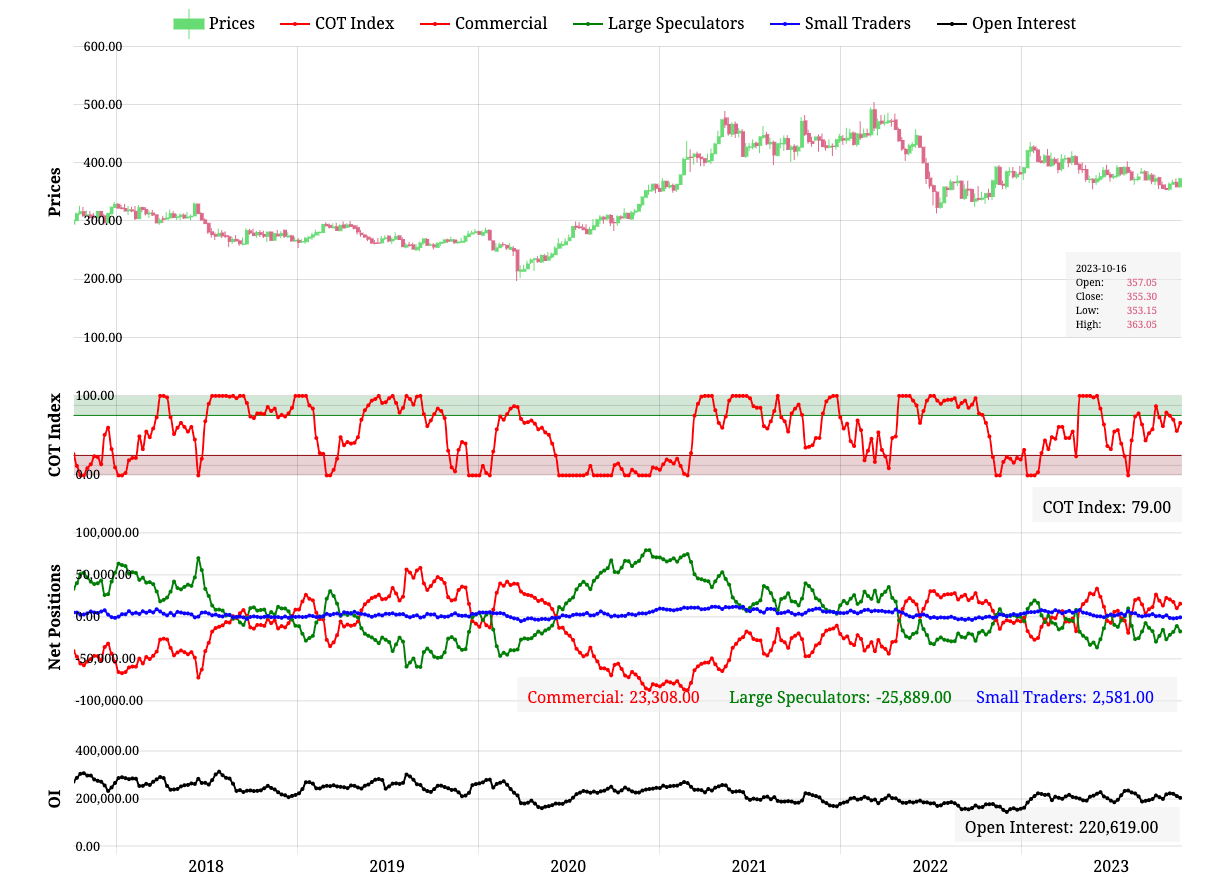

Copper COT chart

However, the quest for copper is not without challenges. Political unrest at Panama's Cobre mine and strikes in Peru have disrupted supply, contributing to a rise in copper prices. In Shanghai, prices reached a two-month high at $9,506, mirroring similar increases on the LME. The ongoing global energy transition further propels copper prices upward, as renewable energy systems, which use up to five times more copper than traditional fossil fuel-based generation, gain momentum. China's ambitious plans, such as doubling its solar capacity ahead of 2030 goals, underscore the nation's role in driving these market dynamics.

Meanwhile, Codelco, the world's largest copper supplier, is taking steps to bolster production. Allocating an additional $720 million for the overhaul of its oldest mine reflects Codelco's commitment to streamlining projects and addressing production challenges.

In a world marked by supply constraints, growing demand, and the transformative shift towards renewable energy, the journey of copper continues against all odds.