Cycles in Motion: Understanding Economic and Seasonal Market Forces

"I believe it is highly possible to improve your long-term results by adjusting your investment position at the extremes of the cycle. Not that often. But at the extremes." Howard Marks

Seasonality and cyclical opportunities weave through the fabric of financial markets, influencing everything from commodity prices to stock valuations.

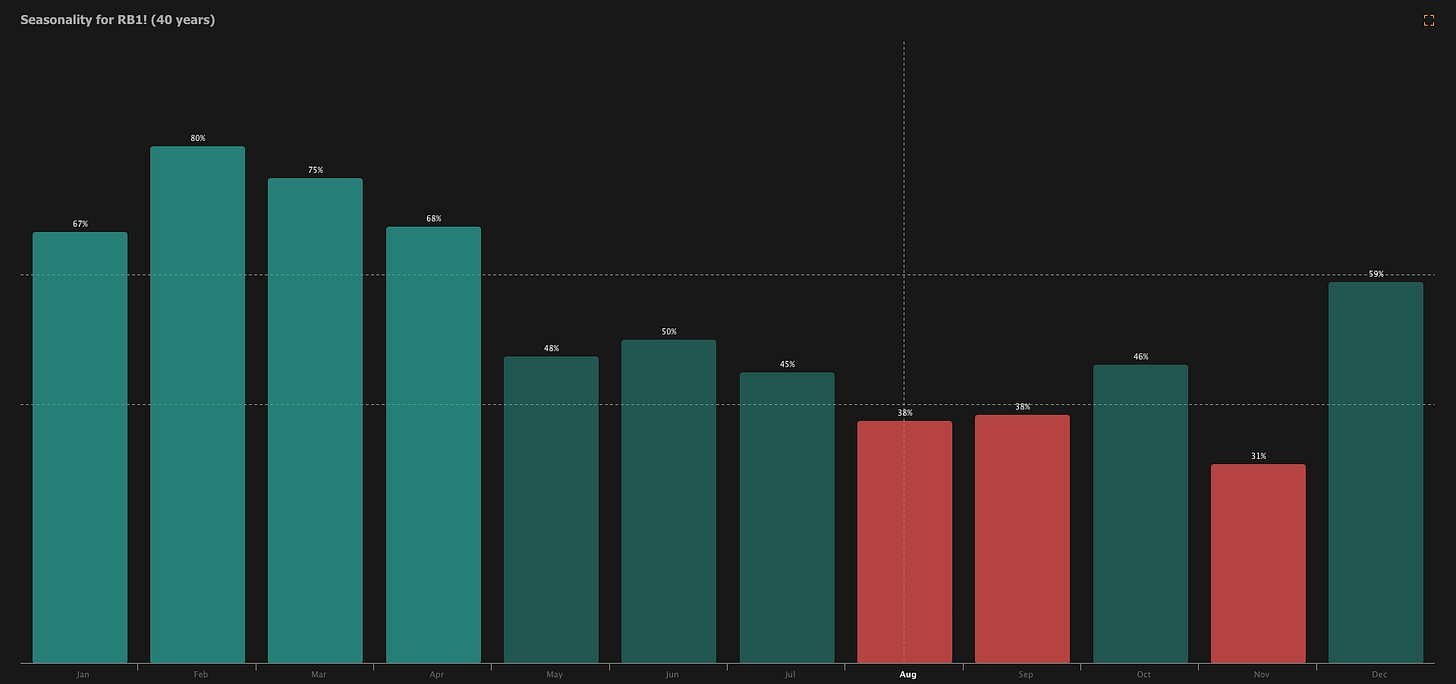

Conventional wisdom often cites summer travel as a prime mover of gasoline and oil prices. However, a closer look at seasonal data reveals that this is a misconception, with energy prices frequently performing well in the winter months contrary to popular belief. By dissecting these seasonal myths, investors can uncover hidden truths and make better-informed decisions.

Seasonality in Macro Markets

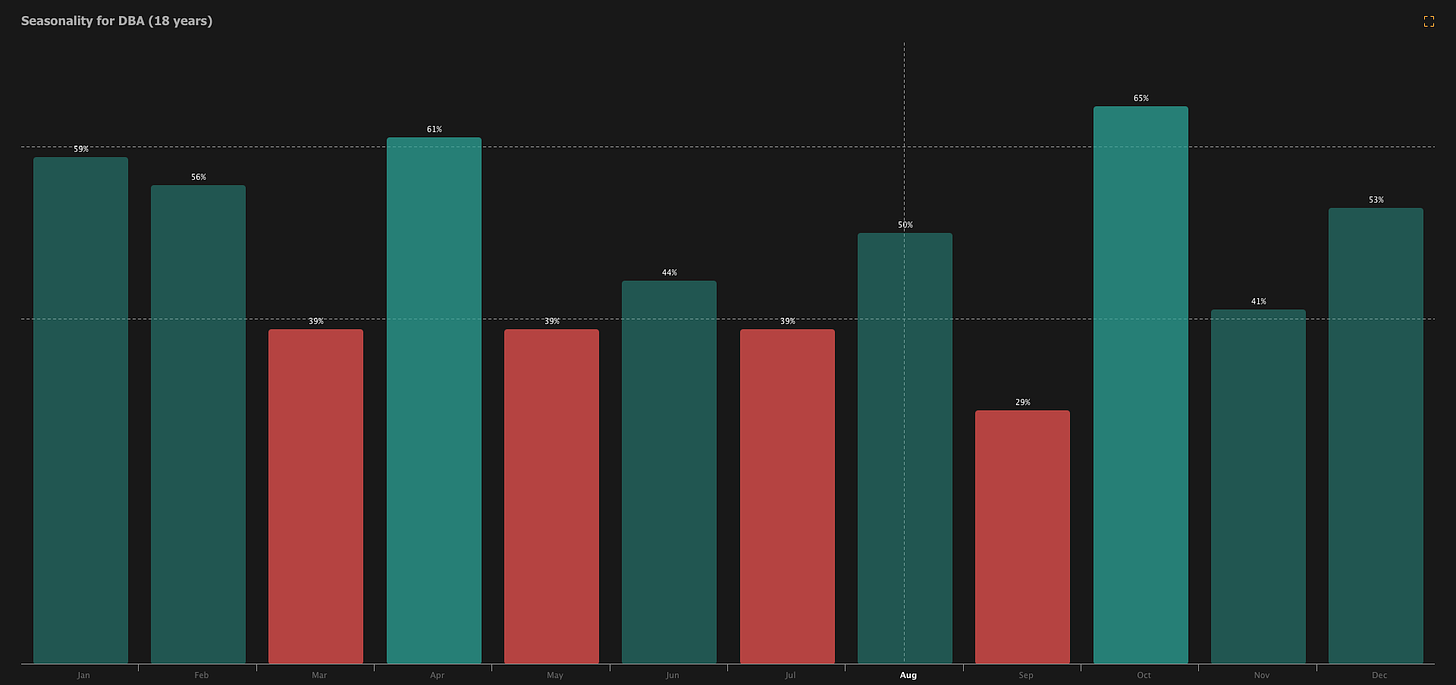

Seasonal weather changes can significantly impact commodity prices. For example, agricultural commodities like wheat and corn are affected by planting and harvest seasons, while natural gas prices may rise in winter due to heating demand.

Agriculture ETF seasonality

Gasoline seasonality-The seasonal patterns can also help you dispel myths that analysts tell you. Gasoline and oil moves higher in the summer because of summer vacations and traveling is one of those. This is straight bull shit as you can see. In the winter when everyone says that energy will not do well because no one is traveling, you can see that that is wrong.

Economic Cycles and The Macro Drivers

Here are the main drivers, as we see it.

Currency Cycles: Growing US debt and higher interest rates necessitate continuous liquidity and money printing, with geopolitical tensions intensifying the risk to its reserve currency status, potentially fueling inflation.

Demographic Cycles: As China's demographic influence wanes and India's ascends, shifts in food demand and the integration of Artificial Intelligence.

Climate Cycle Volatility: Rare convergence of the 220-year solar activity cycle, the 89-year Gleissberg Cycle, and the 60-year sea temperature cycle, alongside volcanic activity, could disrupt weather patterns significantly, impacting commodity prices and inflation.

Crop Cycles: Deforestation in the Brazilian Amazon is altering long-term weather patterns, threatening global crop yields and production, which may push food prices higher.

Further Risks for Inflation: Diseases like African Swine Fever and Avian Flu are reducing livestock populations and boosting demand for alternative proteins, potentially driving up food prices and contributing to inflation.

Identifying Opportunities

For those of you who have not… please check out our report from Monday. Options trades, ideas, systems and more.

Here is the big one that I keep looking at. We already have a reversal trade on it. (New system) But what if it is structural? What if a new trend is starting.

Keep reading with a 7-day free trial

Subscribe to Against All Odds Research to keep reading this post and get 7 days of free access to the full post archives.