DON'T FORGET THE PLAN: What You Need to Know!

“The key is not to prioritize what’s on your schedule, but to schedule your priorities.” — Stephen Covey.

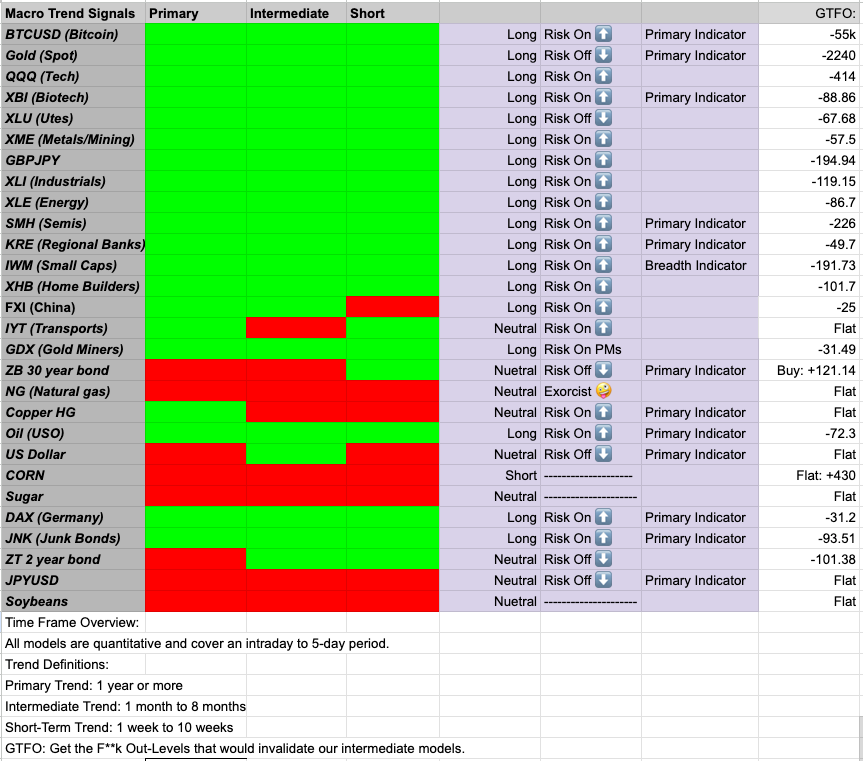

This will be behind the paywall going forward, I wanted to include it in the preview this week as a thank you. I got some great feedback on what I could change to make a better product for everyone. One thing that came up was a way to invalidate a thesis. Here are systematic price levels that would break major trends. We have more ideas incoming as well.

I think every trader should build systems. ( I have not met many successful traders who have not)

Becoming a systematic trend trader has a lot of appeal because it offers a disciplined way to potentially achieve steady returns. Instead of relying on gut feelings, systematic traders use a set of clear rules and algorithms to guide their decisions. This takes the emotional guesswork out of the equation, allowing them to objectively evaluate market trends and jump on price movements that are likely to stick. Plus, these strategies are often tested extensively on past data, giving traders confidence that their approach can work in various market conditions. This structured method provides a sense of security and can be especially reassuring when markets get choppy and unpredictable.

Another big draw to systematic trend trading is its scalability and flexibility. With today's technology, traders can automate their systems to keep an eye on and trade multiple markets and asset types all at once. This not only saves a lot of time but also makes sure no opportunities slip through the cracks. On top of that, these strategies can be tweaked to fit different market scenarios, whether things are going up or down. This adaptability helps traders stay resilient and focused on their long-term goals. By relying on data and eliminating emotional ups and downs, systematic trend traders can create a more disciplined and potentially rewarding trading experience.

I will continue to create more systematic trading methods for everyone to use going forward.

Fundamental System

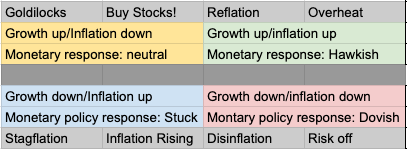

Inflation: The US Treasury’s net financing policy is taking a notably hawkish stance, highlighted by the surge in coupon and bond issuances to multiyear highs in the third quarter, which seems unnecessary given current conditions. This approach contributes to a decidedly negative fiscal impulse. Additionally, the looming expiration of the debt ceiling moratorium in January 2025 raises the likelihood of an increase in the Treasury General Account (TGA) throughout the fourth quarter, signaling potential fiscal tightening on the horizon.

Keep reading with a 7-day free trial

Subscribe to Against All Odds Research to keep reading this post and get 7 days of free access to the full post archives.