Dr. Copper's Diagnosis: Bull Market

New highs across global equities. Breakouts in copper. The message is loud and clear: growth is back.

Everyone is focused on the S&P 500, searching for a reason to believe in it, but the rest of the world has already moved on.

Japan is hitting new all-time highs.

Europe is breaking out across the board.

Even Latin America is catching a bid.

The United States is lagging (2% YTD). It’s not collapsing—but it’s no longer driving the bus. Leadership has shifted.

Global capital is rotating into strength. And the signal confirming this move isn’t coming from headlines or central banks.

It’s coming from copper.

They don’t call it Dr. Copper for nothing and now the doctor is above long tern resistance and ready to move higher.

Copper has earned a reputation as a leading economic indicator. It tracks the heartbeat of global growth—housing, infrastructure, industrial demand. If copper is rising, the global economy is expanding.

And right now, copper is breaking out.

Global copper miners are catching a bid as well.

This isn’t a sideshow. It’s confirmation.

When global equity markets are hitting new highs and copper starts to run, that’s not a coincidence. That’s a message: growth is back, and it’s broad based.

If you’re still asking why stocks are up, you’re missing the bigger picture.

They’re rising because the global economy is gaining momentum—and Dr. Copper just signed off on the diagnosis.

If you want to know where global stocks are going next, look at copper.

Not narratives. Not headlines. Not central banks.

Copper.

Because copper doesn’t move on stories. It moves on demand. When the world is building, copper runs and when copper runs, miners lead.

Let’s walk through the evidence.

Trade Setups

🔹 Hudbay Minerals ($HBM)

This stock is pressing against a decade-long ceiling. The $9.91 level has capped every rally since 2014. Now it’s back—testing that level again. When a stock spends this much time below resistance and keeps coming back, it’s usually not to fail again.

🔹 Taseko Mines ($TGBa0

This one already broke out. It just hit a new 10-year high.

That isn’t random. That’s institutional capital stepping in.

These kinds of breakouts don’t happen in downtrends. They signal strength.

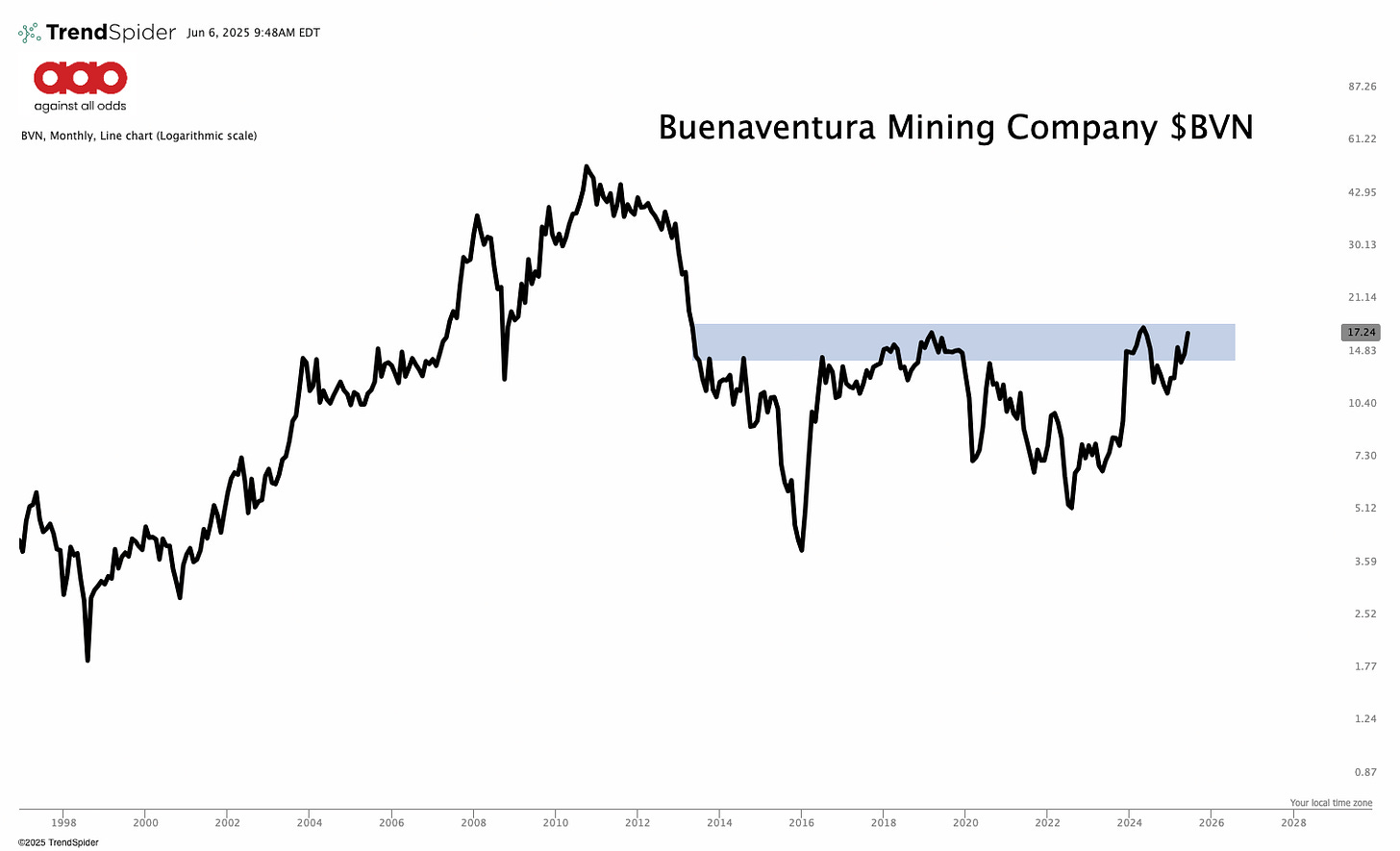

🔹 Buenaventura Mining ($BVN)

This chart spans decades. It’s been trapped in the same range for years—but not anymore. It’s back at the upper end of that range, ready to push. If it breaks through, it confirms what TGB already showed: the copper trade is alive and accelerating.

🔹 Freeport-McMoRan ($FCX)

This is the bellwether. It’s coiled just below long-term resistance at $61.60. But look closely—it’s making higher lows. That’s not indecision. That’s pressure. Breakouts like this don’t drift higher—they explode.

This is not noise.

Copper is confirming the move.

The metal is strong. The miners are leading.

This isn’t what tops look like. This is what new legs in a bull market look like.

While most investors are still watching tech, the market has already rotated.

If you want to know where global equities go next, follow the copper trail.

It’s already moving. The smart money already knows.

The rest will figure it out when these charts are 30% higher.

New Video! (Thanks for asking how the commodity cycle works.)

If you want to understand how the commodity cycle really works, don’t miss this video.

Steve Strazza and I break down the Commodity Playbook—starting with gold, the first mover, and how it sets the tone for the rest of the complex.

We walk through why silver, copper, and oil tend to follow in sequence and where we see the next big trades.

This is your roadmap for navigating commodity trends with precision. Watch now and get ahead of the next move.

AAO Portfolio Weight

Want to see our positions and how we are outperforming the $SPX by over 30% YTD? Subscribe and see our weekly portfolio review.

Portfolio Review: From Breakouts to Blowoff Tops-Precious Metals

Gold usually moves first. Silver follows with force

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees: Help save the native bees! Learn more and get involved here.

Metals have been more interesting than stocks lately lol. Great write up.

The U.S. Dollar is down a lot this year. Has certainly helped portfolios with foreign equities!