Every Cycle Has Its Darlings

(New trades) From mob bosses to markets, the power is in controlling the inputs.

The Last Undervalued Market

Every cycle has its darlings. Tech stocks in the late 1990s. Housing in the mid-2000s. Today, it’s AI. But what often gets missed in the hunt for the “next big thing” is where true value still hides — in the unloved, under-owned corners of the market.

Right now, that’s commodities and the currencies linked to them.

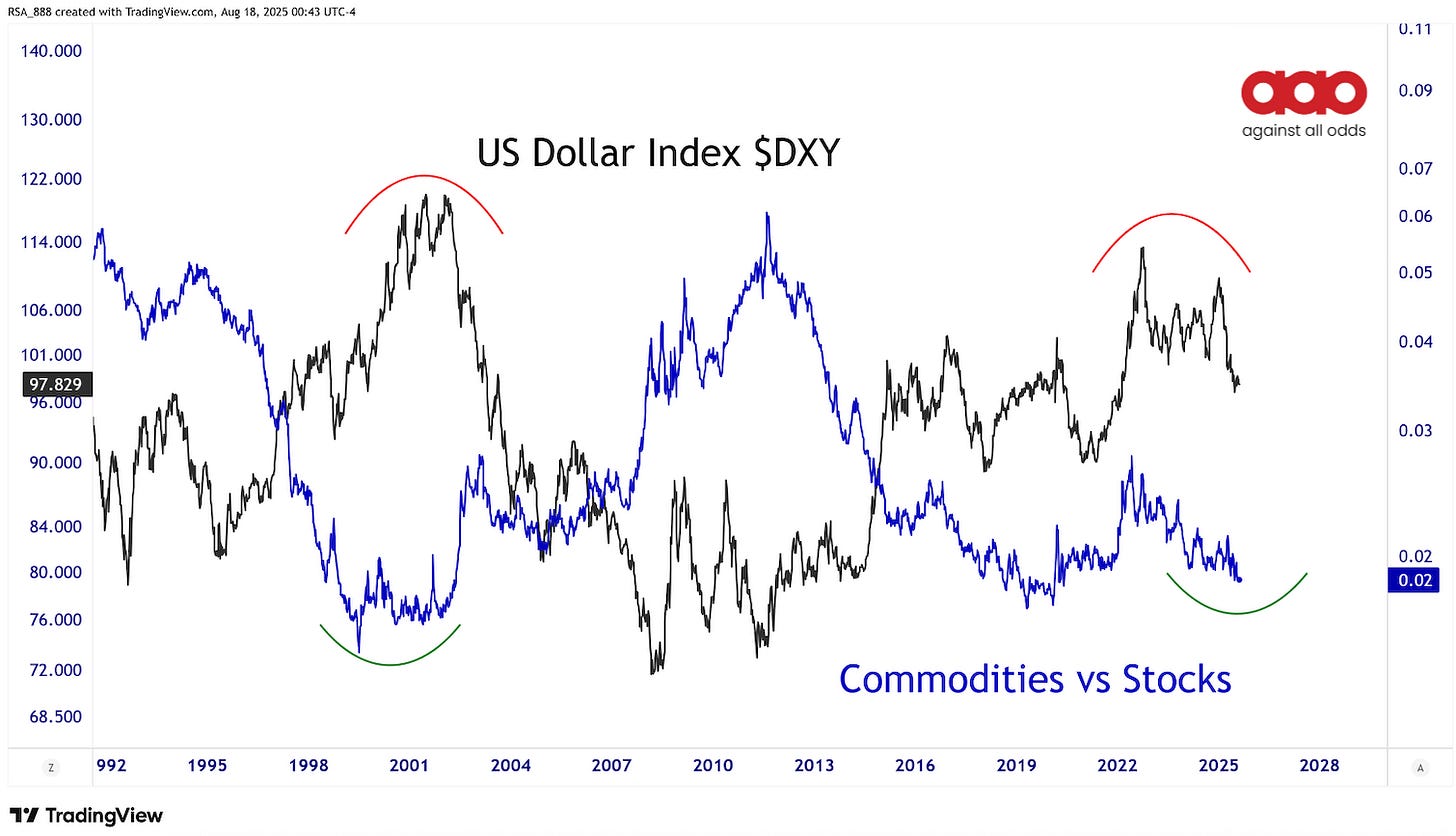

The Dollar vs Commodities and Stocks

The U.S. dollar is the hinge for global capital flows. Every asset on the planet prices off its strength or weakness. When the dollar is strong, commodities struggle — energy, metals, and agriculture get squeezed. When the dollar weakens, commodities catch a bid.

This chart shows the U.S. Dollar Index ($DXY) against the ratio of commodities vs. stocks. The symmetry is impossible to ignore: when the dollar peaks, commodities bottom. When the dollar rolls over, commodities rip higher with a lag.

We’re seeing that rollover now. The dollar has traced out the same topping structure we saw in the early 2000s — right before commodities entered a supercycle. This isn’t just noise. This is regime change.

Gold Miners vs. Gold

Gold futures are already at all-time highs. But look at the Gold Bugs Index ($HUI) vs. Gold Futures ($GC_F). Miners have been lagging for over a decade, crushed under poor sentiment.