Everything You Need to Know About the Week Ahead

Weekly Report: Navigating Trends and Patterns in our current Financial Landscape

Welcome to Against All Odds Research’s weekly subscribers only report! In this edition, we're bringing you the essential tools that have been the cornerstone of my success for years, enabling me to consistently outperform the market and navigate various financial landscapes with confidence. Whether you're a seasoned investor or just starting your financial journey, these insights are tailored to empower you for the week, month and year ahead. Are you ready to elevate your strategic positioning?

Short term levels to watch(Pivots Weekly).

Hey there! We're on a mission to share valuable content, and we could really use your support. If you find our content helpful or entertaining, consider giving it a thumbs up, sharing it with your friends, and hitting that subscribe button. Your support means the world to us, and it helps us reach even more people. Thanks a bunch!

1. This is how it starts. Soon the fed will get “behind the curve” and for now… no one is talking about it. Soon inflation will be transitory again.

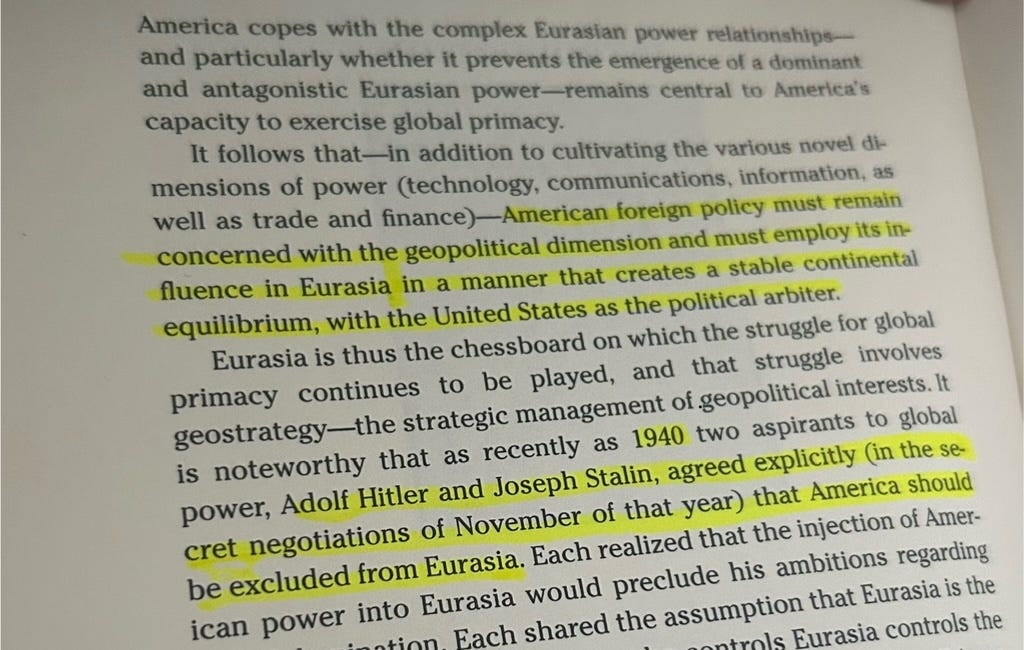

FYI-I started to put together a series on the conflict in the middle east. You can check it out here.

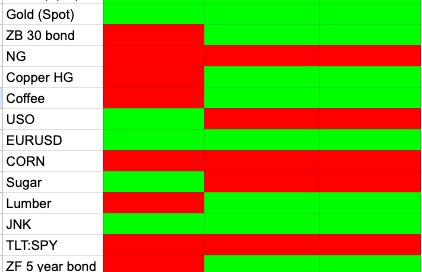

3. I think inter-market analysis will be a recurring theme this year. Right now we are seeing gold drastically outperforming copper again. Gold held up incredibly well for such a terrible environment for precious metals.

4. Gold-We are in full buy signals across the board. The monetary environment is set up for a break out. The economic environment is set up for a break out. The chart is breaking out…

5. CRB:USB-Energy has turned up a bit to start the year and then gave most of it back today. We are long gold and bonds now. Is the energy trade over?

6. 60-65 Crude oil-A serious zone to pay attention to!

7. This is not a timing tool. However it is very good telling you when you want to be a long term holder of gold.

Bonds, Gold and Stocks are outperforming the commodity complex at the moment. This leading us to still believe we are in a goldilocks environment.

10. One of our most popular charts. I am curious, what direction do you think this will resolve Nasdaq continues to lead or small caps?11. The bull bear indicator is still incredibly bullish. Most of my short term indicators are still looking for a short term pull back. However, for a swing or position trade we still think we will move higher.

12. One of those indicators is our bullish percent index. It is now in a sell signal.

13. Semiconductors/Dow-Semis are still leading the way. This is still a risk on environment. Please see friday’s post to see some of the great areas we are rotating in to.

14. I am a huge fan of band squeeze break outs. Please see the how to here.

Keep reading with a 7-day free trial

Subscribe to Against All Odds Research to keep reading this post and get 7 days of free access to the full post archives.