Everything You Need To Know For The Week Ahead

We finally have some signals

I apologize for the duplicate.

Getting good information out to good people.

Welcome to Against All Odds Research’s weekly subscribers only report! In this edition, we're bringing you the essential tools that have been the cornerstone of my success for years, enabling me to consistently outperform the market and navigate various financial landscapes with confidence.

When in doubt, get out and get a good night’s sleep. I’ve done that lots of times and the next day everything was clear… While you are in [the position], you can’t think. When you get out, then you can think clearly again.

Michael Marcus

We don’t buy bottoms or tops. We catch the meat in the middle.

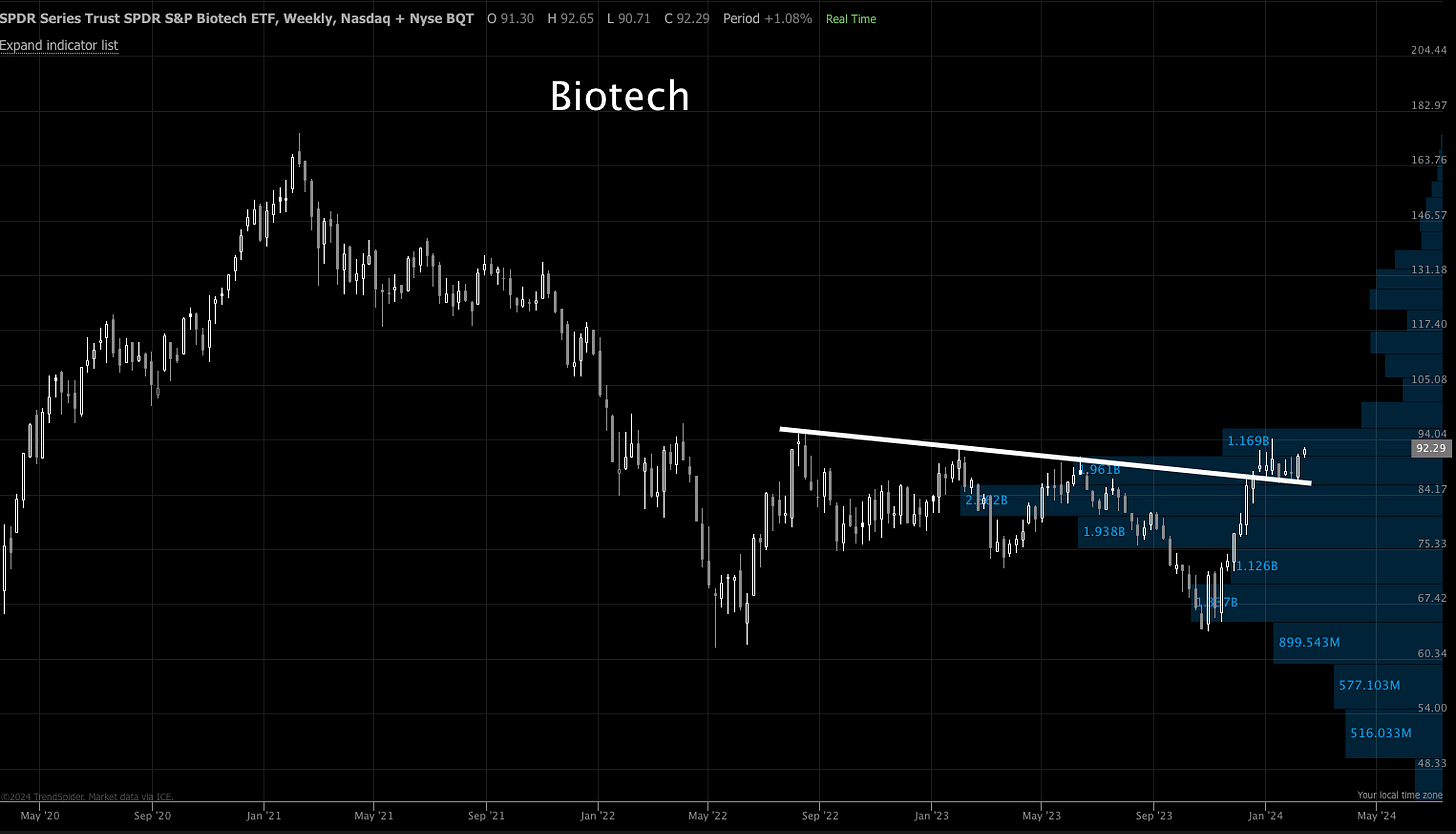

2. Biotech Weekly

3. Biotech Monthly-Buying XBI now if we close the week at this level, for the long term ETF portfolio.

4. Initiating a full position in Vietnam today, with a keen eye on risk management. While I maintain a 16% trailing stop for my long term position, consider setting your initial stop at 5% or less, ensuring trade integrity should it break the right shoulder. As momentum builds, transition to a trailing stop. The band squeeze suggests an imminent explosive upward move, making today an opportune moment to buy in.

5. Our swing trade in bitcoin from 42k-50k has hit all targets. We still have our core positions in bitcoin. We are still holding in to positions.

There is the plain fool, who does the wrong thing at all times everywhere, but there is the Wall Street fool, who thinks he must trade all the time.Jesse Livermore

6. We already have our core positions in ITB but we mentioned last week that new subscribers could enter a new position in ITB if we see a break out on this flag pattern. The signal is here.

6. The internals of the market. Add in Bitcoin and Biotech (already pictured) and you have everything that you need to navigate market direction.