The rotation continues.

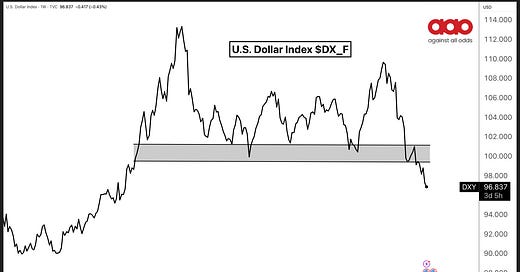

Commodities, metals, and international stocks are leading—Copper, Silver, Gold, India, China, Japan. All ripping. All trending across timeframes. Meanwhile, the U.S. Dollar, bonds, and defensives like retail and biotech are breaking down. You can fight it, or you can follow the flow.

Semis and energy still holding up. But the big story is global: real assets over paper, reflation over recession, strength over fear.

The GTFO levels tell you where you’re wrong. The trends tell you where the money’s going.

Stop debating the narrative. Trade the trend.

This market is strong—broad, aggressive, and led by offense.

Look at the scan: 13 out of 14 key groups are above their 21-day, 50-day, and 200-day moving averages. That’s not rotation, that’s confirmation.

Industrials ($XLI), infrastructure ($IGF), metals & mining ($XME), semis ($SOXX), and even speculative growth ($ARKK) are all pressing toward 52-week highs. Bitcoin, IPOs, small caps, and transports? Also leading.

This isn’t narrow leadership—it’s expansive participation.