Exclusive Commodity Trade Report

Commodities, Countries and MORE... What you need to know to navigate 2024

🌍 As we stand at the threshold of 2024, the winds of change carry with them a sense of optimism for commodities and agricultural markets. Anticipating a more bullish year ahead, we find ourselves amidst a confluence of factors poised to reshape the landscape. The dollar falling this year could come to fruition, heightened weather volatility, and increased demand fueled by a friendlier global monetary landscape set the stage for a potential resurgence. With politicians worldwide seeking favor and trying to buy votes by providing a softer monetary environment. Speculative short positions reaching historic extremes, the gun is loaded, awaiting a catalyst to unleash its impact. The intricacies of geopolitics add an extra layer of unpredictability, capable of further intensifying the impending hard commodity asset inflation storm. While exceptions like Orange Juice and Cocoa hint at bubble-type tops, overall, the seeds of bullish reversals have been sown. As we navigate these dynamic market currents, let's explore the potential triggers and trends that may define this year's journey through the world of commodities.

Commodities CRB index

Commodities or Bonds?

Commercials have possibly created a short term bottom. Speculators are bearish. Commercials are bullish. This is what we want to see. Oil is set up for a short term swing trade. No buy signal yet. Our energy sector trades are still on though.

As I was writing this Mr. Markets & Mayhem brought this to my attention as well.

The current positioning in the dollar hasn't reached extreme levels, but there's a possibility of a bounce in the near term. While the primary trend appears to be downward, it's wise to be prepared for occasional and somewhat unpredictable rallies.

El Nino Modoki has been triggered, currently standing at +0.75. It is projected to start affecting the drying out of Central West Brazil by the latter half of January 2024, while also initiating colder and snowier conditions in the central/eastern parts of the United States, as well as specific areas in Europe.

Brazilian Real-Currently holding

EWZ Brazil ETF-I still like the idea of taking advantage of this by buying these areas. Currently Holding

Also…

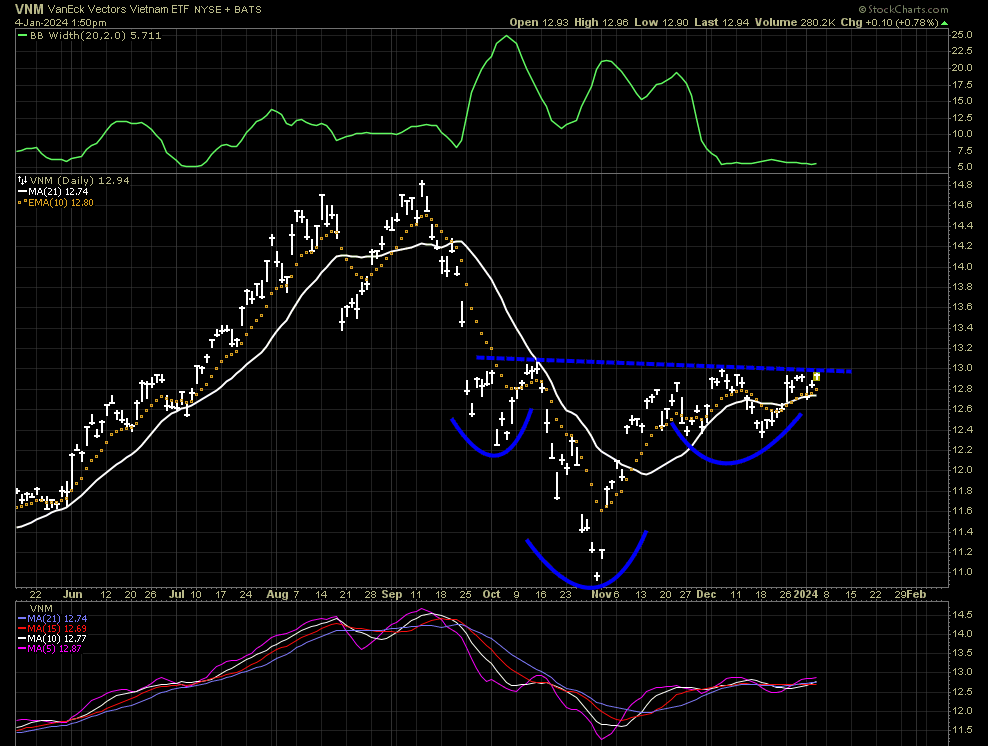

VNM-This was a killer trade in 2020-21. It is very close to a new buy signal. I want to see a close above 13 dollars which would trigger a buy signal and a band squeeze break out. 19% trailing stop.