Forecasting 2024: A Roadmap for Success as a Commodity Trader

Discover Key Trends and Trade Recommendations for the Upcoming Year

I hope everyone had a good weekend! Let’s jump in to it.

While it's uncommon for me to share research from financial institutions, the depth of objective information provided by Goldman Sachs in this instance is noteworthy. (Considering that this information is not always readily available.)

I encourage you to explore the details and draw your own conclusions from my summary of their report.

Goldman Sachs anticipates a fruitful year for commodities in 2024, with a focus on oil, oil products, and key industrial metals benefiting from cyclical and structural support. The bank recommends a "2024 Deficits" basket, suggesting long positions in the GSCI Energy Index (excluding US natural gas) with a forecasted 34% 12-month return, and long positions in the GSCI Metals Index (excluding nickel and zinc) with a predicted 25% 12-month return.

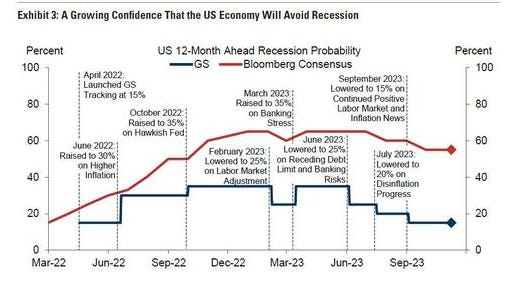

As economic indicators point towards a fading monetary policy drag, receding recession fears, and reduced industrial destocking, Goldman projects increased demand and spot prices in 2024. Despite a slight adjustment in its 2024 average Brent price forecast to $92/bbl (down from $98), the bank expects prices to rebound to the higher end of the $80-100 range.

Structural support for commodity returns is anticipated from OPEC carry, refinery tightness, and growing demand for green metals. While OPEC's pricing power is expected to drive carry due to declining inventories, elevated spare capacity may limit the upside to spot prices.