From Energy to Sugar, Coffee, and Wheat: Navigating the Diverse World of Commodity Markets

Your Exclusive Commodity Report/A Deep Dive in to the Commodity Sector

We've started to observe indications that demand is surfacing across various commodity markets last week. These signs manifest through different means, including actual export figures, the bullish behavior of futures spreads (with nearby prices surpassing deferred ones), strengthening cash basis levels (where cash prices outperform futures prices), and even price index upticks. These collective observations suggest that the U.S. and global economy might be on a path toward recovery. This shift could potentially challenge the prevailing pessimistic narrative of "perpetual commodity demand decline" and replace it with the notion that excessive apathy toward demand may have been overstated. I have already talked about this so I won’t go any deeper.

Now we are seeing it show up in the price action. Remember… we are starting to see signals in oil, heating oil and gasoline. 50 day highs across the board.

I talked about our seasonal sweet period last week but here are the charts. RB (Gasoline) up 85% of the time in February over the last 20 years.

Dear Subscribers, if you've found our content on energy, sugar, coffee, and wheat commodities valuable and insightful, we'd greatly appreciate your support. Please take a moment to 'Like' this post, 'Share' it with your network, and 'Subscribe' to stay updated with our latest updates and analyses. Your engagement helps us continue providing you with quality information. Thank you for being a part of our community!

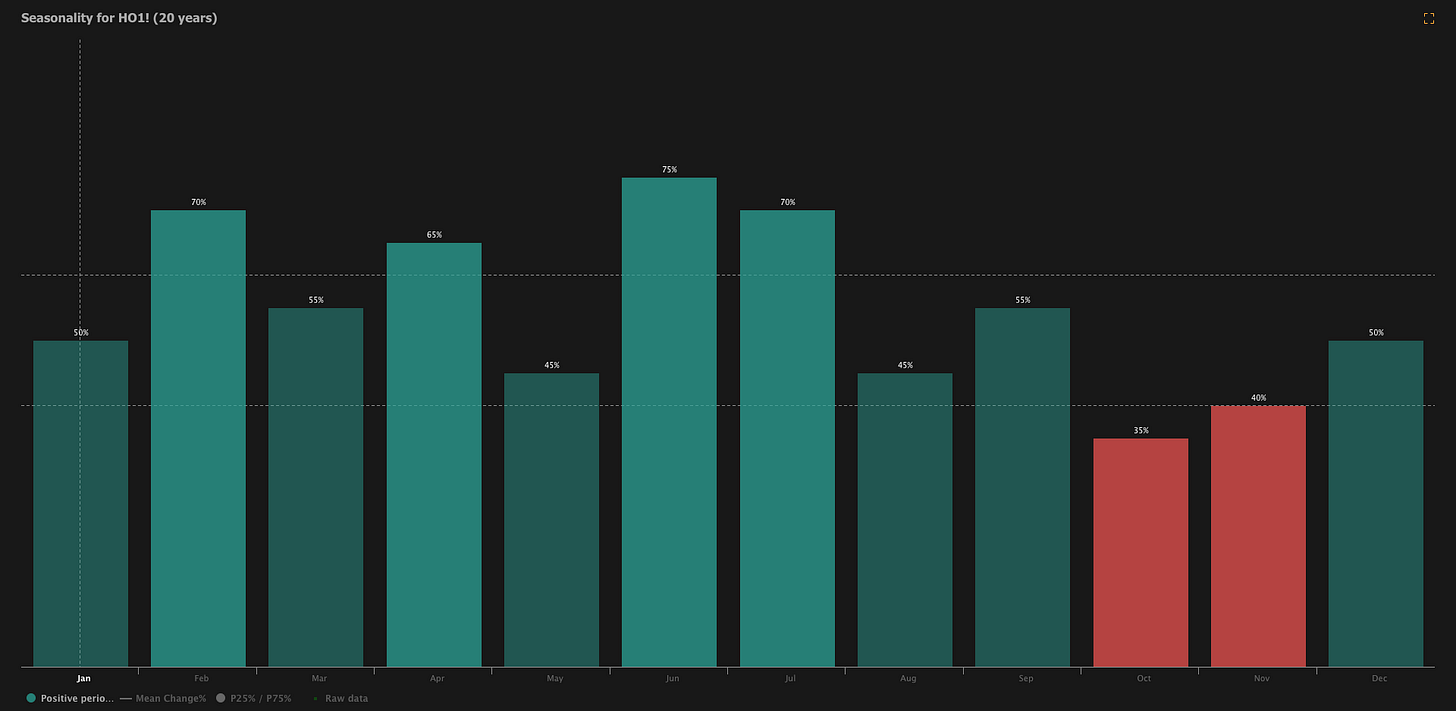

Heating oil is up 70% of the time in the last 20 years in February.

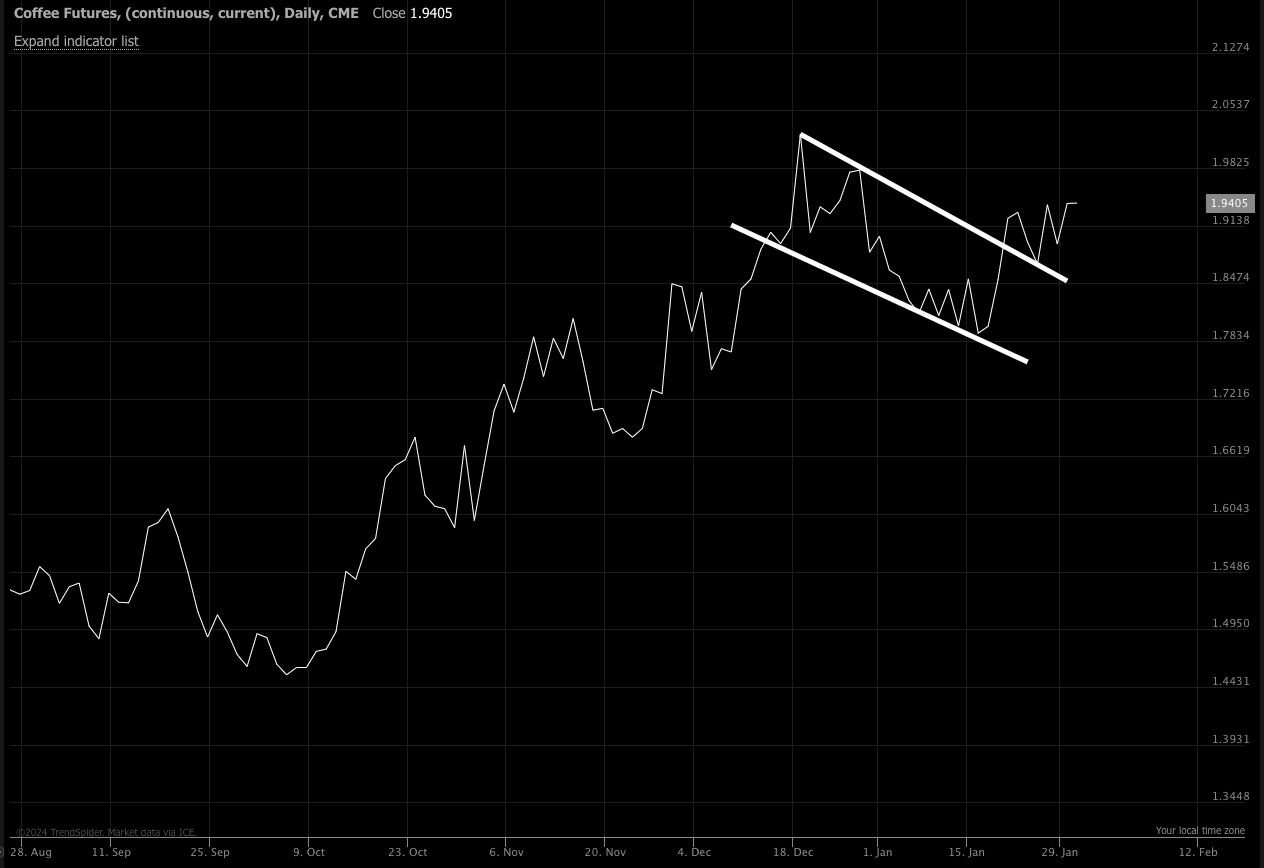

Coffee-The drought in Brazil's coffee-producing regions has subsided, but its impact has already been inflicted. Now, we must evaluate the consequences of this event. Crop assessments are commencing, which will provide insights into the volume of cherries on the trees and form the foundation for estimating the potential harvest in the summer of 2024, assuming no further weather disruptions occur. We are of the opinion that current prices do not yet fully account for the severe heat occurring precisely at the wrong time for the conversion of coffee buds into cherries.

As updates from crop tours gradually emerge, it is likely that coffee prices will see upward pressure again. This would be a reflection of the realization that the 2024 crop may not be able to replenish the critically low ending stocks, leaving the market in a precarious position once more for the 2025 crop year. All hopes will be pinned on a return to normal weather conditions to avoid a significant supply shortage.

Certified coffee stocks are still limited but are slowly increasing, while cash differentials remain subdued as roasters attempt to refrain from making hasty decisions. In summary, coffee supplies are in short supply, and prices are expected to continue rising until we gain a more precise understanding of the Brazilian crop's deviation from initial expectations.

Sugar-Hitting resistance. If we can get over this next zone we will most likely hit the old highs.

Sugar COT-We are still seeing major commercial/producer buying on every dip.

The recent dip in Brazil's sugar supplies, which temporarily alleviated the global sugar shortage, has given way to a rebound in prices, marking a significant turnaround. Ultimately, the trajectory of global sugar prices hinges on India's sugar production, and as long as they anticipate a favorable crop for 2024, the sugar export ban will persist. This maintains a delicate balance in the global sugar market, especially given Thailand's equally precarious supply situation.