Goldilocks and the 3 Crazy Bears: Strategies for Winning in the Current Market Climate

Market Regimes, Bitcoin, Commodities, Bonds, Equities...

“Do not anticipate and move without market confirmation - being a little late in your trade is your insurance that you are right or wrong.” - Jesse Livermore

Understanding Goldilocks

In the current market environment, Goldilocks stands out as the prevailing top-down market regime, fostering a risk-on sentiment where investors are typically rewarded for embracing higher risk. What does this mean for portfolio construction? In Goldilocks, it's all about favoring risk assets over defensive ones, prioritizing high beta over low beta, growth over value, and international markets over the US. Additionally, emphasis is placed on spread products and corporates over Treasuries, short rates over long rates, and industrial commodities over energy and agricultural commodities. In terms of currencies, the focus is on positions against the USD.

It is important to remember that this is just a guard rail. I still wait for price action signals to help me enter and exit positions.

Examples…

These models have been around forever. Way before Dalio. This one is from Merrill Lynch.

Ray Dalio’s model.

Someone took their ideas and made a whole business based on it and attacking it’s former employee’s but I digress…

Assessing Retail and Institutional Investor Positioning

It’s not whether you’re right or wrong that’s important, it’s how much money you make when you’re right and how much you lose when you’re wrong”. - George Soros

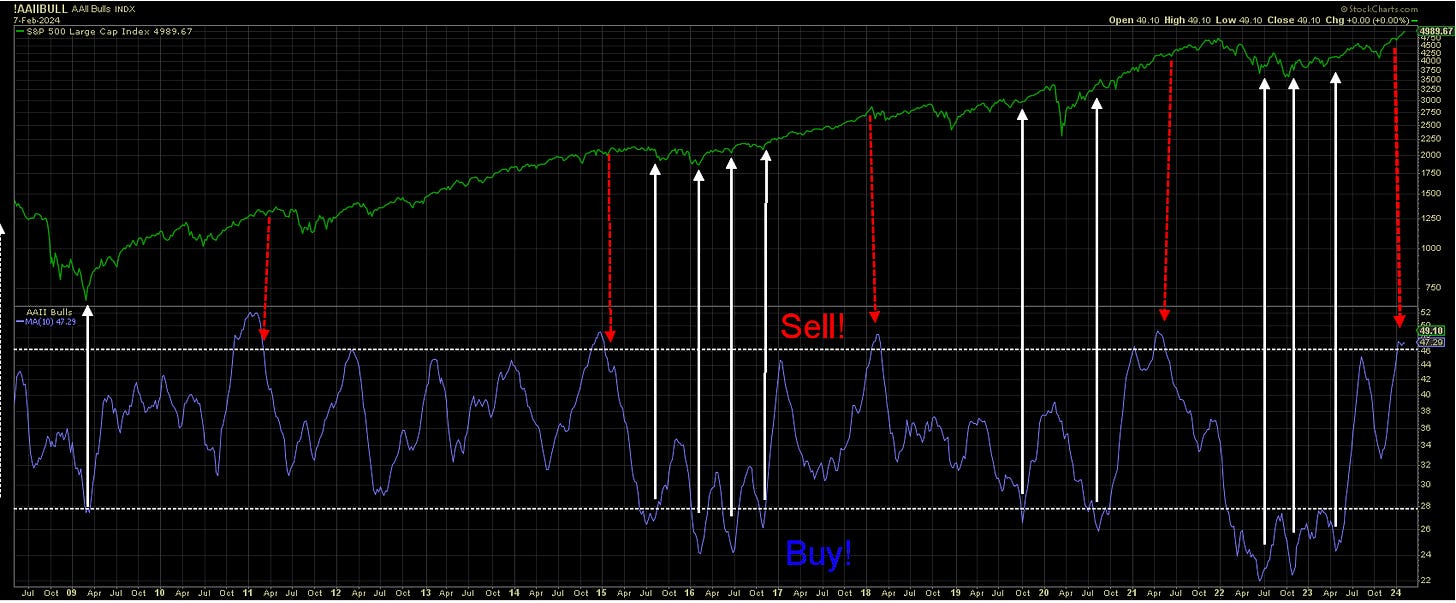

Retail traders are currently leaning heavily towards stocks, as indicated by the AAII Bulls-Bears Spread, suggesting a heightened risk of a market correction. Discretionary investors, on the other hand, are moderately overweight stocks, flat on bonds, and low on cash, signaling potential vulnerability to a cross-asset correction. Systematic investors are also favoring stocks, a trend reflected in realized volatility. However, recent data suggests they may have become increasingly exposed, potentially elevating the risk of a market downturn. This is a short term outlook. We have talked bout possible risk in February and March. We are not closing our longs by any means but it is appropriate to manage risk at this point. Smaller positions sizes and stay nimble!

GS CTA Positioning model. Also stretched. These are not timing tools but they can help us to realize where we are in the cycle.

10 year bond COT data-I am going to go out on a limb here and say that bonds have actually bottomed. We have extreme commercial buying. In 2018 I bought bonds on a similar set up and held that long until 2020. In the end of 2020 we went short bonds and stayed short bonds until 2022. 2023 was a year of chop for the long bond. Now are long bonds from 3 month bonds all the way to the 30 year bonds.

Investor positioning in US Treasurys and commodities is at extreme bearish levels according to the CTFC Commitment of Traders Report. Historically, such positioning has been bullish for bonds.

Bond ETFs-Here are the facts. They are not a place for alpha. They are a place to extra cash. If you want alpha, trade futures or LEAPs. This does not mean that you should not use them. This just means that you should manage your expectations.

TLTiShares 20+ Year Treasury Bond ETF (if you are buying options on bonds use this ETF)

IEFiShares 7-10 Year Treasury Bond ETF

SHYiShares 1-3 Year Treasury Bond ETF

Bond Futures

ZB_F 30 year bond futures

ZN_F 10 year bond futures

ZF_F 5 year bond futures

ZT_F 2 year bond futures