Guess What I Am Buying:Hint-I Said I Would Not Buy it! Portfolio Update

The Reflation Trade is Taking Off. The Final Pieces are Coming To Fruition

First off I just want to thank you guys for helping share the message here by subscribing, liking and sharing our content. Thank you for helping the channel grow.

Sometimes you get a signal and you look back at it and say… no fucking way. Sorry to say it bluntly but it is the only way I can express the feeling I get when I get a trade that comes in like this.

The Nasdaq/Semis in 2023, Cocoa last year, Natural gas (every time), shorting oil in 2020… I felt the same way. Honestly I feel that way on 50% of my trades. However I know that my loss is limited to 1% of my portfolio.

Example-$100,000 dollar example. 1000 dollars is a 1% loss. While winners average 5000 dollars.

With this strategy I can be wrong a lot. This is the key to making money. Not picks, not news and not analysis of all kinds. It is all about being wrong… seriously.

Create a strategy where you can be wrong a lot so when you are right a lot you make a lot of money and you protect your capital.

This is why it is SO important to protect your capital. 10-20 and even a 30% drawdown, you can come back from. More, it gets harder and harder. If you are protecting your capital and you can catch those big winners, you win. This is how superior returns are achieved. My best years were never created though 50% drawdowns and gaining it back. It was achieved by keeping my loses small and letting my winners run.

“Where you want to be is always in control, never wishing, always trading, and always, first and foremost protecting your ass” – Paul Tudor Jones

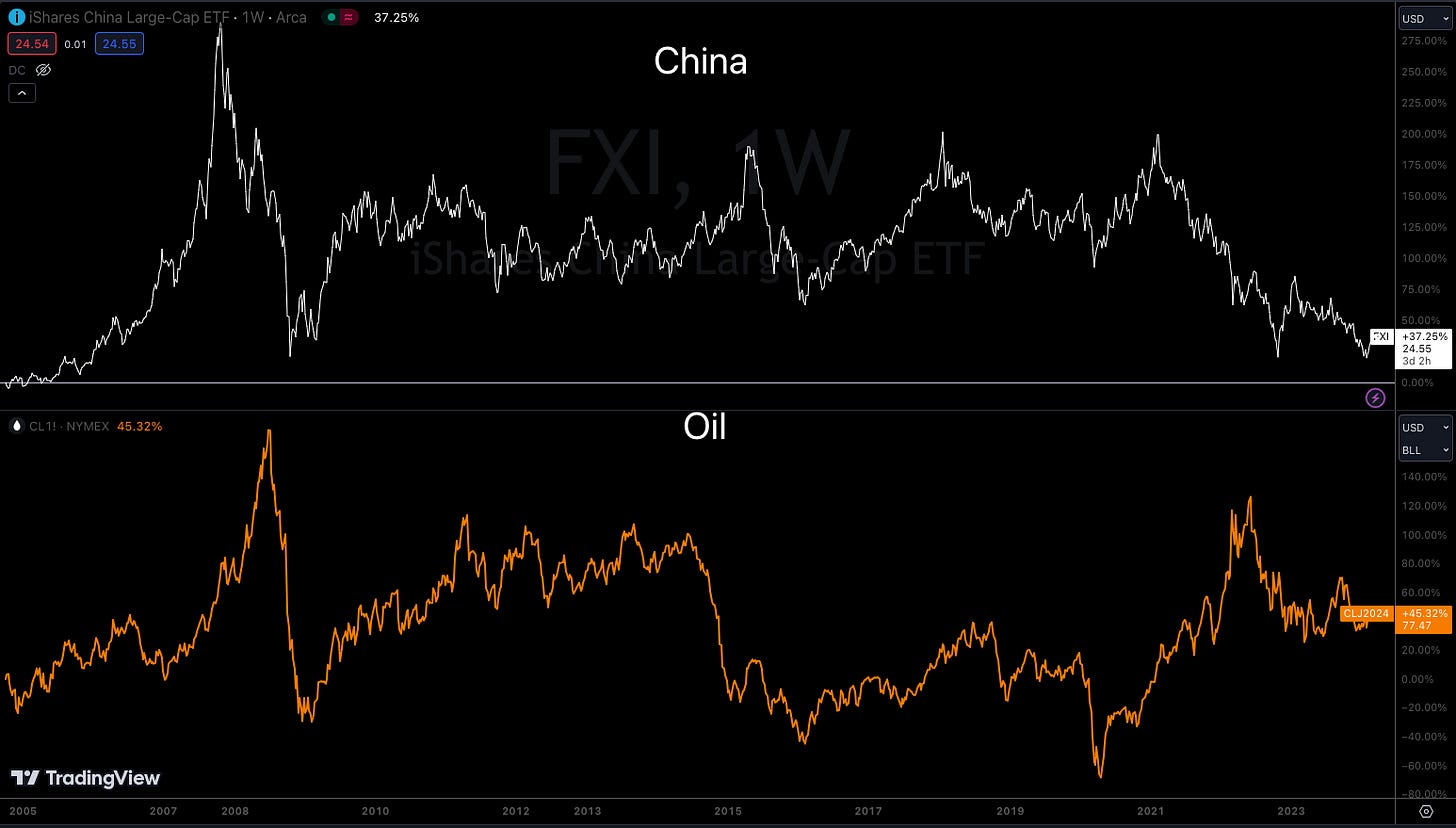

Now back to China.

So yesterday. I made a post and I brought up China. Seasonality is strong here as well.

Regime Change!:Everything You Need To Know For The Week Ahead

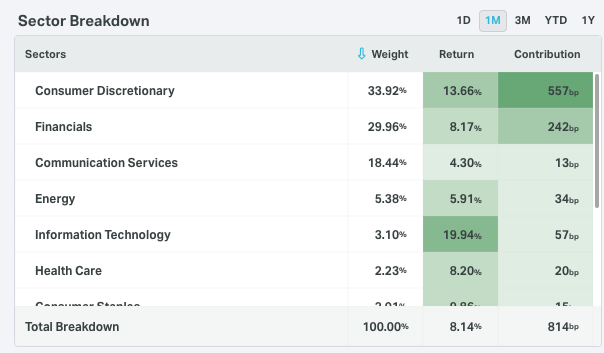

Cocoa, continues to win YTD. We are still long cocoa. (See last weeks commodity report for more) Cotton is right behind it. Japan, feeder cattle and hogs are in the top 5. We are long all of them at the moment. Crypto Currency YTD-3 majors are all up over up%

All of our inter market filters are saying it is time to start buying China. Usually it runs with the reflation trade.