Inflation’s Upturn Holds, But When Does It Matter for Markets? Portfolio Review-New Trades

"He who lives by the crystal ball will eat shattered glass." Ray Dalio

The November CPI numbers came in exactly where we expected right in line with our framework that points to a sustained inflation cycle upturn.

Here’s the breakdown:

Headline CPI surged to a 3-month SAAR of 3.0%, hitting a 7-month high and solidly above trend.

Food CPI? Up to 3.8% on a 3-month SAAR—its highest reading since March 2023.

Energy CPI? Still below trend at -6.7% on a 3-month SAAR, but it’s the strongest in six months.

Core CPI jumped to 3.6% on a 3-month SAAR—another 7-month high and firmly above trend.

Core Goods CPI climbed to 2.1% on a 3-month SAAR, the highest since June 2023.

Core Services CPI decelerated but remains elevated at 3.9% on a 3-month SAAR. That’s a 3-month low, but still above trend.

Shelter CPI slowed to 3.8% on a 3-month SAAR, marking its lowest level since April 2021.

And let’s not forget Super Core CPI, which sped up to 4.2% on a 3-month SAAR, hitting a 7-month high.

So what’s the takeaway?

I see the “sticky inflation” theme has stuck around.

It’s not likely to become a problem for markets until the Fed abandons its current asymmetric, dovish reaction function. And that’s not happening until two things fall into place:

The Fed returns to a neutral policy rate.

The balance sheet runoff ends.

Any hawkish shift from the Fed won’t seriously shake up the current risk-on Market Regime until Q2 2025, at the earliest. Unless these 2 things come in to play.

That said, this isn’t a “nothing to see here” moment.

Sticky inflation’s impact on the Fed’s ability to backstop the economy is just one of the risks on the horizon.

Investors need to prepare for a host of potential left-tail risks as we head into 2025.

Let’s go over a few of our positions…

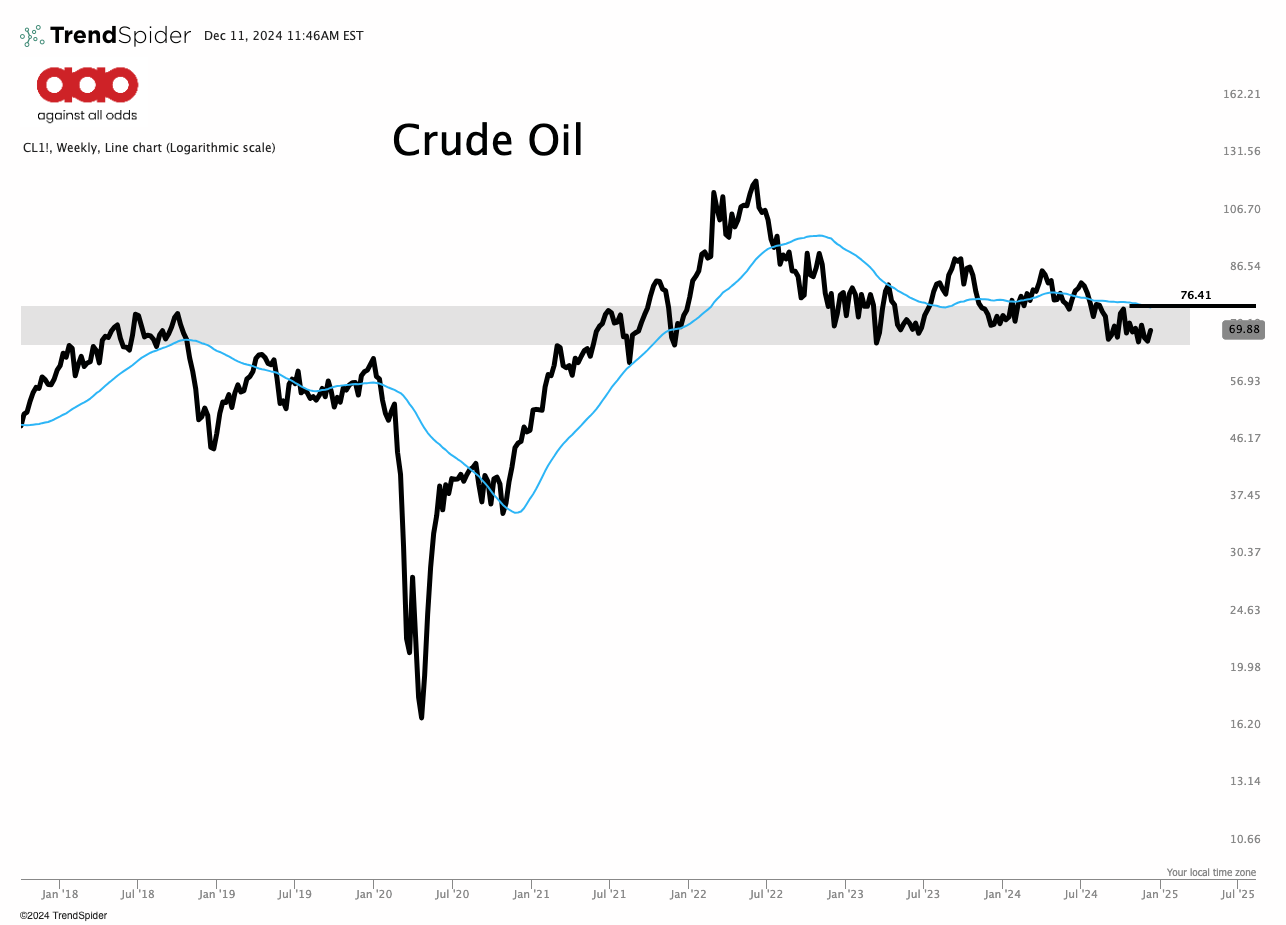

Oil:

Buy trigger: Over $76.41 for the first trend signal.

Stop: 16% trailing stop for trend models.

Position: Currently flat in the trend portfolios. Reversal model is long.

OPEC Meeting Highlights:

OPEC makes its fifth and largest downward revision to 2024 oil demand growth forecasts.

The downgrade is based on recently received bearish Q3 data, signaling weaker-than-expected demand trends.

The IEA's updated forecasts are expected on Thursday, providing further clarity on the outlook.

Note: Refer to yesterday’s piece on Syria for deeper insights. Highly recommend checking it out.

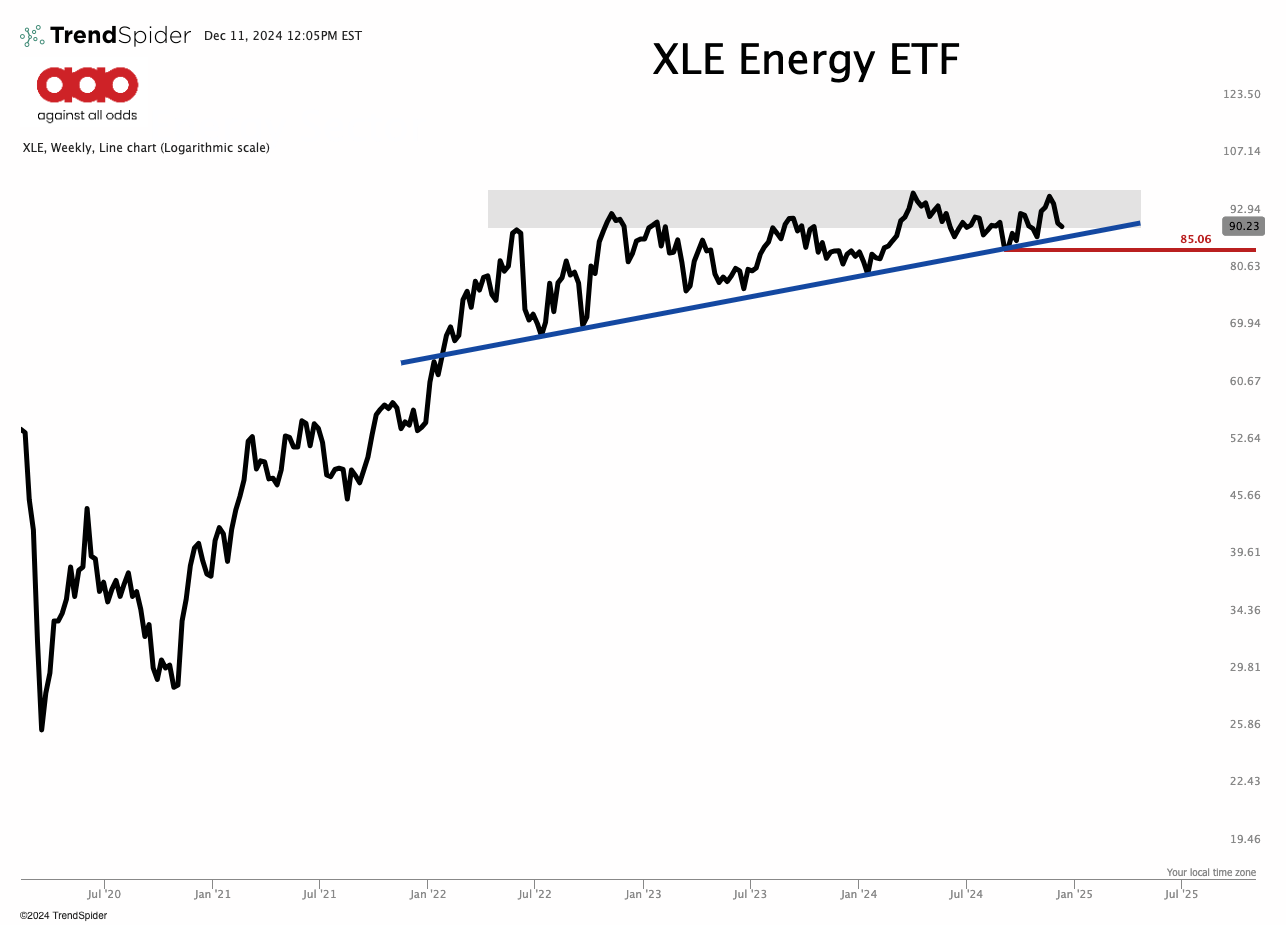

XLE:

Sell trigger: $85.06.

Stop: 18% trailing stop (long-term portfolio).

Position: Long, but currently choppy.

Bitcoin:

Sell trigger: $60607=39.87% away. 60 days since we hit that level.

Stop: 70214.87=30.26% trailing stop.

Position: Long.

Shoutout: Sam Gatlin’s chart… absolute killer.

Next step: Time to level up this trade with options. Here’s the plan: