Is Inflation Ramping Up? Portfolio Update

Gasoline, The Fed, Soybeans, Corn, Hogs, Cocoa and more...

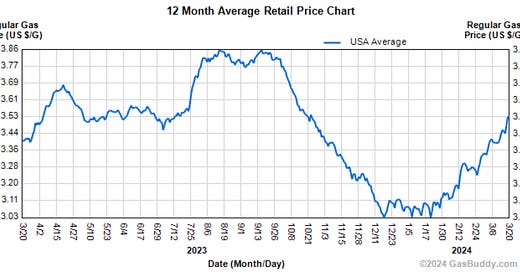

I thought inflation was dead? Oddly enough gasoline prices have now topped 3.50. As we go though the commodity complex you can see that inflation has been building under the surface this whole time. “A fed pivot is coming soon” they say.

(We have been talking about this for months.)

An economic or market based black swan would have to happen to see that pivot. I say.

When you have been doing this for awhile you start to realize that the fed is pretty quick to hike rates but they are not as quick to cut rates. The belief that they are going to cut rates can cause insane rallies. This is why rates being “higher for longer” is not a reason to stop taking buy signals.

The Fed could raise rates to combat this but I don’t think that is necessary. What they most likely will do is… If everything keeps moving higher. They will say we are not cutting rates anytime soon. In an election year I would be surprised to see rate hikes. If we start to see cracks in the economy we could see cuts. Like always we have to wait for a signal.

So how are we trading it?

Take a look at our positions. We are trading like the market still expects rate cuts because that is exactly what our signals are telling us to do. Let’s stay long. In the end who cares what we are thinking. We have to trade what is in front of us!

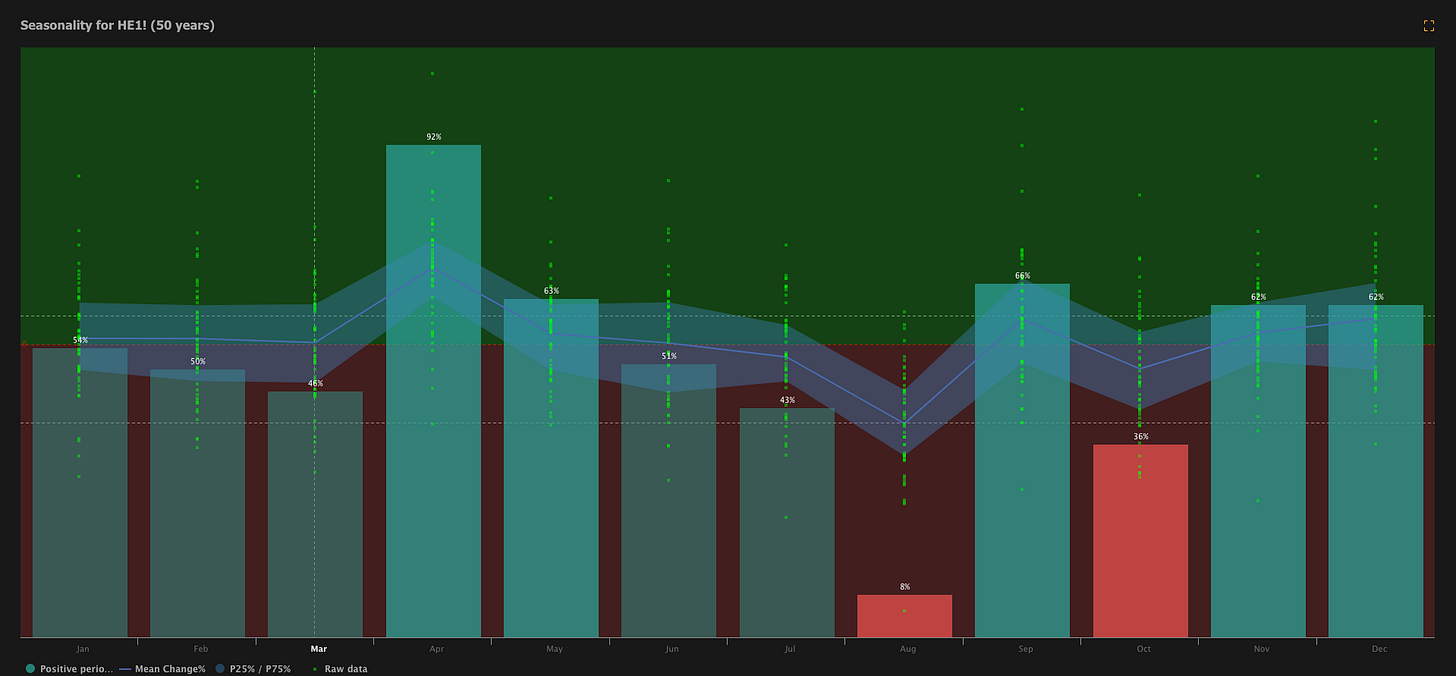

Lean hogs-Reminder, as we are consolidating, our trade is coming up at the beginning of the month. Be ready for that break out!

Extremely bullish set up in April.