Liquidity Signals: Is the Fed’s QT Clock Running Out?: System Addicts Journey

"We think of commodities: as an alternative currency and store hold of wealth, as a growth-sensitive asset class, and as an asset with specific supply and demand considerations" Ray Dalio

Something I want to focus on this year is making complex topics simple.

Let’s look at the fundamental picture.

Liquidity:

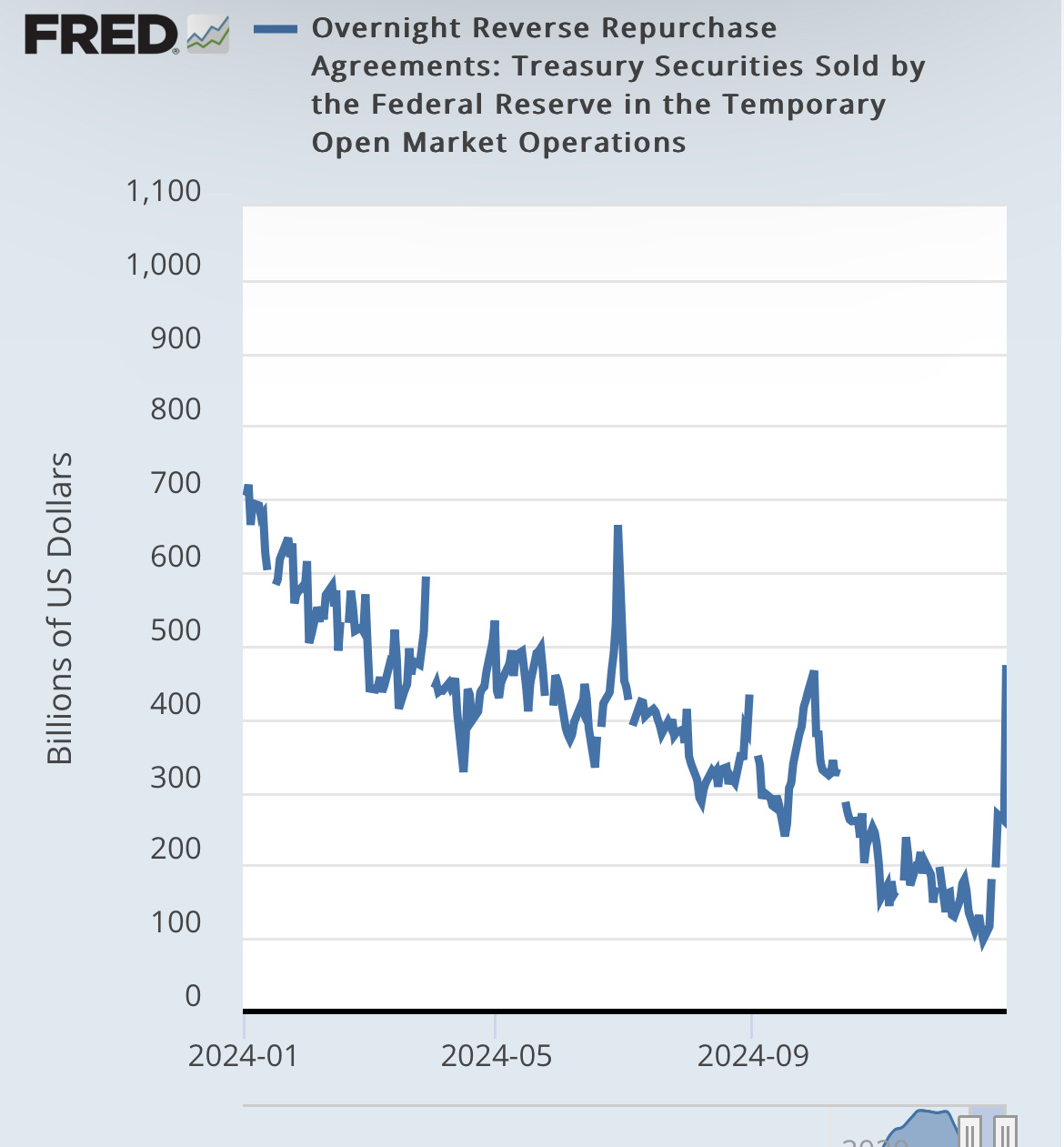

The reverse repo facility hit under $100B before Christmas for the first time since 2021.

That cushion? It’s running out. Repo usage is creeping back in-first time since 2020.

That’s your signal: balance sheets are tightening, and the Fed’s QT clock is ticking. I’m saying it now, QT wraps up in 2025.

Watch for it to start moving above 700 billion.

And now it’s already up 300 billion.

Inflation & Rates:

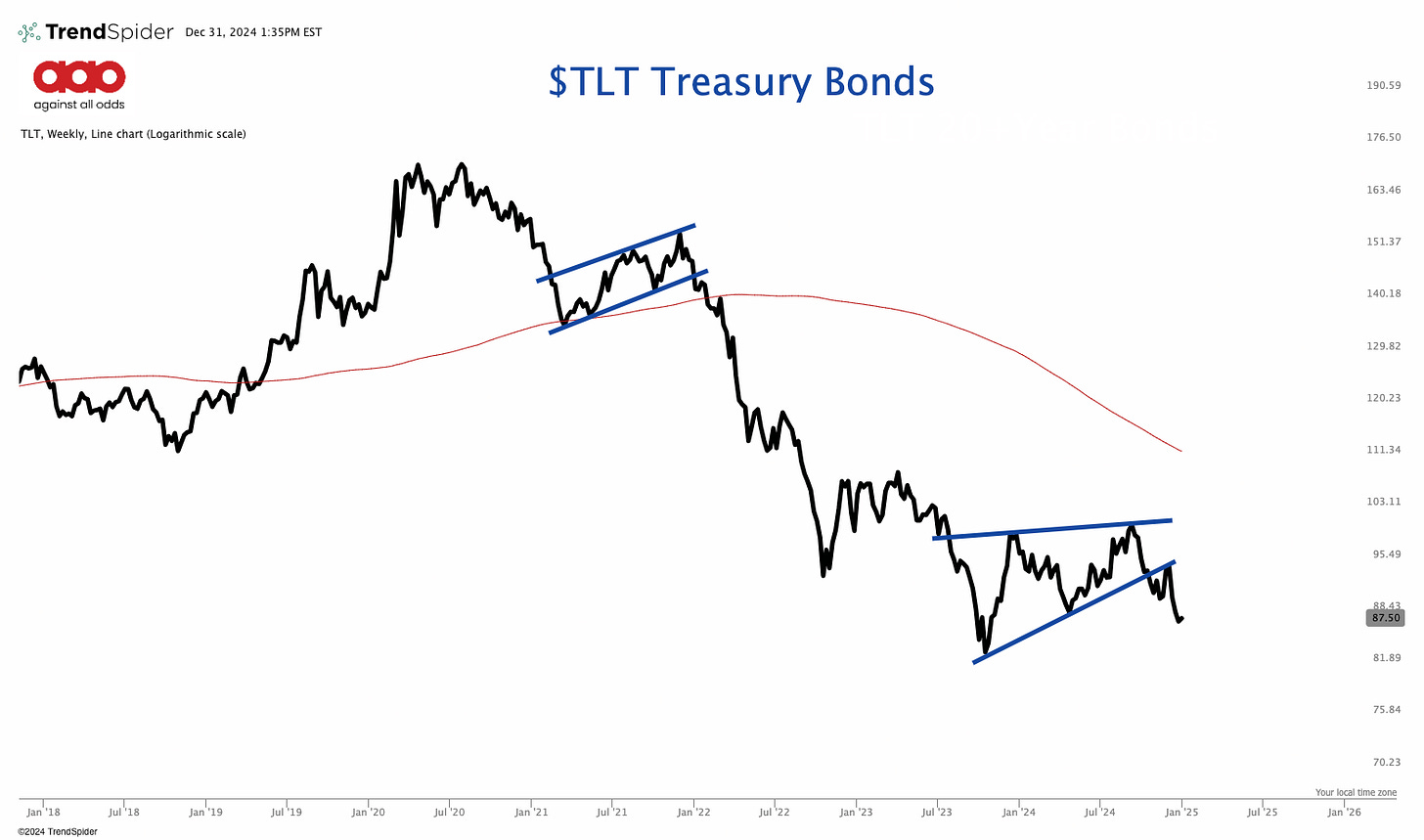

The Fed just cut rates by 25 bps to 4.25%-4.50%, but here’s the twist: they bumped 2025 inflation targets to 2.5% and raised rate forecasts to 3.9%. Markets weren’t happy stocks, bonds, bitcoin, all sold off and interest rates are moving higher (Bond prices are moving lower).

Fiscal dominance is running the show, and higher rates are only making deficits worse. It’s a feedback loop, and it’s not going away anytime soon.

China:

Now let’s talk China. Their 10-year bond yields dropped fast from 2% to 1.685%. That’s a big red flag. Exports are strong, but the domestic economy? Not so much. Property markets are deflating, households aren’t spending, and growth is stuck in neutral.

Why care? China is commodities. Copper, oil, iron ore… they all move on China’s demand. If they stabilize or stimulate, those markets are primed to rip. It’s the wildcard for 2025.

The Bottom Line:

Liquidity remains tight for now, but signs point to potential expansion ahead. Keep a close watch on the repo market and global bond yields for clues on the next move.

Get ready to trade it.

Two quick updates:

AAO’s final sale is happening now! If you’ve been waiting to get involved, this is your chance. Prices are going up in January, so don’t miss out! https://aaoresearch.substack.com/TheLastSale

Also I messed up posting the link to the conference call yesterday. Here is it.

AAO Monthly Call

Thursday Jan 2, 2025 ⋅ 1pm – 2pm (Eastern Time - New York)

Link: https://streamyard.com/henqcaay7e