As we hit fresh equity highs in both of our portfolios, certain stock market sectors, some commodities and precious metals are also riding the wave. It’s no surprise we’ve learned to embrace the summer chop and keep trading right through it. Summer is a dead, choppy market and autumn is where trends are reborn. This is how we take advantage of the moves that we are seeing now as fall is approaching.

While no one can predict exactly when this turbulence will end, we do know one thing: opportunity waits for no one. This year flipped the usual "sell in May and go away" mantra on its head, turning into a "sell in April, buy in May" scenario and that sounds ridiculous.

As I always say, you never know where your biggest winners will come from, and returns are often lumpy—just ask my buddy Andy, who said in times of doubt he could hear me saying “LUMPYYYYYYY”. The key is being prepared for the next big move, just like I was back in November and December 2020, when I had my best months ever as a fund manager. It all came down to positioning for what was to come.

I will tell you the one thing that I hate about about this time of year.

I have to say goodbye to the summer. Bye to my bees and bye to my garden.

(I just got done with a basketball game, don’t mind my appearance lol)

Around this time of year, I spend time in my garden saving wasps and bees. Many are either aging, struggling in the cold, or simply lost. In a hive, the queen releases pheromones that keep the workers focused. But when summer ends, she stops producing them, and the workers are forced out, eventually dying from either the cold or starvation. While I haven’t figured out how to warm the earth (yet), I can at least ensure they don’t go hungry.

This makes me reflect on why I continue to take new positions during the summer. Pain is a part of life, and by navigating the summer chop and managing risk properly, we position ourselves for the next phase of trading—when the turbulence fades and new trends emerge.

New Emerging Trends

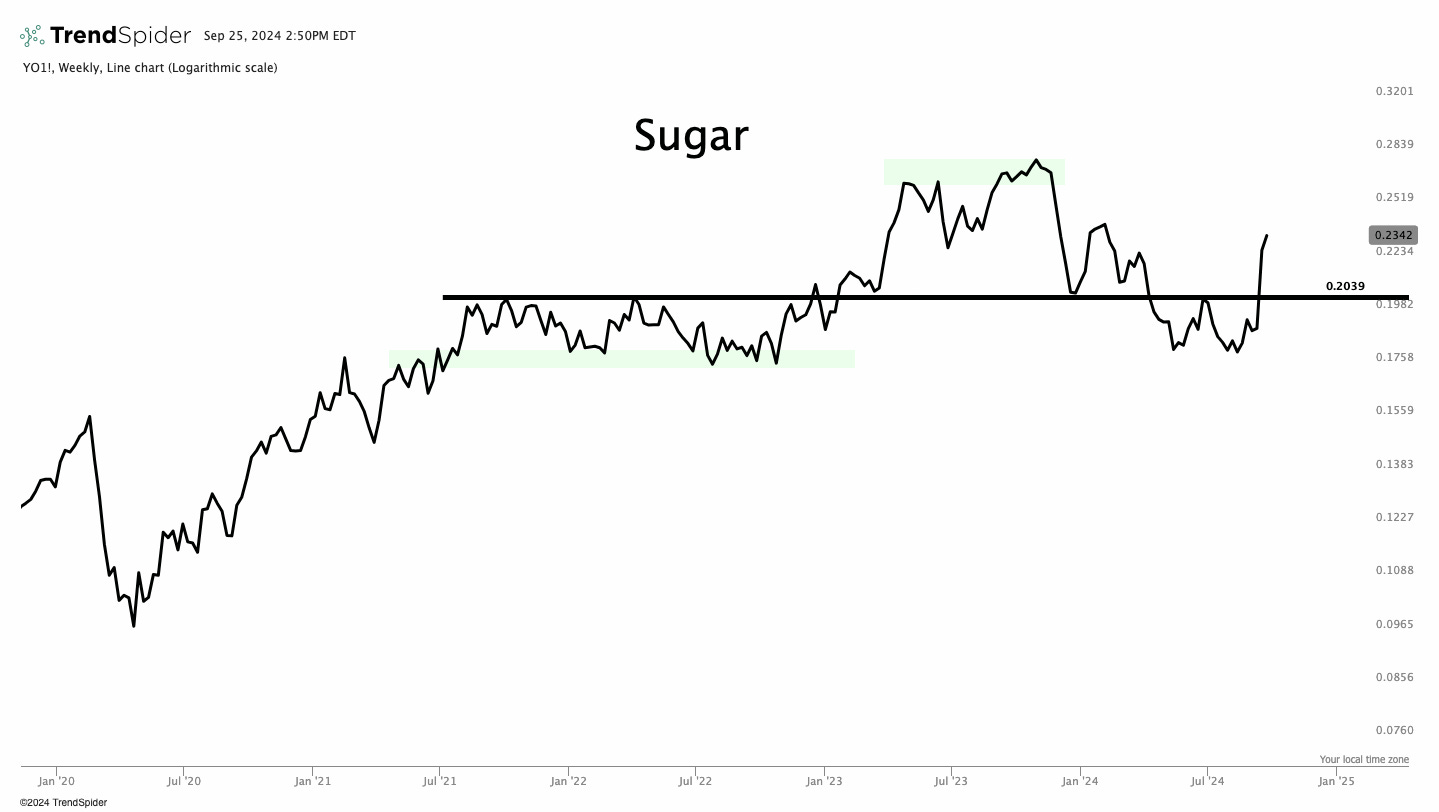

Drought conditions in Brazil and Russia/Ukraine are fueling uncertainty across key markets, sending shockwaves through soybeans, winter wheat, orange juice, sugar, and coffee.

As we broke through a major support zone. We have started a new trend higher. Subscribers got our entry signal for our reversal model (Signal was in the beginning of August) and our false breakdown signal. (Our buy stop was hit on Wednesday last week

)