New Trade, Old Lessons: A Portfolio Review in Fragile Markets

When leadership breaks down and sentiment crumbles, we don’t predict — we align with the survivors. From crude oil to currencies, here’s what we’re doing and why.

Upgrade to paid to play voiceover

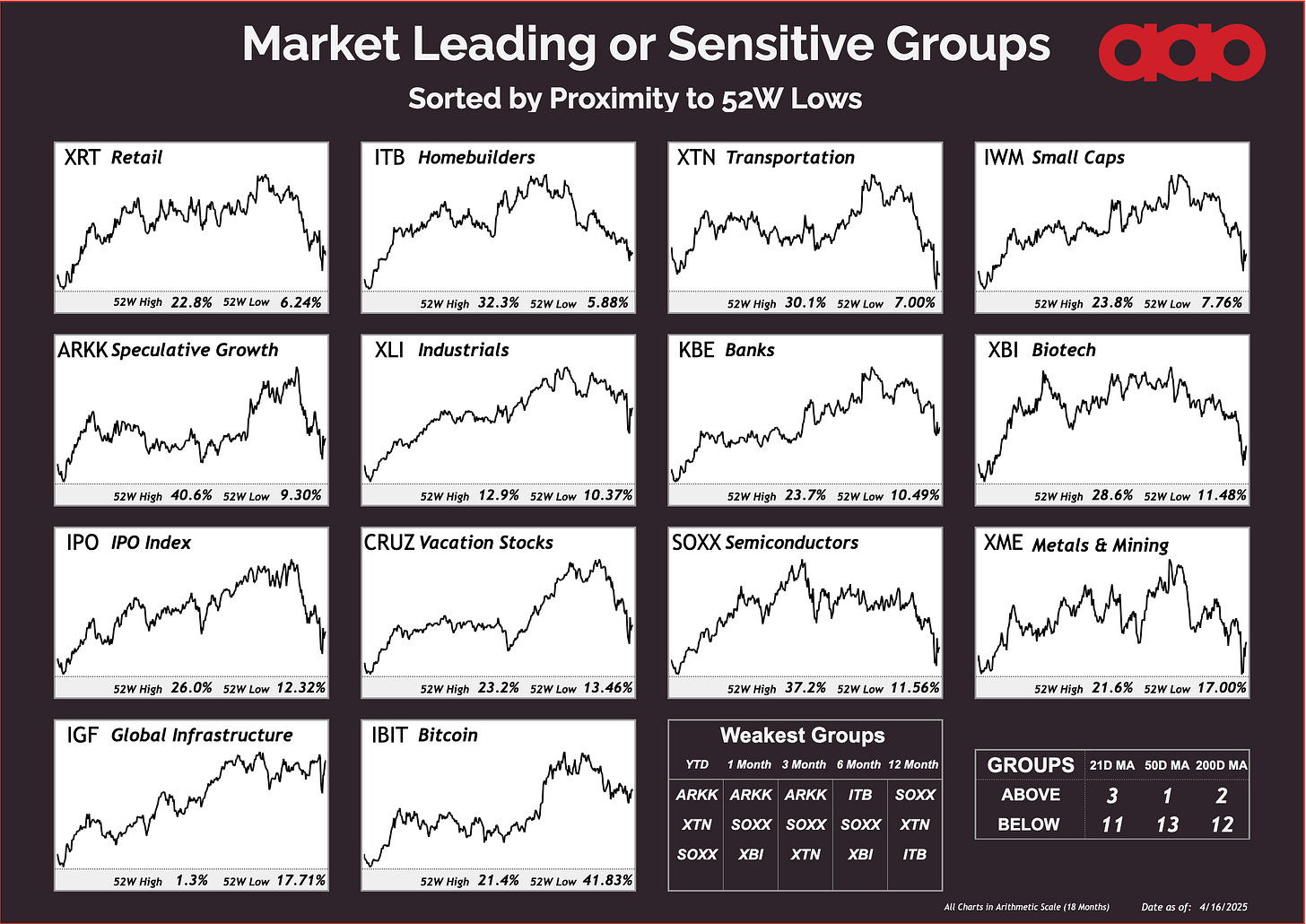

Most of our equity leadership groups still look broken.

Only 2 out of 12 have made it back to their 200 day moving averages: $IGF (global infrastructure) and $IBIT (spot Bitcoin ETF). That’s it.

IBIT is the odd one. Bitcoin itself hasn’t reclaimed the 200 day, but the ETF looks stronger. Why? Because Bitcoin doesn’t sleep. It trades on weekends, around the clock. Different rhythm. Same story.