Platinum Verses Gold: "The Other Metal"

Examine the diverse influences on platinum prices, ranging from geopolitical events to the evolving automotive industry and the global push towards new technology.

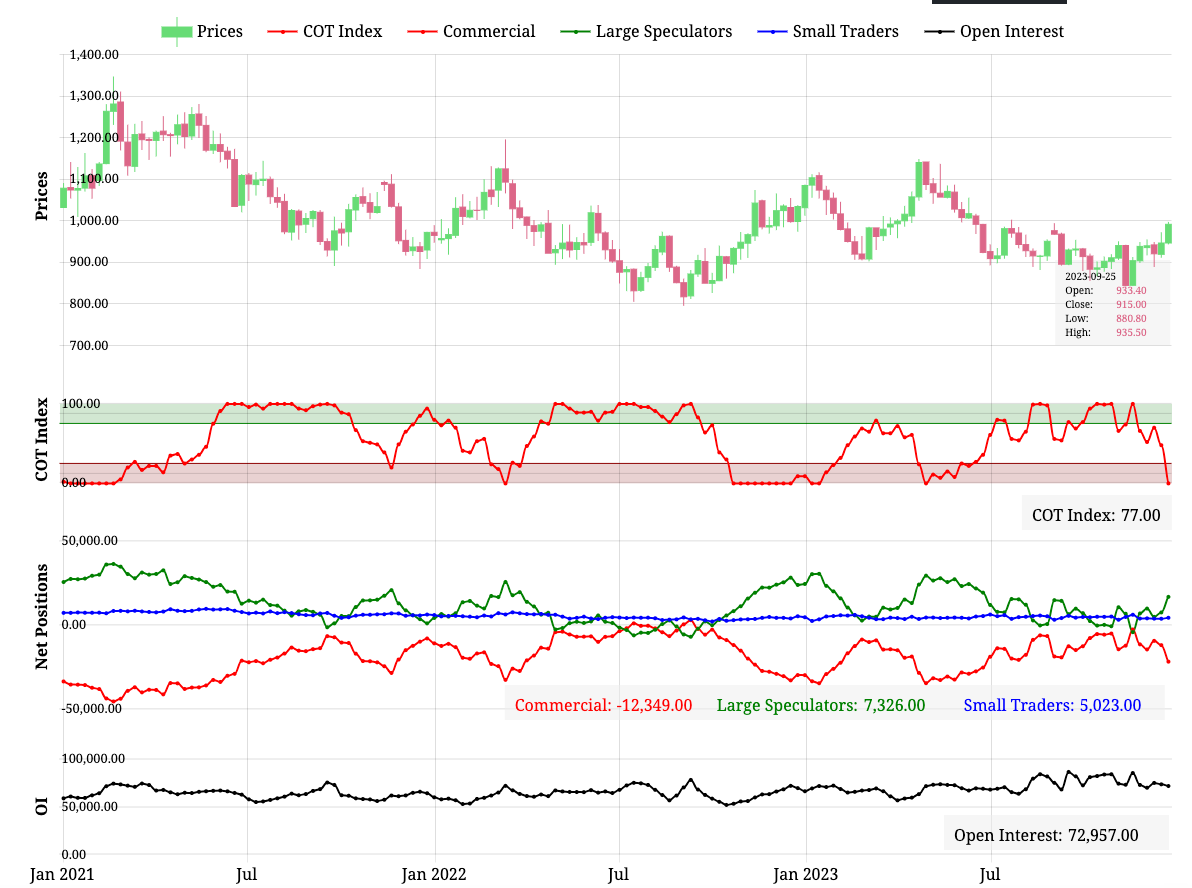

Platinum could explode higher! Quickly.

You may have noticed that platinum was added to the portfolio last week. Let’s go over the basics of platinum for those that are new to it.

We need your help! If you find this content valuable, please consider liking, sharing, and subscribing. Feel free to pass it along if you think it can benefit others.

We are getting over most of the high volume zones. Gold and Silver are strong. Platinum could easily explode higher. PL futures run a 18% trailing stop. Small positions are the key to commodity trading.

We are long platinum futures but I think it is important just to understand a little bit about “the other” precious metal.

When considering precious metal investments, gold and silver often take the spotlight. However, platinum, with its unique attributes, presents an equally compelling opportunity for investors seeking diversity and potential returns. Here's why platinum could be a valuable addition to your investment portfolio:

Diversification Options: Platinum investment mirrors the well-known avenues available for gold and silver. Investors can choose from a range of options, including bullion bars, coins, jewelry, ETFs or ETPs (Exchange Traded Funds or Exchange Traded Products), and shares in mining companies. By diversifying your portfolio with platinum, you harness the potential benefits of a precious metal that stands out for its rarity and utility. Personally I recommend this weighting in your precious metals holdings. You 65% Gold-30% Silver-5% Platinum

Volatility and Supply Dynamics: Platinum's market is known for its higher volatility compared to gold, adding an element of dynamism to your investment strategy. It's crucial for investors to stay informed about supply factors, especially considering that a significant portion of the world's platinum is mined in South Africa and Russia. Geopolitical events, such as the Russian invasion of Ukraine and subsequent sanctions, have demonstrated the impact on platinum supply and price fluctuations.

Price Trends and Potential Returns: Examining recent trends, platinum has showcased price movements reflective of global circumstances. In 2020, the metal experienced spikes and declines, influenced by factors like mining strikes and market uncertainties. In 2022, the price surged in April, offering investors opportunities for strategic entry points. As of the latest data, platinum is valued around $990 per ounce, presenting potential for investors to capitalize on market movements.

Key Price Drivers: Understanding the chief drivers of platinum prices is essential for informed investment decisions. The circumstances in platinum-producing countries, particularly South Africa, play a significant role. Mining strikes and geopolitical events can create price fluctuations. Additionally, the automotive industry, accounting for over one-third of platinum consumption, shapes demand. Shifts in automobile production and a growing emphasis on green technology contribute to the metal's price dynamics.

Diverse Industrial Applications: Platinum's demand extends beyond jewelry, encompassing critical industries such as automobiles, computers, green energy, and medicine. Its role in catalytic converters, vital for reducing vehicle emissions, positions platinum at the forefront of environmental initiatives. Investing in platinum aligns with broader trends toward sustainability and technological advancement.

In conclusion, platinum offers investors a compelling opportunity to diversify their portfolios, navigate market dynamics, and participate in the growth of industries promoting sustainability. Stay informed, seize strategic entry points, and position yourself for the unique advantages that platinum brings to the world of precious metal investments.

We brought Platinum to your attention recently when funds were incredibly short! I would assume we see some consolidation before a major move higher. Stay nimble.