Portfolio Update: How to Think Markets

"No man can consistently and continuously beat the stock market though he may make money in individual stocks on certain occasions."

Quick update: Holiday in the states. I hope everyone is enjoying the day off. The US cash markets are closed today. The full commodity report will be out tomorrow.

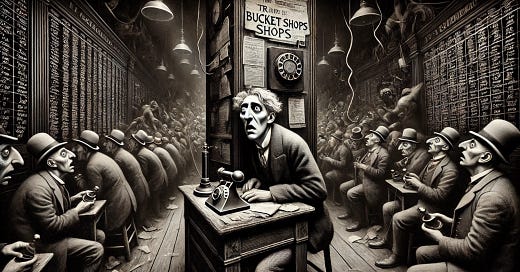

Until then here are some of my favorites from Reminiscences of a Stock Operator

"He wants to get something for nothing. He does not wish to work. He doesn't even wish to have to think."

"You find many people, reputed to be intelligent, who are bullish because they have stocks. I do not allow my possessions- or my pre possessions either- to do any thinking for me."

"There is profit in studying the human factors-the ease with which human beings believe what it pleases them to believe; and how they allow themselves-indeed, urge themselves- to be influenced by their cupidity or by the dollar-cost of the average man's carelessness. Fear and hope remain the same."

"The principles of successful stock speculation are based on the supposition that people will continue in the future to make the mistakes that they have made in the past."

"Investments were not wanted. The demand was for easy money; for the sure gambling profit."

Trends

"the big money was not in the individual fluctuations but in the main movements - that is, not in reading the tape but in sizing up the entire markets and its trend."

"It never was my thinking that made the big money for me. It always was my sitting.(...) Men who can be both right and sit tight are uncommon. I found it one of the hardest things to learn."

"Disregarding the big swing and trying to jump in and out was fatal to me. Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end."

"When a stock is going up no elaborate explanation is needed as to why it is going up."

Speculators

"I was no longer betting blindly or concerned with mastering the technic of the game, but with earning my successes by hard study and clear thinking."

"A man must give his entire mind to his business-if he wishes to succeed in stock speculation."

"I try to stick to facts and facts only, and govern my actions accordingly. Sometimes I do not see the facts-all the facts-clearly enough or early enough; or else I do not reason logically. Whenever any of these things happen I lose. I am wrong. And it awlays cost me money to be wrong. (...) But I object to losing money when I am right."

"Investors are a different breed of cats. Most of them go in strong for inventories and statistics of earnigs and all sort of mathematical data, as though that meant facts and certainties. The human factor is minimised as a rule."

"The wisest investor I ever knew (...) He was a great investigator (...) He believed in asking his own questions and in doing his seeing with his own eyes. He had no use for another man's spectacles."

"Observation, experience, memory and mathematics-these are what the successful trader must depend on."

"The speculator's deadly enemies are: Ignorance, greed, fear and hope."

Keep reading with a 7-day free trial

Subscribe to Against All Odds Research to keep reading this post and get 7 days of free access to the full post archives.