Price Already Voted-The Next Big Country Trade

Before headlines shift and narratives catch up, price tells the truth. And right now, it’s pointing to new leadership—across borders, metals, and crypto—while the dollar and domestic sectors fade.

Markets don’t need permission to change direction—they respond to pressure, and that pressure just reversed.

One week ago, headlines warned of tariffs, fentanyl, and a breakdown in U.S.-China relations. Then Beijing softened its tone, the security chief reached out, tariffs were quietly lifted—and it wasn’t the news that signaled a reversal, it was price.

As you can see on the chart: The market surged through the exact level where the fear began.

That’s not a coincidence—it’s price memory.

And it’s not the only place where things are shifting.

The leadership board continues to flip.

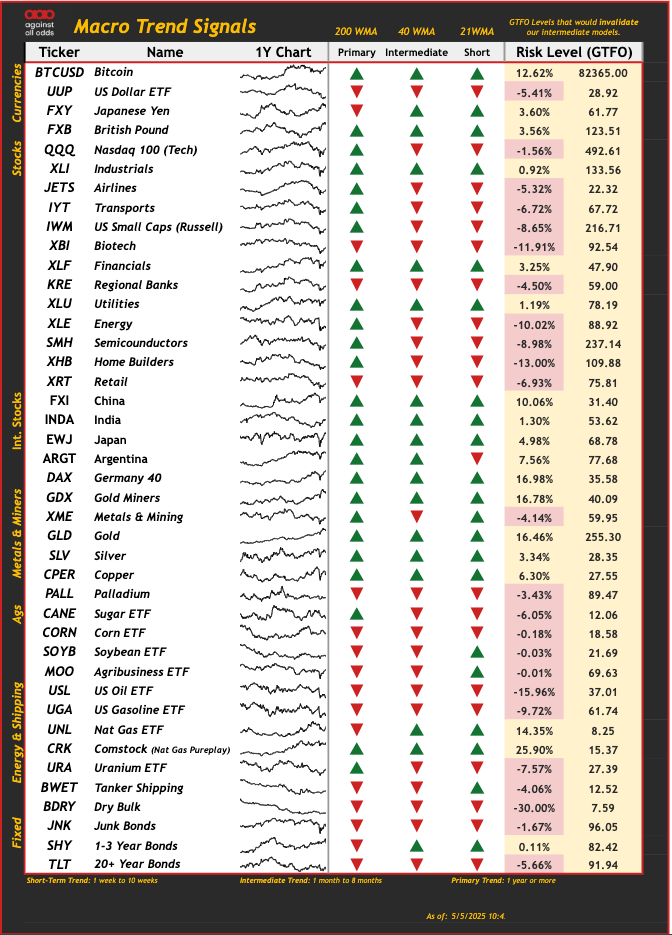

Bitcoin is in a confirmed uptrend across all timeframes—short, intermediate, and long—and gold is as well. Silver and copper are gaining strength, while Japan, Germany, India, and Argentina are all pushing higher.

This is not where weak hands are hiding—this is where momentum lives.

The U.S. dollar is in a clear downtrend, while small caps, financials, and regional banks continue to get sold. Bonds are offering no clear direction. Utilities and energy are stalling, and sectors like biotech and retail are starting to roll over.

It’s clear where capital is flowing.

It is moving into precious metals, crypto, and international equities. It is moving away from the dollar, from small caps, and from the sectors most tied to domestic credit risk.

Price is not just drifting—it is sending a clear message.

The world is re-aligning around new leadership. If you wait for confirmation, you’ll miss the turn. If you stare at headlines, you’ll miss the flow.

The spreadsheet doesn’t lie—gold is trending, bitcoin is 30% off of it’s lows, international stocks are leading, and the dollar is falling.

This isn’t speculation; it’s rotation, and it’s already underway.