Random Reflections: Random thoughts on why the market will make new highs.

SPY seasonality… The holidays can be very bullish. 77% of November’s returns over the last 31 years have had positive returns.

A loss never bothers me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does damage to the pocketbook and to the soul.

Jesse Livermore

Headline from Goldman…

”There is no need for a recession”

It appears that many of us are currently experiencing the effects of an economic downturn, even if it might not be technically classified as a recession. The impact on our finances is palpable. Inflation, chop, stagnation and watching friends and family that are being effected. I've always maintained a perception of the market as a distinct entity, separate from the real world. This viewpoint has allowed me to generate consistent returns over time. Despite this, I, like everyone else, find it challenging to make investments when the world seems to be in a state of turmoil. However, my understanding is that the market doesn't necessarily operate in sync with the turmoil of the world.

The swing chart got back in to a buy quickly.

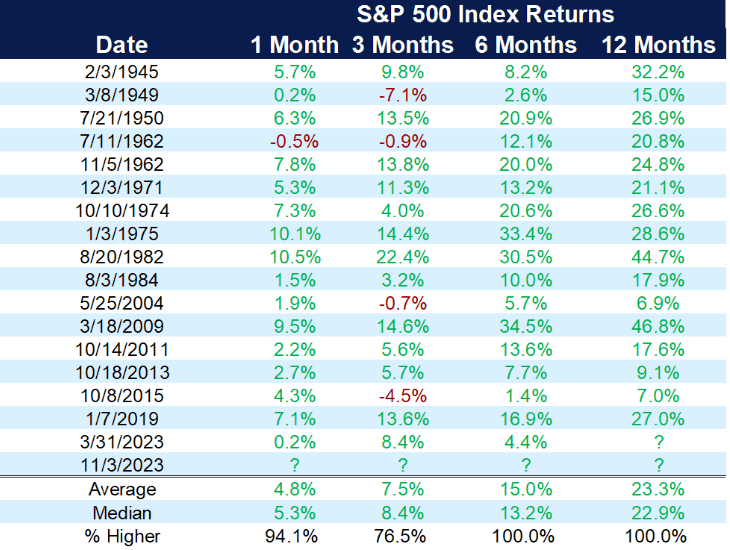

Martin Zweig devised this momentum indicator to demonstrate a "thrust" when, over a 10-day period, the average number of advancing issues transitions from below 40% to above 61.5%. This shift signifies a move from an oversold market to one displaying strength, yet it is not yet considered overbought.

I am surprised that I am not seeing every technician in the world discussing this. They do love to talk about breadth thrusts! Historically, these are quite significant. For instance, consider the last one in March that initiated a major rally. This recent one occurred in just 5 days! My viewpoint remains consistent from the beginning of the year - we will witness all-time highs before experiencing a new bear market. That does not mean that it will be pretty and I think it will just be stagflationary.

Source: Ryan Detrick

As you see. Most of the time these lead to solid returns.