Reflections: Connecting The Dots

"Soros has taught me that when you have tremendous conviction on a trade, you have to go for the jugular. It takes courage to be a pig. It takes courage to ride a profit with huge leverage."

Major developments continue to unfold.

As I mentioned last week…

For those subscribed to the premium version, we’ll be putting these trades into action. With our reversal system now public (Canadian dollar, palladium and more…have made huge moves), it’s time to take the next step. If you’ve followed my posts over the past decade, you know the level of detail and strategy I’m about to share.

Especially during an election year. In 2020 we had back to back 50% months in November and December.

We have some major opportunities coming up. Trading is not about consistent returns. Trading is about creating opportunities for lumpy returns. Big lumpy returns are coming.

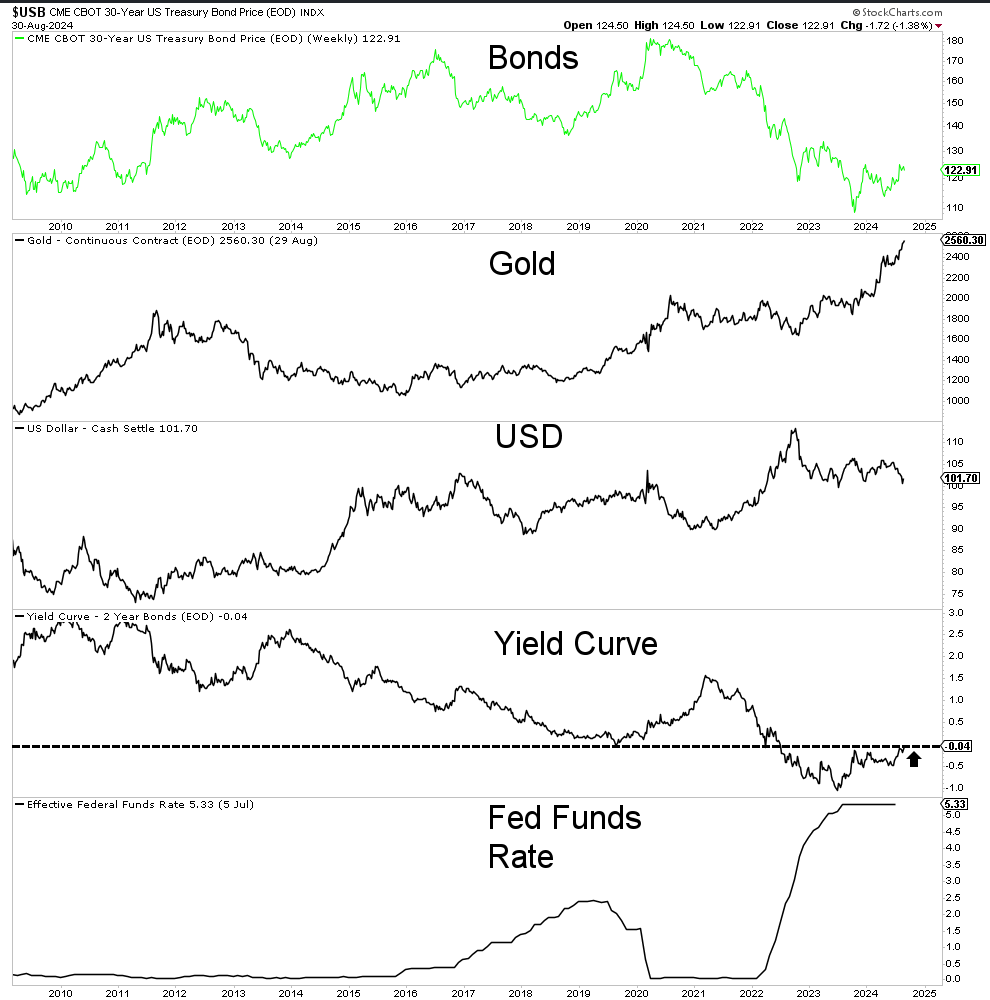

Big Picture: The Yield Curve is Telling a Story

Bonds play a crucial role in understanding the stock market. When the market stalls or drops, the bond market becomes your friend, especially if you're using leverage like call options.

Futures are a great tool for this trade, and options are looking particularly promising right now.

Currently, we’re seeing a unique opportunity. Inter market analysis and new breakouts are telling the story.

Gold is the missing piece. Typically, bonds and gold move in opposite directions, with inflation boosting gold while hurting bonds. However, in a late-cycle environment, they can rise together as monetary easing lowers interest rates and boosts bond prices.

This scenario can also raise concerns about currency depreciation and inflation, potentially leading to higher rates, which contrasts with their usual relationship.

Right now, we are in that late-cycle environment. We're currently emerging from a yield curve inversion. While this isn’t always immediately bearish for stocks and it typically creates a favorable environment for bonds.

WE ARE BUYING BONDS ACROSS THE CURVE.

Buy ZB/ZN/ZF/ZT Futures.

Premium subscribers: hold your call options.

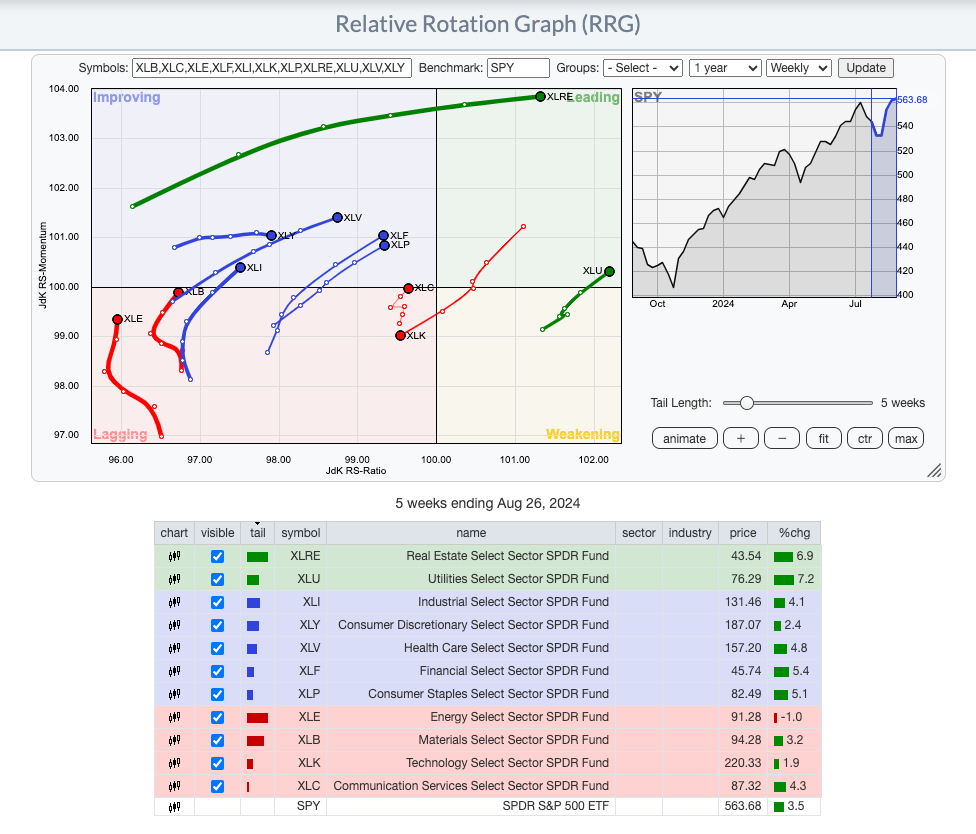

Global Equities

RRG charts are showing that money is flowing in to these sectors. Look what sectors are leading. Sectors that lead when bond yields are dropping.

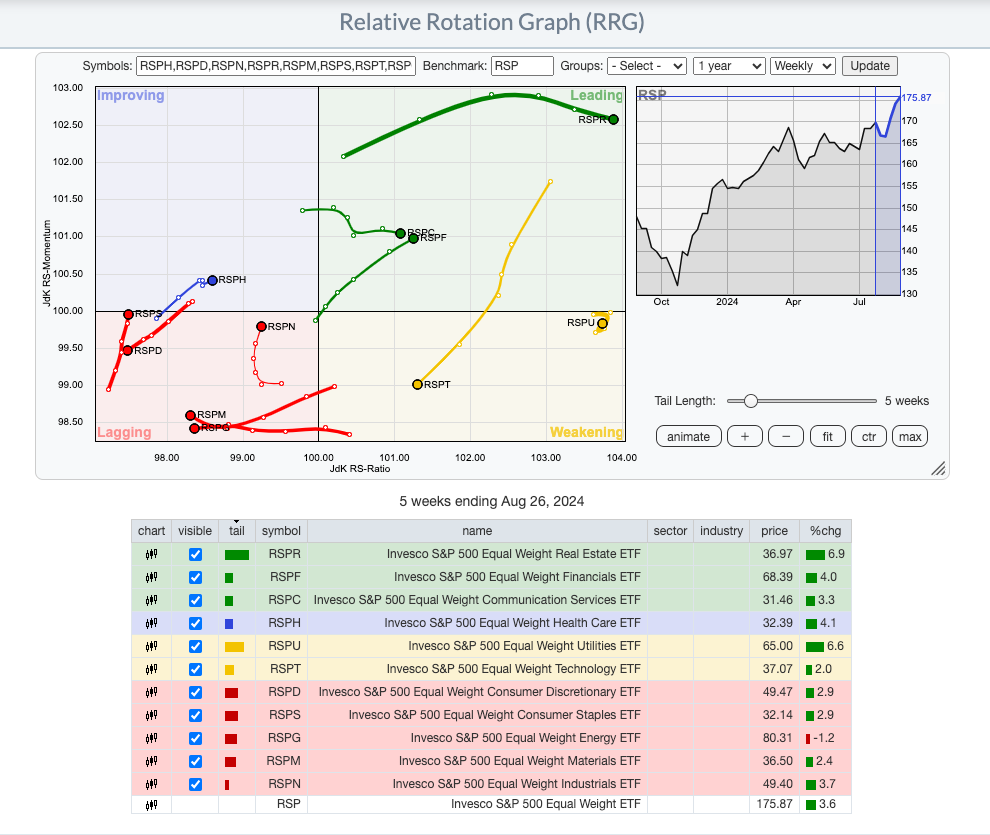

The equal weight is giving us a similar set up. However, the equal weight financials are right behind real estate.

And if you don’t own banks in this environment. You are missing out.

When the short end of the yield curve rises faster than the long end—a condition known as a steepening yield curve—banks often benefit significantly. This scenario enhances their net interest margin, the difference between the interest income generated by banks on their lending activities and the interest they pay out to depositors.

Essentially, banks can borrow money at lower rates on shorter-duration liabilities and lend at higher rates on longer-duration assets. This increase in the spread between what they earn on loans and what they pay on deposits can lead to improved profitability. Additionally, a steepening curve typically reflects expectations of economic growth and potentially higher inflation, which can drive more robust lending and banking activity overall.

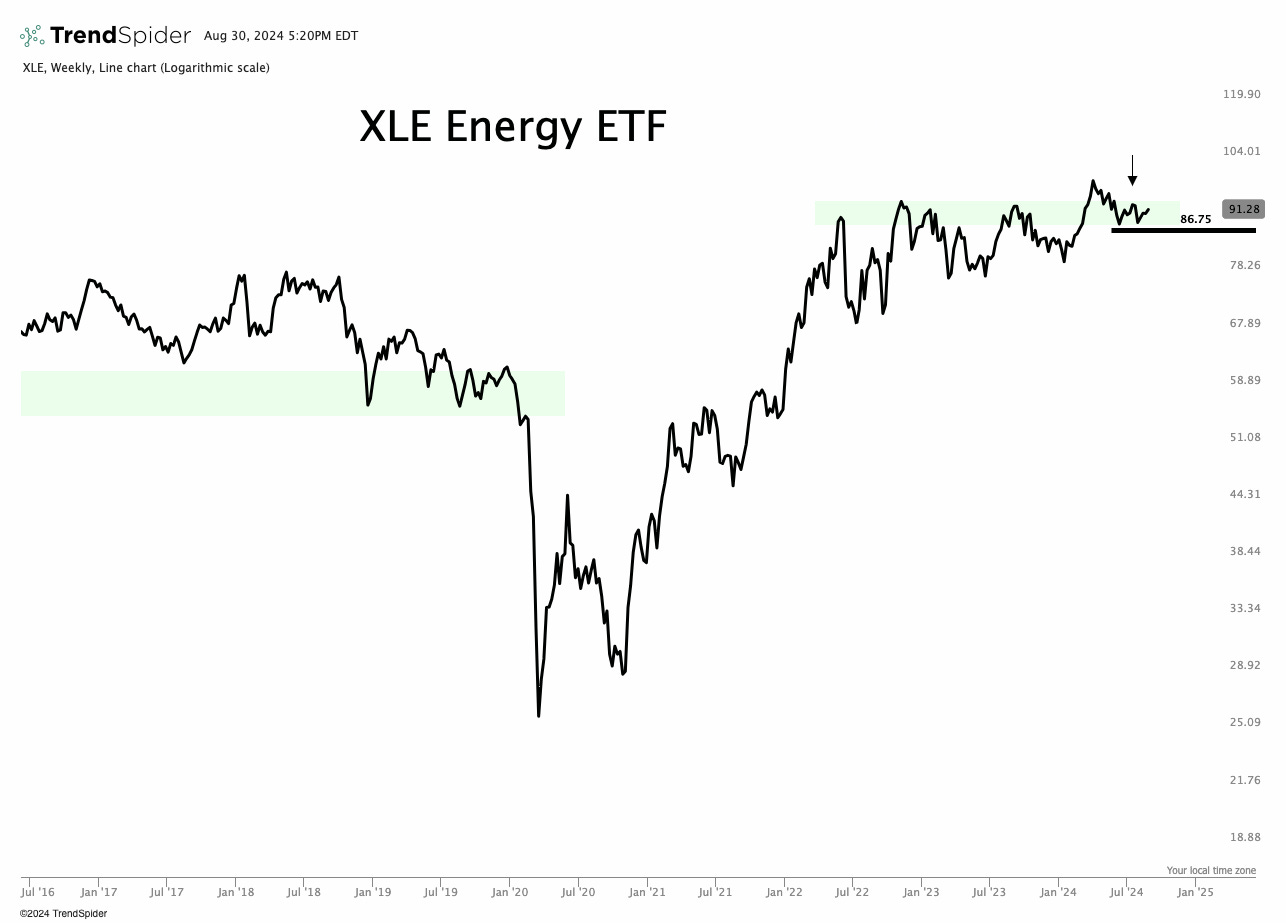

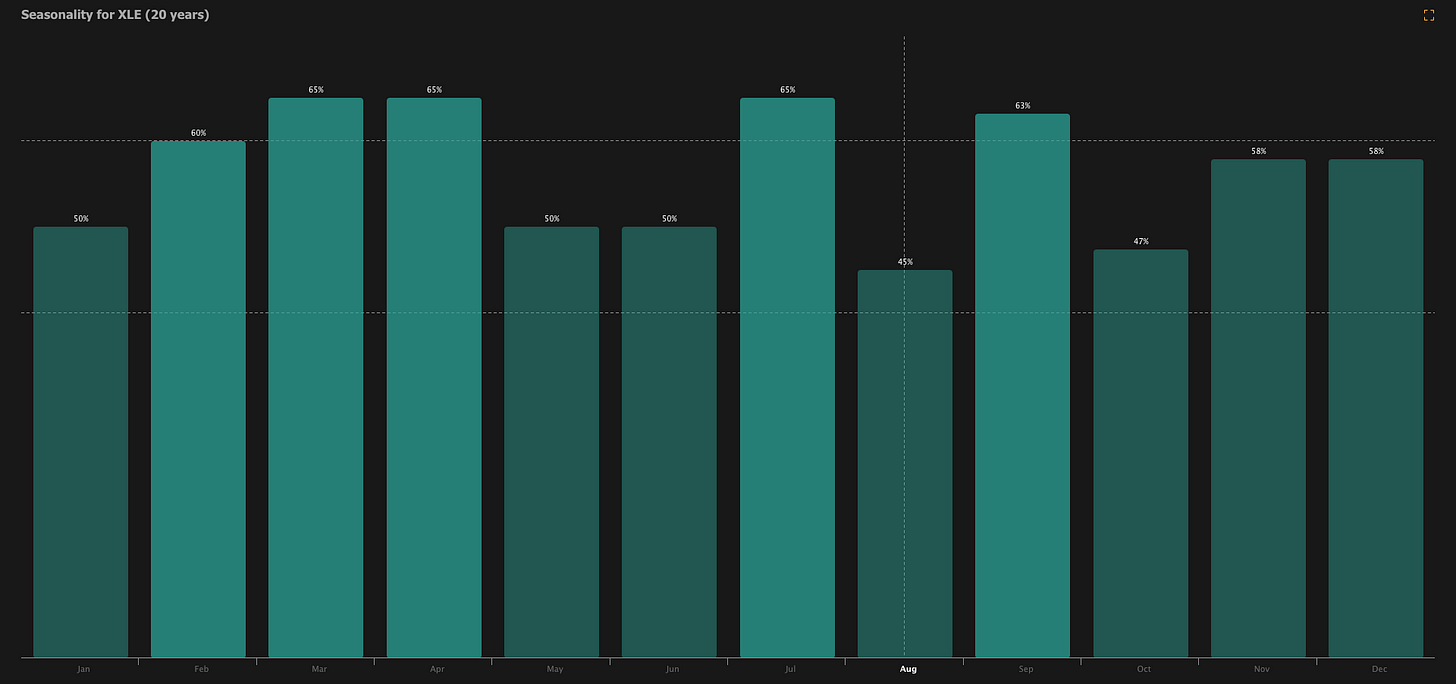

Energy can also follow. However, that will happen later.

And guess who banks lend a lot of money to, especially the regionals.

Energy companies…

Look what’s coming up? September is a good month for energy.

This is either going to be a massive slowdown or a reflationary market. For now I think reflation will start to take over in a month or two.

Stay tuned as we update our regime models weekly.

Ags/Softs

The time to buy agricultural commodities is coming. If Wheat opens higher on Sunday. It is time to buy wheat… FINALLY!

September brings significant agricultural risks, including potential frost in the Midwest, linked to West Pacific Typhoon recurvature.

Concurrently, there's concern over the implications of a dry planting season in Russia and Ukraine for winter wheat. Additionally, the ongoing record drought and fire season in Brazil—one of the worst in a century—poses serious challenges as the critical first half of the growing season unfolds (September to December).

This drought is likely to impact key crops such as soybeans, coffee, sugar, and the orange juice market, potentially disrupting global supply chains.

Takeaways:

The bond market is heating up with breakout signals across the curve.

Energy markets may shift if global growth slows, though a year-end rally is likely.

Stay long in technology, but watch small caps and industrials for future outperformance.

Get ready to buy wheat!

I'm excited to share my global macro strategy more thoroughly with you all, the cornerstone of my trading.

Stay open-minded and flexible in your trading approach. If you are humble, you are always teachable and ready to learn!

Remember that global macro trading offers a unique lens to view the interconnectedness of markets worldwide. Keep these insights in mind as you refine your strategies and prepare for the dynamic shifts that lie ahead.

Against All Odds Research Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)