Regime Change (you are here): What You Need to Know

The difference between being right and making money

TLDR: We're excited to introduce a new model that will be updated during major market turning points, periods of overheating, and moments of extreme positioning. The goal is to provide you with timely reversal signals across commodities, currencies, and equities. Remember, these trades require proper risk management to fully capitalize on opportunities. More trade opportunities are coming next week.

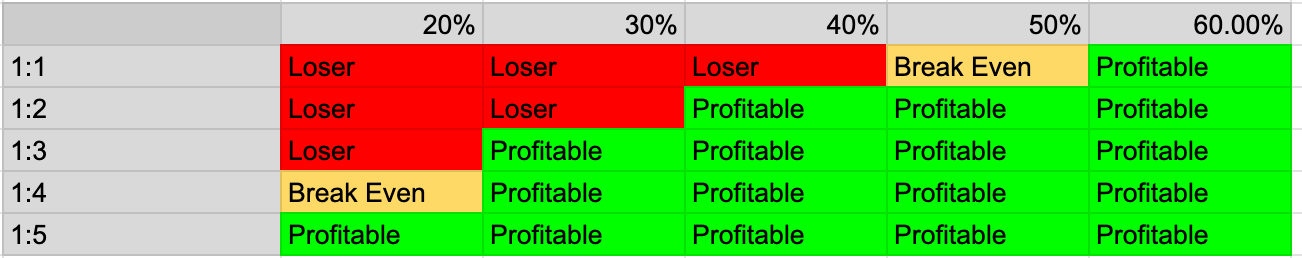

The strategy behind this model is inspired by the wisdom of Paul Tudor Jones, who emphasizes the importance of a 5:1 risk/reward ratio. This means risking one dollar to make five, allowing traders to remain profitable even if they are wrong 80% of the time. This approach highlights the power of asymmetric risk management, showing that success in trading is not about having a high win rate, but ensuring that gains significantly outweigh losses.

In current market sentiment, there's a significant shift in bullishness as seen in a recent chart shared by Jim Bianco. The percentage of bullish newsletters dropped sharply over the past two weeks, marking the largest decline since major market events like the 1987 crash and the 2008 financial crisis. Despite this, the VVIX/VIX model indicates complacency, and the Advance-Decline line remains strong, suggesting resilience in the market.

On the intermarket front, gold appears to be a high-probability bet, likely heading higher as yields move lower. Silver is also expected to see a significant bounce. We're approaching a seasonal turning point where the commodities-to-bonds ratio typically rises, and we're eagerly awaiting this week's commodity update for further insights.

Teaser/New Model: This system will be updated during major market turning points, periods of overheating, and extreme positioning. My aim is to provide you with reversal signals that highlight key moments in commodities, currencies, and equities. Keep in mind, these are like any other trades—proper risk management is essential to capitalize on them. Stay tuned, more trade opportunities are coming next week.

“[I’m looking for] 5:1 (risk /reward). Five to one means I’m risking one dollar to make five. What five to one does is allow you to have a hit ratio of 20%. I can actually be a complete imbecile. I can be wrong 80% of the time, and I’m still not going to lose.”

Paul Tudor Jones

Why do the greats say this?

The quote emphasizes the importance of risk/reward ratios in trading, particularly the strategy of aiming for a 5:1 ratio. This means that for every dollar risked, the potential profit is five dollars. By adopting this approach, a trader doesn’t need to be right most of the time to be profitable. Even if a trader is wrong 80% of the time, the 20% of successful trades can still result in an overall profit due to the high reward relative to the risk taken on each trade.

This strategy highlights the power of asymmetric risk management. It underscores that success in trading isn’t solely about having a high win rate, but about ensuring that when you do win, the gains significantly outweigh the losses. This mindset allows traders to maintain profitability even with a low hit ratio, protecting them from substantial losses even when their predictions are often incorrect.

There is a huge difference between being right and making money!