Capital moves for a reason—lately, it’s been moving out of America.

It started with tariffs. Then came reshoring. Then capital controls, energy bottlenecks, and conflicting industrial policy. Each step chipped away at the core pillars that made the U.S. the world’s safest home for capital.

Now we’re staring at the other side of the mountain.

For over a decade, the U.S. was the cleanest shirt in a dirty hamper. The rest of the world was a mess—Europe was stagnating, Japan was zombified, and China couldn’t inspire confidence. So global capital flooded into U.S. stocks, bonds, real estate, and private equity. Trillions.

But nothing lasts forever.

The setup today looks dangerous for U.S. stocks.

The Net International Investment Position is deeply negative—foreigners own more U.S. assets than Americans own abroad. That’s never been true at this scale.

Global funds are still massively overweight U.S. exposure. A small unwind could spark a much larger cascade.

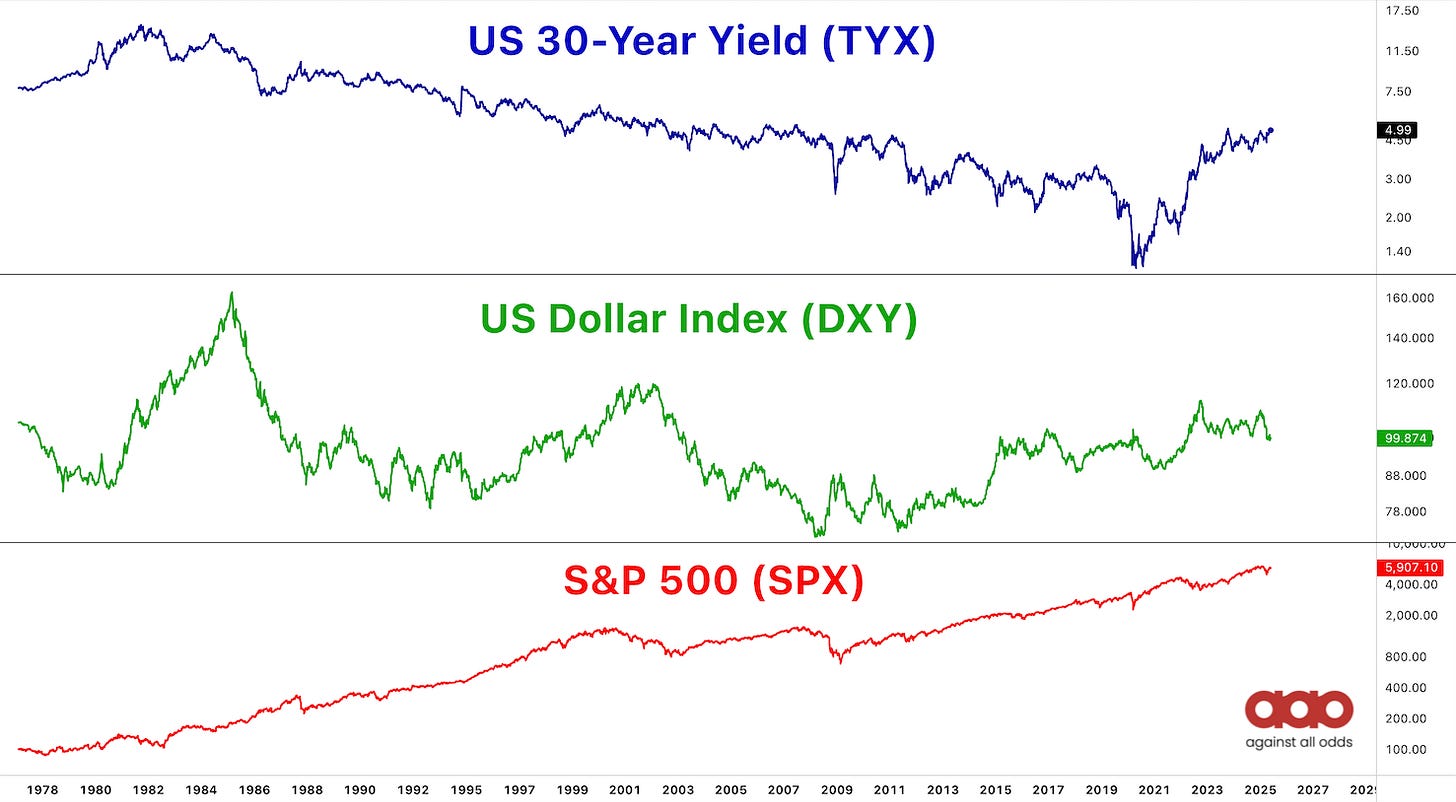

Last month, we saw a rare signal—rates up, dollar down, U.S. stocks underperforming foreign markets by double digits. That hasn’t happened since 1982.

The problem? Policymakers don’t seem to realize they’re holding a Fabergé egg.