Sector Rotation: The Only Way to Survive

Sticking to one theme kills returns. Flexibility builds them.

When I first started trading, I saw how easy it was for people to get trapped in a theme. If tech was hot, traders would call themselves “tech investors.” When tech turned into dead money from 2000 to 2011, many still clung to it. I watched gold bugs who refused to own anything but gold, even as technology and equities ripped higher after 2011.

That’s not investing. That’s identity. And identity kills returns.

The market doesn’t reward loyalty to a sector. It rewards flexibility. If the goal is to make money, we have to recognize the cycle, understand the macro backdrop, and be willing to rotate into unloved assets before they turn into leadership. That’s the only way to capture the real asymmetric moves.

That’s why I trade the way I do.

When Bitcoin first broke onto the scene, I was interested, not skeptiacal.

When gold caught a bid again, I was ready.

When commodities moved broadly, I shifted with them.

When international stocks began to lead, I pounced.

Sector rotation isn’t a theory. It’s survival.

Sector Scan: The Heart of Reflation

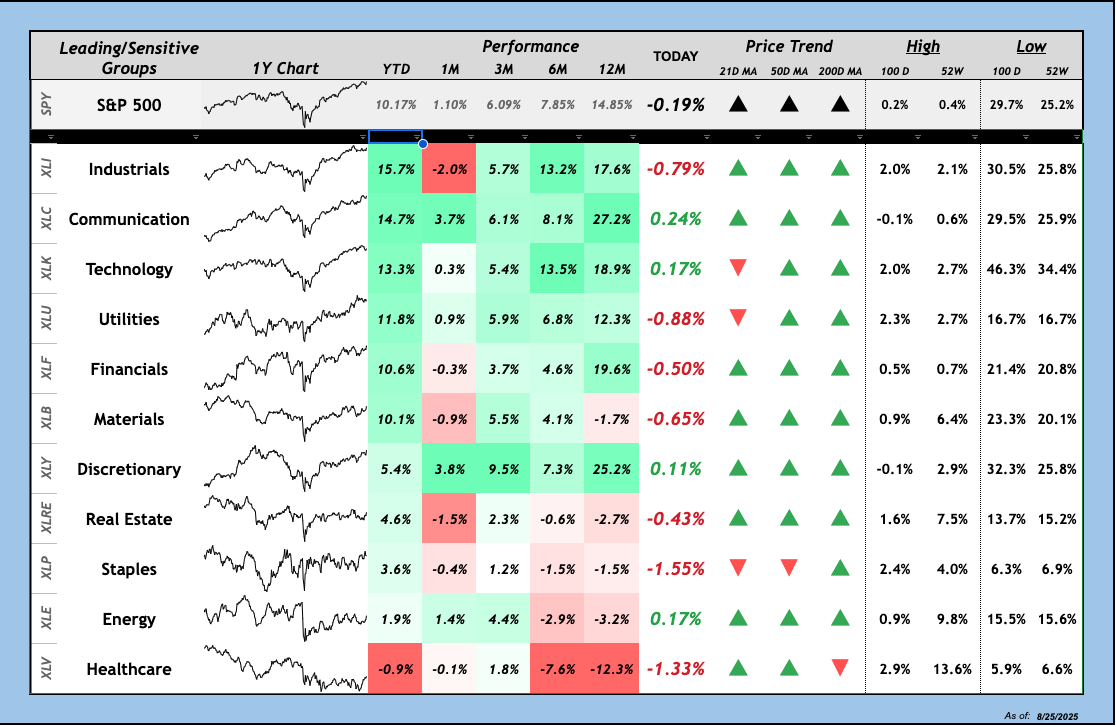

📊 Chart: Sector Performance (Industrials, Technology, Financials, Materials)

Look at the current sector scan: Industrials, Technology, Financials, and Materials are all up double digits year-to-date. That’s not random noise—that’s classic reflationary leadership.