System Addict: A Web of Macro Trades

"Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected." George Soros

Every week, we peel back the layers of the market to reveal hidden opportunities and navigate the complex currents of the economy with precision. 🔪

There is a reason that we start out every week with this market outlook.

To uncover unsystematic opportunities, we must employ systematic strategies that allow us to quantify and analyze the market's dynamics. QUICKLY. By establishing a clear way to determine whether something is cheap or expensive, we have the groundwork for informed decision-making.

This involves not just relying on numbers, but also it helps us to find narratives that resonate with broader macro sentiment.

It’s the narrative that attracts attention and drives market behavior. Without a compelling story, an asset, no matter how undervalued, may remain overlooked and stagnant. However, it’s essential to ensure that the narrative is backed by solid data.

This approach—where systematic analysis meets storytelling—enables us to identify unique opportunities that others might miss. By blending quantitative analysis with an understanding of the narrative, we position ourselves to capitalize on opportunities.

This is how we find unsystematic opportunities through the disciplined application of systematic strategies.

This is why we review our "boring" models every single week.

This is how we hunt for outliers!

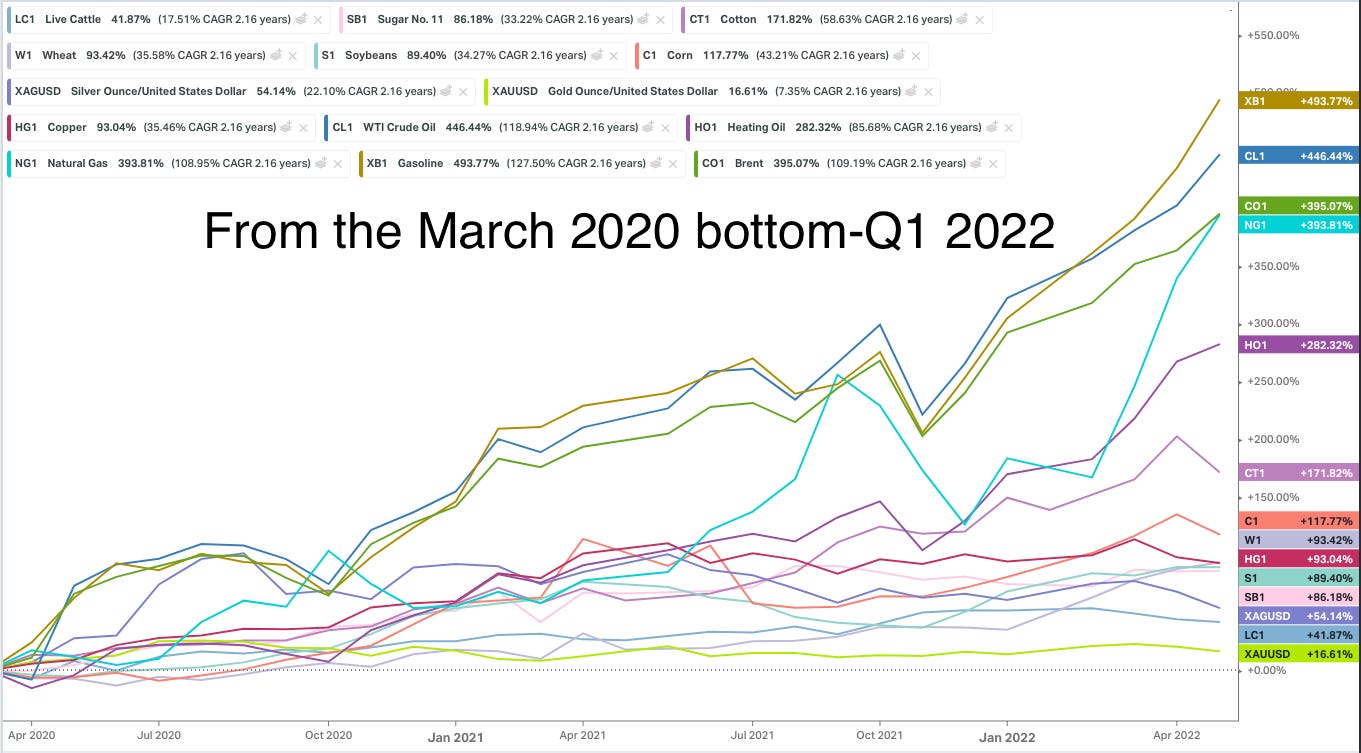

You all know what I am going to say. Especially those of you who watched me trade it in 2020.

The narrative was deflation forever after the shut down and only a few people were on the side of inflation. The narrative shifted towards QE and money printing causing something but they compared that sort of inflation to 2008. So once again they thought if we did have inflation, it would be short lived.

The price action started to tell us a different story. Way before the Fed caught on and started to call inflation “transitory” the price action was already giving long signals across energy, softs and agricultural commodities.

Here is what we are seeing now…