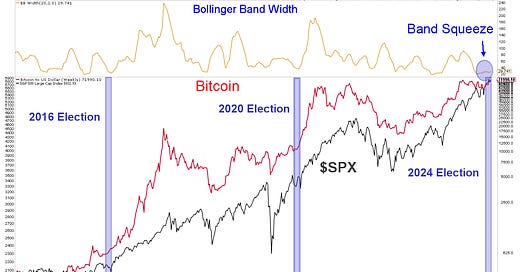

Bitcoin Breakout!

After a long nine-month range between $72K and $55K—the longest consolidation in its history—Bitcoin has finally broken out. This move is significant for two main reasons: first, it signals a potentially profitable Bitcoin trade, and second, it aligns with the election cycle, which could drive broader market momentum.

I posted a Bitcoin …