The Futures Trader: The Commodity Report

Being a successful trader also takes courage: the courage to try, the courage to fail, the courage to succeed, and the courage to keep on going when the going gets tough. Michael Marcus

Michael Marcus is renowned as one of the greatest futures traders, turning a $30,000 investment into an astounding $80 million over twenty years. His trading journey and insights were prominently featured in Jack Schwager’s classic, "Market Wizards," where his interview stood out among many other trading legends.

Here are some of the tools he used to become a great trader.

Psychology/Mindset He believed that losing could lead to more losing due to negative psychology, but he stayed open-minded and willing to accept hard truths. He emphasized the importance of gut feel, courage, and perseverance. Even during tough times, when he doubted his abilities, an inner voice urged him to keep going.

Risk management was another cornerstone of Marcus's strategy. He took larger positions at critical intraday points but used tight stops to minimize risk. This allowed him to capitalize on market movements while keeping losses in check. He likened his trading style to surfing, aiming to catch the perfect wave but ready to exit quickly if things didn’t go as planned. He also stressed the importance of holding onto winners and cutting losers, recognizing that both actions are crucial for long-term success.

Marcus's trading philosophy combined technical analysis, trend following, fundamentals, and market sentiment to identify high-probability trades. He believed successful trading required a balance of these elements, comparing it to an art form that involves both innate skill and learned competence. He stressed the need for courage in holding positions and continually evaluating market conditions, trusting that following his methodology would eventually yield positive results when market conditions were favorable to his strategy.

Commodity hits

Position: Flat

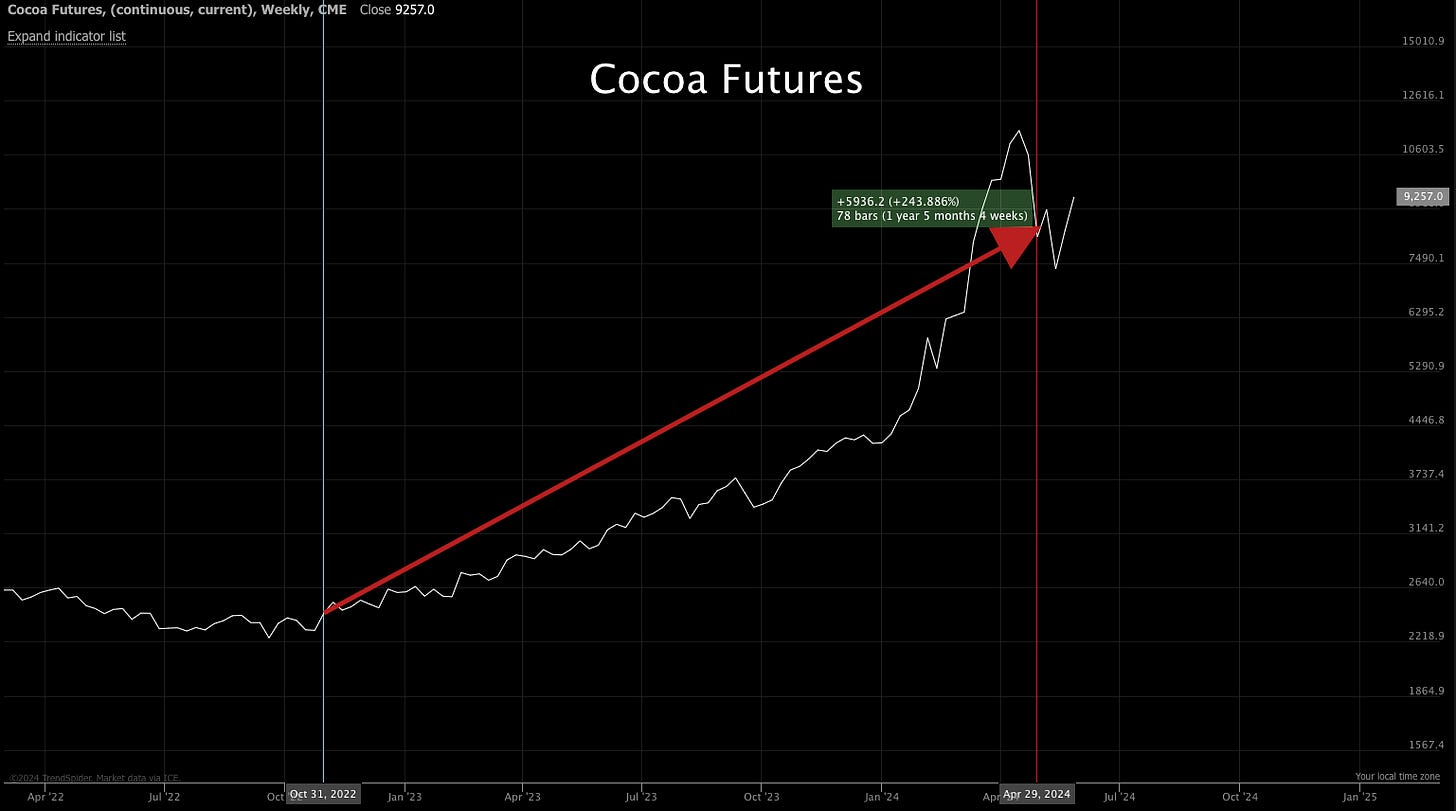

Drought risks in West Africa have driven cocoa prices higher, necessitating more demand rationing before the market can stabilize. No buy signal yet but it could come back in to play. Which is fucking crazy, however it does happen.

Position: Long

Brazil's coffee harvest has been dismal, and the upcoming frost season in July poses a risk of driving prices to record highs. This could lead to an explosive increase in coffee prices.