The Most Hated Sector Is Setting Up for a Breakout (Portfolio Review)

Energy hasn’t broken down — it’s been building strength in silence.

Too choppy. Too volatile. Too cyclical.

Energy has been called a mess.

And yet — the XLE, the broad energy ETF, has quietly avoided something nearly every other sector has seen:

It hasn’t made a new 52-week low in five years.

That’s not noise. That’s resilience.

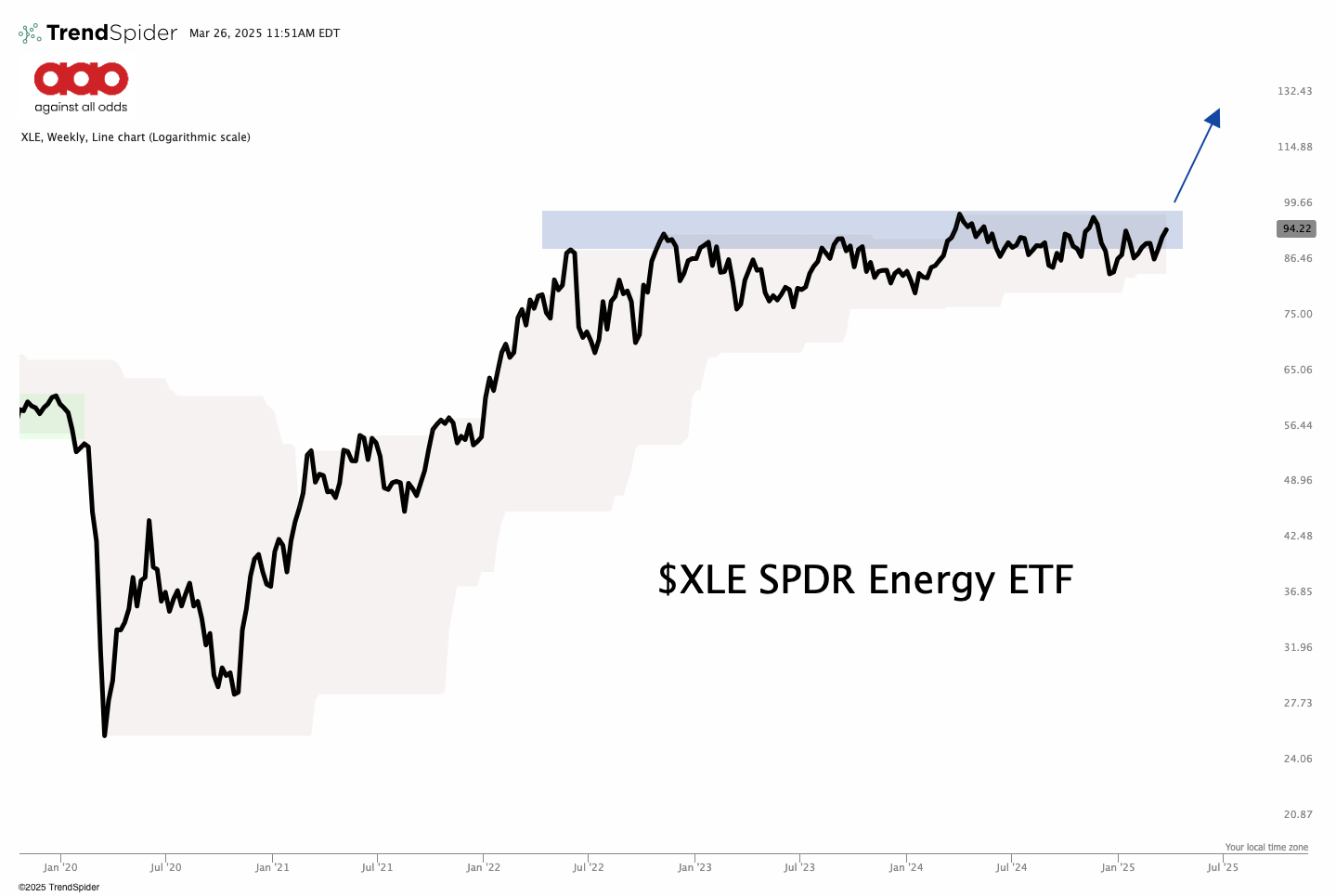

What we’re looking at is a textbook setup.

A massive rally from the 2020 lows, followed by two years of consolidation.

No breakdowns. No blowouts. Just tension building — like a spring slowly winding tighter.

Today, XLE is back at $94 — the same level it topped out at in 2022.

It’s been walking in place for two years. That’s not stagnation. That’s a base.

And bases are where breakouts are born.

I haven’t had a strong view on this for a while. But today, I do. (I have been long XLE since the false breakdown entry on December 31st 2024)

I’m buying…