The Seven Day Scope (Snipers Only)

Weekly report showing you the market trends..

Significant capital is currently pouring into money market funds, prompting the question of whether this influx of funds will eventually seek alternative investment avenues. As the financial landscape evolves and market conditions fluctuate, investors often assess the potential for diversification to optimize their returns. The abundant liquidity in money market funds may spur a search for alternative investment options that offer higher yields or different risk profiles. This shift in capital allocation reflects the dynamic nature of financial markets, where investors continually evaluate opportunities to maximize returns while managing risks.

"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." — George Soros

No one likes this chart… yes, I know, breadth is terrible. Yes I also believe that the rotation out of big tech will happen one day. I just don’t see it happening today.

The magnificent 7 (as they are calling it) are now capturing a staggering 91% of the S&P's year-to-date journey. This is wild. That’s the only word I can use to describe this without swearing or breaking something…

In to the end of the year I can see a bullish set up for equities. After this, fundamentals might start to catch up to this. However I can’t deny the price action. Here is what I am seeing on that side.

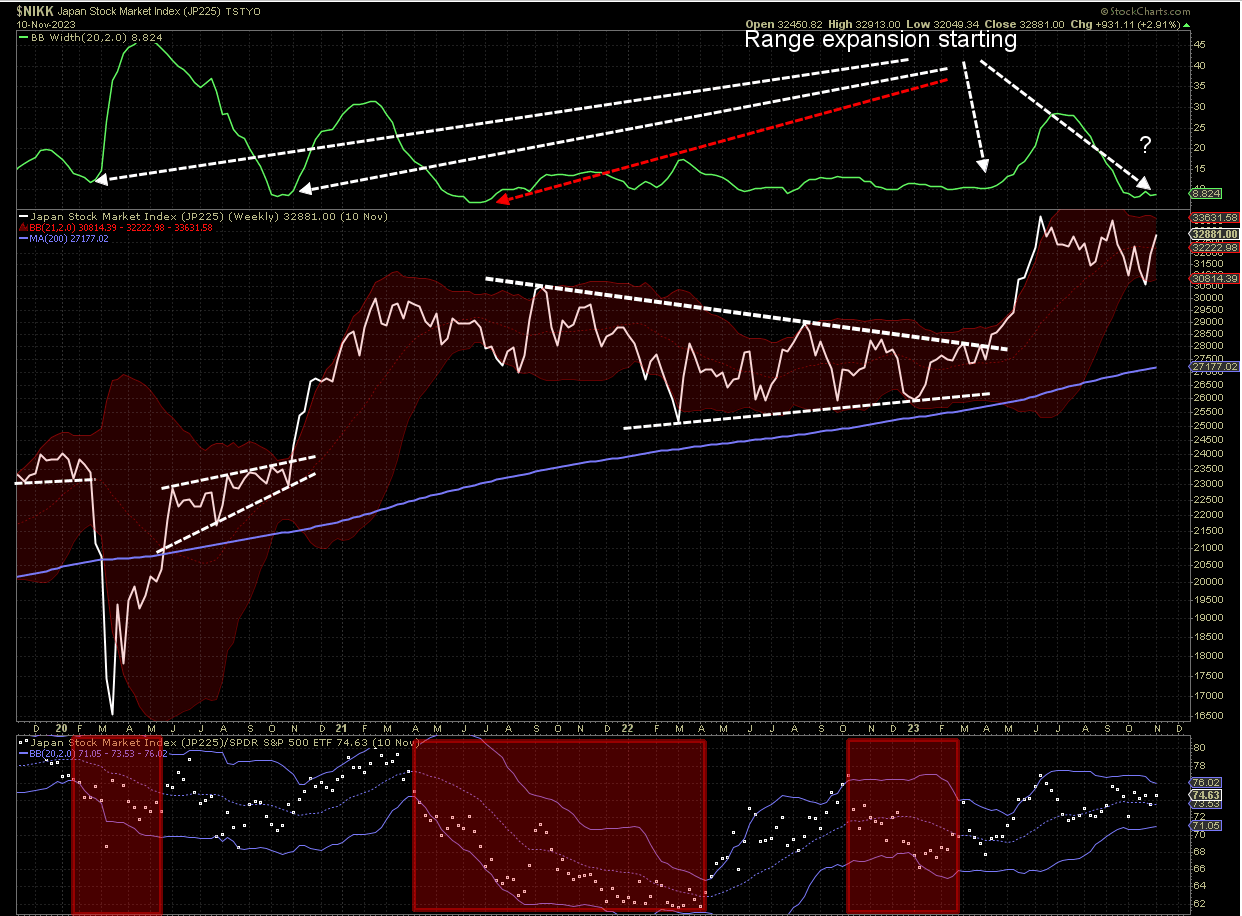

Japan is currently navigating a challenging economic scenario akin to a slow-motion train wreck. The nation grapples with an enormous national debt, now exceeding $9 trillion, surpassing 200% of its GDP. The pressure intensifies with rising interest rates, impacting the Japanese yen, which has plunged to its lowest value against the dollar in over two decades. The ongoing money creation program by the Japanese central bank, involving quantitative easing to bolster the bond market, contributes to the yen's decline. The economic landscape poses significant hurdles, demanding a close watch on Japan's fiscal strategies and their impact on global markets.Holiday shoppers are anticipated to maintain budgets on par with last year. Here is the most optimistic view I can come up with… Consumers seemingly express a preference for discounts before initiating their spending spree. However, if people don’t have it, they don’t have it! They do not.

From: Wayne Whayley

This was a fun one-I’ll explain it more on the audio file.

No one talks about the yield curve anymore but it is still significant! Banks will continue to feel pain until this is resolved.

The Gold conspiracy that is becoming less conspiratorial…

In recent weeks, China's strategic move to take delivery of gold from New York has garnered attention, particularly in relation to the Shanghai Premium. Confirmation of this development comes from two unrelated sources—a banking analyst and an Asian fund manager. Their reports align with the drawdown in China followed by a similar trend in the US Comex. One of the sources stated in October, "…the Chinese have now taken delivery of a bunch of physical New York gold in response to that arb." This revelation sheds light on potential implications for the GLD ETF's recent unusual behavior.

Now, connecting the dots for our subscribers, recent developments suggest a circumstantially accurate scenario. A month ago, our China contact Bai Xiaojun revealed a mini vault run on SGE gold in August/September, witnessing a substantial drawdown for local entities. Despite challenges, China remained committed to fulfilling its promise of complete deliverability, orchestrating the process with order and precision. While the specifics of the New York gold delivery remain undisclosed, the industry interchangeability of "New York" with "Comex" amplifies the intrigue surrounding this development. The question persists: who, what, and why is driving this significant shift?

Adding another layer to the narrative, we look to the history and influence of Chengtong PM, another key player. Collaborating with the People's Bank of China and other top-degree units, Chengtong PM has been instrumental in designing and establishing the Shanghai Gold Exchange. Their role in leading the historical reform of silver from a planned economic system to a market-oriented one, along with contributions to the design of silver contracts in the Shanghai Futures Exchange, positions them as a formidable force shaping China's silver and gold markets.

October witnessed a significant surge in Bitcoin futures activity on the CME, reaching notable milestones. The open interest for Bitcoin futures on CME soared to an unprecedented 20,369 contracts on October 25, 2023, marking a new all-time high. Impressively, six of the top ten open interest days for Bitcoin futures occurred between October 20 and 27, underscoring the heightened market participation during this period. The total open interest on CME reached an impressive $3.58 billion by October 30, 2023. In a milestone achievement, CME surpassed the 100,000 BTC mark for the first time in October, securing its position as the second-largest exchange for standard Bitcoin futures and perpetual futures, trailing only behind Binance, as reported by CoinDesk. Additionally, the daily traded volume for front three-month expiries on CME peaked at a year-to-date high of 25,185 contracts on October 25, 2023.