The Truth About Cocoa: The Seven Day Scope: Snipers Only-Complimentary Weekly Report

Cocoa, Currencies, Software, Oil, Energy...

So everyone wants to talk about Cocoa. Let’s talk about it?

Kashyap recently shared this on Peter's page. While it would be tempting to just boast about how great I look, I always strive to keep it real with everyone. Whether it's here, on a platform filled with strangers, or face-to-face, honesty is my policy. I don't gloss over my past – from being a professional bike rider to battling addiction, and starting out as a less-than-stellar trader. Anyone who claims they were a trading prodigy from day one is not being truthful.

I can't promise you'll find more insights, news, or random chatter here. But what I can assure you is that I'm a successful trader who has overseen institutional funds and hasn't experienced a losing year doing so. I've transitioned from account blow-ups to financial stability. I have studied the markets for over 20 years and I don’t talk about the things I don’t know. You will not get led astray here.

For me, financial freedom isn't about flaunting a Lamborghini or a mansion filled with cash stacks (hint: those cars and houses in my videos are probably rentals or Airbnb stays). It's about not having to worry anymore. I grew up in what many would consider impoverished conditions, though it never occurred to me back then. My parents made countless sacrifices to ensure I had food, shelter, and the essentials. I was fortunate to be adopted by admirable individuals whom I could emulate.

I never aspired for material possessions; my goal was simply to reach a point where I felt invulnerable to the ebbs and flows of life.

Here is Cocoa in all it’s glory. This is the pretty one but I had plenty of small wins and small losers before this.

From an earlier report-”Our main concern is that the current wet weather pattern might transition into the drier Harmattan wind season, which typically runs from late November to early March. We anticipate that this year's Harmattan season could be particularly severe. This would bring challenges such as reduced sunlight due to the high sand content in the air and harsh winds that could damage the budding cocoa crop for 2024.

If our prediction of an exceptionally destructive wind season proves accurate, it's difficult to anticipate just how high cocoa prices could rise to address this potentially unparalleled situation.

Our trend models are long cocoa still. I would be on alert as we search for a final blow off top. Tighten stops, take profits… however you do it, that is up to you. Either way, I would be ready for another possible move higher.”

This was when everyone said the cocoa market was done. Most importantly the trend was still up.

From an October report. In another one I also say that we could get past the highs in the 1970s.

Alright, enough of the bull shit. Let's get real. Every single year, without fail, there's a trade like this in my portfolio. Why? Because I've shaped my entire portfolio strategy around it. Above all else, I understand my identity as a trend follower. I know the importance of setting loose stop losses to avoid getting chopped out. And most importantly, I recognize that in my pursuit of outliers, a couple of these trades will yield solid returns for the year. This is why I have consistently beat the market.

Some years, like 2019, 2020 and 2021 a lot of things seems to align in my favor. This creates superior returns. Those years where we knock it out of the park and hit triple digits. Those were the years when even small winners and losers in Cocoa added up and it meant nothing to the overall performance. That's precisely why diversification across markets and strategies is crucial.

1. Sectors-Our subscribers have been in the strongest sectors all year long. Software looks great.

Currencies

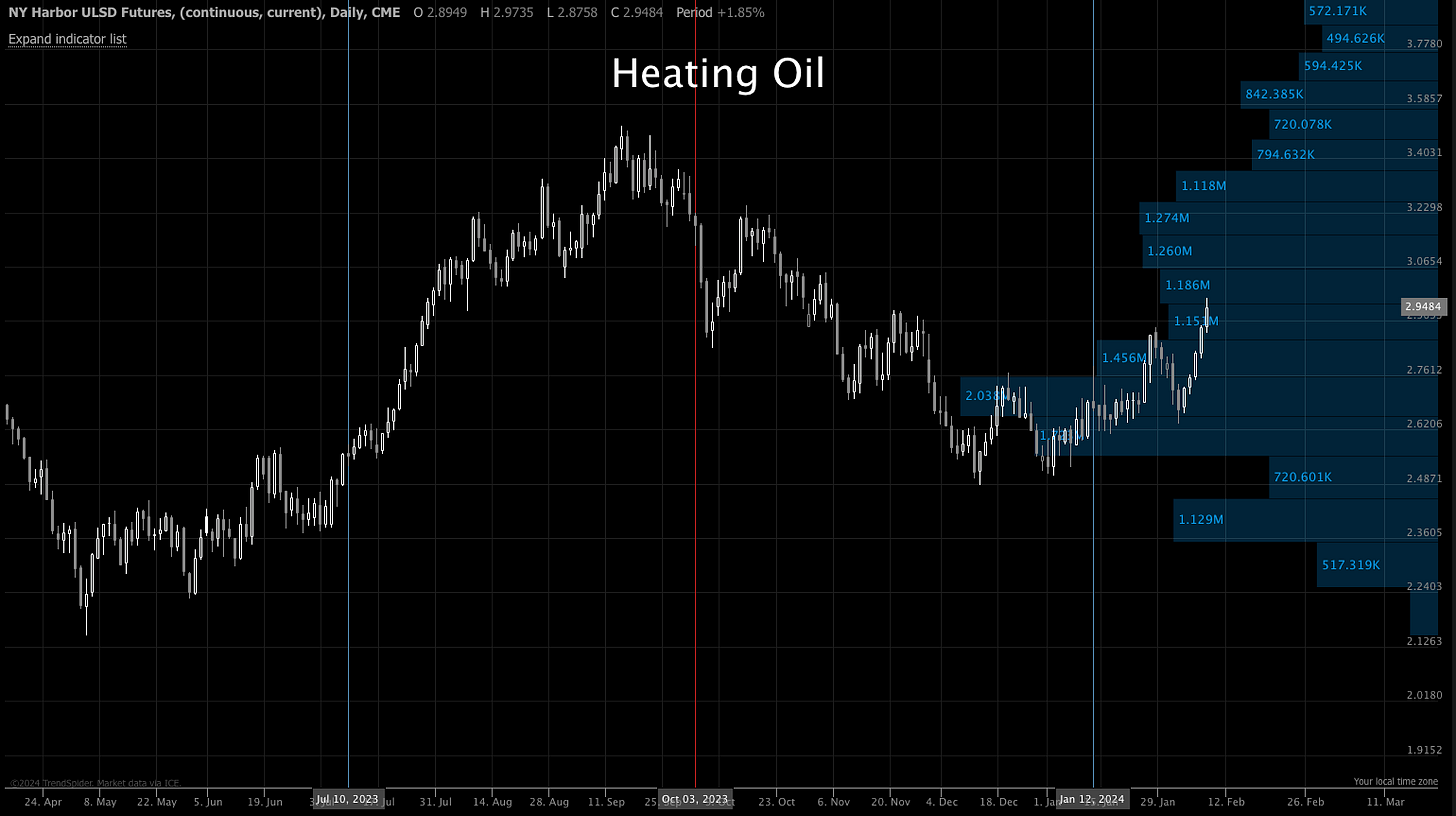

3. Futures-Commodities on top.4. Heating Oil-STAY LONG ENERGY!

5. Here's an update on our swing trade. Last week, we advised buying Bitcoin with a target range of 48-50k. If you wish, you can close the position at this point. However, we're maintaining our core position and futures trade as we haven't received any sell signals yet.

It is beautiful outside. Go outside and enjoy your weekend. I even got to see some bees. (for those that know I am crazy about bees. I love them)

Stay informed. Stay resilient. Against all odds.

Warm regards, Jason Perz

If you find this content valuable, please consider liking, sharing, and subscribing.Feel free to pass it along if you think it can benefit others.

YouTube: @againstalloddsresearch https://www.youtube.com/channel/UCLvDNCnhNQbQnABUSFbwagg

Twitter: @jasonp138

Substack: aaoresearch.substack.com

Against All Odds Research

jperz1985@icloud.com