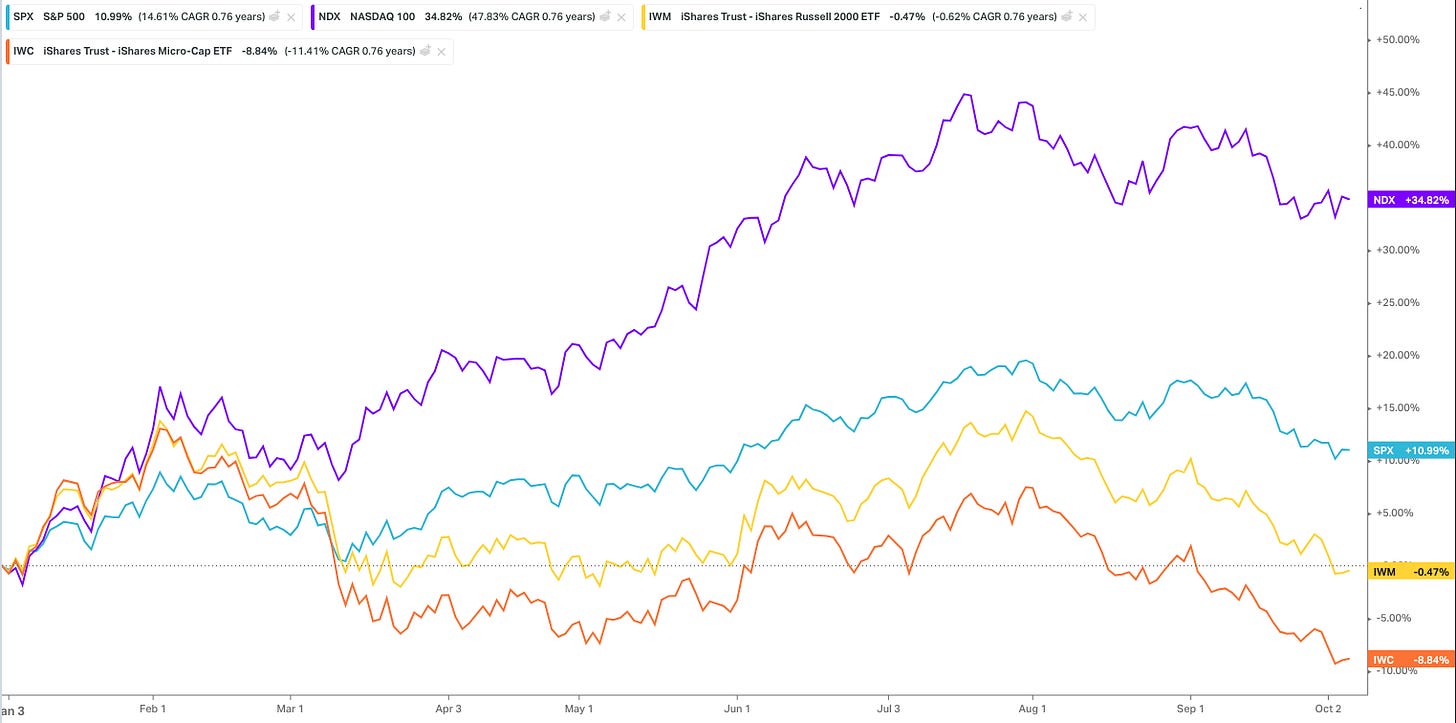

Small cap stocks have been facing significant challenges, with the S&P SmallCap 600 experiencing one of its worst annual performances relative to the S&P 500 since its inception in 1994. This struggle is reflected in the year-to-date returns, where the S&P Mid cap Index has only seen a modest 1.56% gain, while the Russell 2000 Small Cap Index is down by -0.25%. The situation is even more dire for the Russell Micro cap, representing the bottom 1000 stocks of the Russell 2000, which has plummeted by a staggering 8.47%, marking the lowest point of the year. In fact, a mere seven stocks have managed to stay in the green for the year, while the majority have barely moved, seemingly hesitant to invest amid the uncertainties of 2023, making cash a seemingly attractive option.

One significant factor contributing to this small cap underperformance is the state of high-yield corporate bonds, as indicated by HY credit spreads. Historically, when these spreads, which measure the difference between high-yield bond yields and Treasury yields widen, it can spell trouble for small cap stocks. Currently, HY spreads are hovering around 4. However, for a sustainable period of small cap outperformance to occur, these spreads would need to increase further to see a bottom in small caps. Until this happens, it's likely that small cap stocks will continue to face challenges, as evidenced by their largest underperformance against the S&P 500 in nearly 22 years.

I personally like to think of environments and exactly what environment is favorable to small cap stocks.

1. Economic Growth: Small cap stocks often perform well during periods of robust economic growth. This is because smaller companies are typically more sensitive to changes in the domestic economy. When the economy is expanding, consumer spending and business investments increase, benefiting many small and domestically-focused companies.

Low-Interest Rates: Small cap stocks can benefit from low-interest-rate environments. When interest rates are low, borrowing costs are reduced for small businesses, making it easier for them to expand and invest in growth opportunities.

Rising Consumer Confidence: Improving consumer confidence often leads to increased spending, which can benefit smaller companies that rely more heavily on domestic consumer markets. Positive consumer sentiment can boost revenues and profitability for small cap stocks.

Innovation and Technological Advancements: Smaller companies are often at the forefront of innovation and technology. When new technologies or disruptive innovations emerge, smaller companies can experience rapid growth, driving up the value of their stocks.

Mergers and Acquisitions: Large companies seeking growth opportunities may acquire smaller firms, leading to potential stock price appreciation for small cap stocks. Mergers and acquisitions activity can create value for shareholders of the acquired companies.

Market Sentiment and Risk Appetite: Investor sentiment and risk appetite play a significant role in small cap stock performance. During periods of optimism and risk-taking in the markets, investors may favor small cap stocks, attracted by their growth potential.